US Airways 2010 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

11. Related Party Transactions

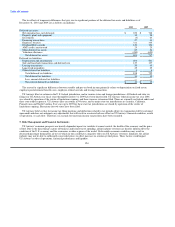

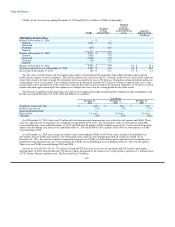

The following represents net payable balances to related parties (in millions):

December 31,

2010 2009

US Airways Group $ 571 $ 607

US Airways Group's wholly owned subsidiaries 55 35

$ 626 $ 642

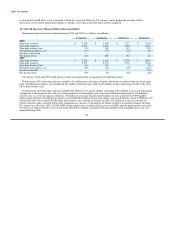

(a) Parent Company

US Airways Group has the ability to move funds freely between its operating subsidiaries to support operations. These transfers are

recognized as intercompany transactions. In September 2009, US Airways Group contributed $600 million in net intercompany

receivables due from US Airways to the capital of US Airways.

US Airways recorded interest expense for the years ended December 31, 2010, 2009 and 2008 of $9 million, $27 million and

$61 million, respectively, related to its intercompany payable balance to US Airways Group. Interest is calculated at market rates, which

are reset quarterly.

(b) Subsidiaries of US Airways Group

The net payable to US Airways Group's wholly owned subsidiaries consists of amounts due under regional capacity agreements with

the other airline subsidiaries and fuel purchase arrangements with a non-airline subsidiary.

US Airways purchases all of the capacity generated by US Airways Group's wholly owned regional airline subsidiaries at a rate per

ASM that is periodically determined by US Airways and, concurrently, recognizes revenues that result primarily from passengers being

carried by these affiliated companies. The rate per ASM that US Airways pays is based on estimates of the costs incurred to supply the

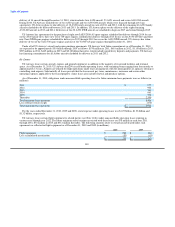

capacity. US Airways recognized Express capacity purchase expense for the years ended December 31, 2010, 2009 and 2008 of

$460 million, $451 million and $417 million, respectively, related to this program.

US Airways provides various services to these regional airlines, including passenger handling, maintenance and catering. US Airways

recognized other operating revenues for the years ended December 31, 2010, 2009 and 2008 of $89 million, $87 million and $89 million,

respectively, related to these services. These regional airlines also perform passenger and ground handling services for US Airways at

certain airports, for which US Airways recognized other operating expenses for the years ended December 31, 2010, 2009 and 2008 of

$158 million, $142 million and $154 million, respectively. US Airways also leases or subleases certain aircraft to these regional airline

subsidiaries. US Airways recognized other operating revenues of $78 million related to these arrangements for each of the years ended

December 31, 2010, 2009 and 2008, respectively.

US Airways purchases a portion of its aviation fuel from US Airways Group's wholly owned subsidiary, MSC, which acts as a fuel

wholesaler to US Airways in certain circumstances. For the years ended December 31, 2010, 2009 and 2008, MSC sold fuel totaling

$879 million, $677 million and $1.33 billion, respectively, used by US Airways' mainline and Express flights.

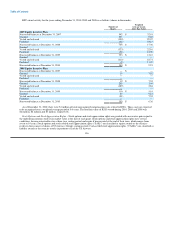

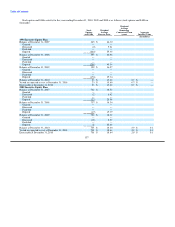

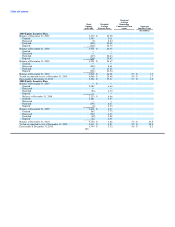

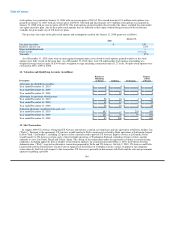

12. Operating Segments and Related Disclosures

US Airways is managed as a single business unit that provides air transportation for passengers and cargo. This allows it to benefit

from an integrated revenue pricing and route network that includes US Airways, US Airways Group's wholly owned regional air carriers

and third-party carriers that fly under capacity purchase or prorate agreements as part of US Airways' Express operations. The flight

equipment of all these carriers is combined to form one fleet that is deployed through a single route scheduling system. When making

resource allocation decisions, the chief operating decision maker evaluates flight profitability data, which considers aircraft type and

route economics, but gives no weight to the financial impact of the resource allocation decision on an individual

134