US Airways 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

during 2009 due to a change in the amount of holdback held by certain credit card processors for advance ticket sales for which US

Airways has not yet provided air transportation.

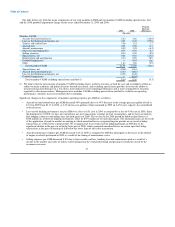

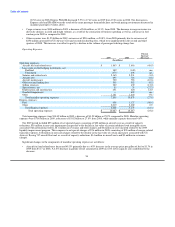

Net cash used in financing activities was $307 million in 2010 as compared to net cash provided by financing activities of $701 million

in 2009. Principal financing activities in 2010 included debt repayments of $764 million, including the repayment of existing debt

associated with eight Airbus aircraft refinanced by a December 2010 enhanced equipment trust certificate ("2010 EETC") issuance and

the repurchase of $69 million aggregate principal amount of our 7% notes. These cash outflows were offset in part by proceeds from the

issuance of debt of $467 million, which included $340 million of proceeds from the issuance of equipment notes associated with the 2010

EETC issuance as well as the financing associated with the purchase of Airbus aircraft. Principal financing activities in 2009 included

proceeds from the issuance of debt of $919 million, which primarily included the financing associated with the purchase of Airbus

aircraft, as well as the issuance of $172 million of convertible notes in a May 2009 public offering, additional loans under a spare parts

loan agreement, a loan secured by certain airport landing slots and an unsecured financing with one of our third party Express carriers.

These cash inflows were offset in part by debt repayments that totaled $407 million in 2009. Financing activities in 2009 also included

net proceeds from the issuance of common stock of $66 million from a May 2009 public offering of 17.5 million shares and $137 million

from a September 2009 public offering of 29 million shares.

2009 Compared to 2008

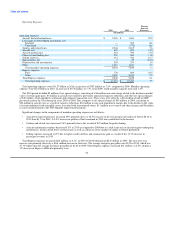

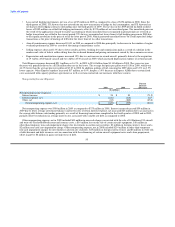

Net cash provided by operating activities was $59 million in 2009 as compared to net cash used in operating activities of $980 million

in 2008, a year-over-year improvement of $1.04 billion. Operating cash flows significantly improved in 2009 due to the substantial

reduction in the cost of fuel offset by declines in revenues as a result of the global economic recession. Our mainline and Express fuel

expense was $2.28 billion, or 48%, lower in 2009 as compared to 2008 on 4.5% lower capacity. The weak demand environment caused

by the global economic recession resulted in a $1.66 billion, or 13.7%, decline in total operating revenues. In addition, operating cash

flows in 2009 improved by $321 million principally as a result of the wind down of our fuel hedging program. In the latter part of 2008,

we recognized unrealized losses on certain open fuel hedge transactions as the price of heating oil fell below the lower limit of our collar

transactions and caused us to use cash from operations to collateralize our counterparties. Since the third quarter of 2008, we have not

entered into any new transactions to hedge our fuel consumption, and we have not had any fuel hedging contracts outstanding since the

third quarter of 2009. Accordingly, our 2009 operating cash flows were not significantly impacted by fuel hedging transactions as any

hedges settling in 2009 had been fully collateralized through the cash deposits posted during 2008.

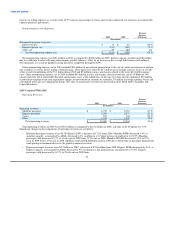

Net cash used in investing activities was $495 million and $915 million in 2009 and 2008, respectively. Principal investing activities in

2009 included expenditures for property and equipment totaling $683 million primarily related to the purchase of Airbus aircraft. These

cash outflows were offset in part by $76 million in proceeds from dispositions of property and equipment, a $60 million decrease in

restricted cash and proceeds from sales of investments in marketable securities of $52 million. The $76 million in proceeds from

dispositions of property and equipment was the result of the swap of one of US Airways' owned aircraft in exchange for the leased

aircraft involved in the Flight 1549 accident and sale-leaseback transactions involving four aircraft and five engines. Restricted cash

decreased during 2009 due to a change in the amount of holdback held by certain credit card processors for advance ticket sales for which

US Airways has not yet provided air transportation. Principal investing activities in 2008 included expenditures for property and

equipment totaling $1.07 billion, including the purchase of 14 Embraer aircraft, five Airbus aircraft and a $139 million net increase in

equipment purchase deposits for aircraft on order, as well as a $74 million increase in restricted cash, all of which were offset in part by

net sales of investments in marketable securities of $206 million. The change in the 2008 restricted cash balance was due to changes in

the amount of holdback held by certain credit card processors.

Net cash provided by financing activities was $701 million and $981 million in 2009 and 2008, respectively. Principal financing

activities in 2009 included proceeds from the issuance of debt of $919 million, which primarily included the financing associated with the

purchase of Airbus aircraft, as well as the issuance of $172 million of convertible notes in a May 2009 public offering, additional loans

under a spare parts loan agreement, a loan secured by certain airport landing slots and an unsecured financing with one of our third party

Express carriers. These cash

57