US Airways 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

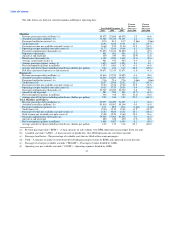

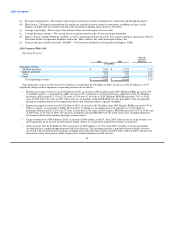

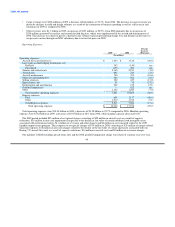

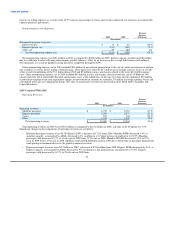

Nonoperating Income (Expense):

Percent

Increase

2010 2009 (Decrease)

(In millions)

Nonoperating income (expense):

Interest income $ 13 $ 24 (46.3)

Interest expense, net (329) (304) 8.2

Other, net 37 (81) nm

Total nonoperating expense, net $ (279) $ (361) (22.9)

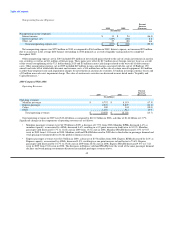

Net nonoperating expense was $279 million in 2010 as compared to $361 million in 2009. Interest expense, net increased $25 million

due to an increase in the average debt balance outstanding in 2010 primarily as a result of liquidity raising initiatives completed

throughout 2009.

Other nonoperating expense, net in 2010 included $53 million of net realized gains related to the sale of certain investments in auction

rate securities as well as an $11 million settlement gain. These gains were offset by $17 million in net foreign currency losses as a result

of the overall strengthening of the U.S. dollar during 2010 and $5 million in non-cash charges related to the write off of debt issuance

costs. Other nonoperating expense, net in 2009 included $49 million in non-cash charges associated with the sale of 10 Embraer 190

aircraft and write off of related debt discount and issuance costs, a $14 million loss on the sale of certain aircraft equipment, $10 million

in other-than-temporary non-cash impairment charges for investments in auction rate securities, $3 million in foreign currency losses and

a $2 million non-cash asset impairment charge. The sales of auction rate securities are discussed in more detail under "Liquidity and

Capital Resources."

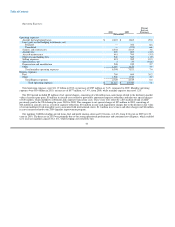

2009 Compared With 2008

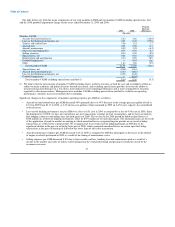

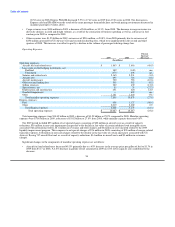

Operating Revenues:

Percent

Increase

2009 2008 (Decrease)

(In millions)

Operating revenues:

Mainline passenger $ 6,752 $ 8,183 (17.5)

Express passenger 2,503 2,879 (13.1)

Cargo 100 144 (30.3)

Other 1,103 912 20.9

Total operating revenues $ 10,458 $ 12,118 (13.7)

Total operating revenues in 2009 were $10.46 billion as compared to $12.12 billion in 2008, a decline of $1.66 billion or 13.7%.

Significant changes in the components of operating revenues are as follows:

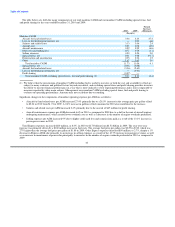

• Mainline passenger revenues were $6.75 billion in 2009, a decrease of 17.5% from 2008. Mainline RPMs decreased 4.4% as

mainline capacity, as measured by ASMs, decreased 4.6%, resulting in a 0.2 point increase in load factor to 81.9%. Mainline

passenger yield decreased 13.7% to 11.66 cents in 2009 from 13.51 cents in 2008. Mainline PRASM decreased 13.5% to 9.55

cents in 2009 from 11.04 cents in 2008. Mainline yield and PRASM decreased in 2009 due to the decline in passenger demand and

weak pricing environment driven by the global economic recession.

• Express passenger revenues were $2.5 billion in 2009, a decrease of $376 million from 2008. Express RPMs decreased by 2.6% as

Express capacity, as measured by ASMs, decreased 3.9%, resulting in a one point increase in load factor to 73.6%. Express

passenger yield decreased by 10.7% to 23.68 cents in 2009 from 26.52 cents in 2008. Express PRASM decreased 9.5% to 17.42

cents in 2009 from 19.26 cents in 2008. The decreases in Express yield and PRASM were the result of the same passenger demand

declines and weak pricing environment discussed in mainline passenger revenues above.

45