US Airways 2010 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

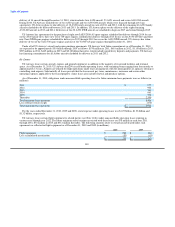

3. Debt

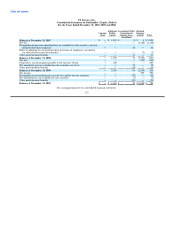

The following table details US Airways' debt (in millions). Variable interest rates listed are the rates as of December 31, 2010.

December 31, December 31,

2010

2009

Secured

Equipment loans and other notes payable, fixed and variable interest rates ranging from 1.66% to 10.29%,

maturing from 2011 to 2021 (a) $ 1,890 $ 2,201

Aircraft enhanced equipment trust certificates ("EETCs"), fixed interest rates ranging from 6.25% to 9.01%,

maturing from 2015 to 2023 (b) 809 505

Other secured obligations, fixed interest rate of 8%, maturing from 2015 to 2021 85 84

Senior secured discount notes — 32

2,784 2,822

Unsecured

Airbus advance, repayments through 2018 (c) 222 247

Industrial development bonds, fixed interest rate of 6.3%, interest only payments until due in 2023 (d) 29 29

Other unsecured obligations, maturing from 2011 to 2012 23 81

274 357

Total long-term debt and capital lease obligations 3,058 3,179

Less: Total unamortized discount on debt (81) (94)

Current maturities, less $4 million of unamortized discount on debt at December 31, 2009 (381) (418)

Long-term debt and capital lease obligations, net of current maturities $ 2,596 $ 2,667

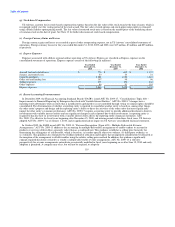

(a) The following are the significant equipment financing agreements entered into in 2010:

In 2010, US Airways borrowed $181 million to finance Airbus aircraft deliveries. These financings bear interest at a rate of LIBOR

plus an applicable margin and contain default provisions and other covenants that are typical in the industry.

(b) The equipment notes underlying these EETCs are the direct obligations of US Airways and cover the financing of 27 aircraft. See

Note 8(c) for further discussion.

In December 2010, US Airways created two pass-through trusts which issued approximately $340 million aggregate face amount of

Series 2010-1A and Series 2010-1B Enhanced Equipment Trust Certificates (the "2010 EETCs") in connection with the refinancing

of eight Airbus aircraft owned by US Airways. The 2010 EETCs represent fractional undivided interests in the respective pass-

through trusts and are not obligations of US Airways. The net proceeds from the issuance of the 2010 EETCs were used to purchase

equipment notes issued by US Airways in two series: Series A equipment notes in an aggregate principal amount of $263 million

bearing interest at 6.25% per annum and Series B equipment notes in an aggregate principal amount of $77 million bearing interest

at 8.5% per annum. Interest on the equipment notes is payable semiannually in April and October of each year, beginning in April

2011. Principal payments on the equipment notes are scheduled to begin in October 2011. The final payments on the Series A

equipment notes and Series B equipment notes will be due in April 2023 and April 2017, respectively. US Airways' payment

obligations under the equipment notes are fully and unconditionally guaranteed by US Airways Group. Substantially all of the

proceeds from the issuance of the equipment notes were used to repay the existing debt associated with eight Airbus aircraft, with

the balance used for general corporate purposes. The equipment notes are secured by liens on aircraft.

121