US Airways 2010 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

recorded a tax benefit on the loss from continuing operations, which was exactly offset by income tax expense on other comprehensive

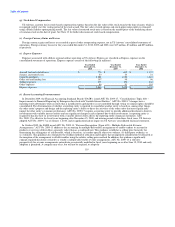

income as follows (in millions):

Change in

Net Loss Income Other Comprehensive

Statement Income

Pre-allocation $ (161) $ 37

Tax allocation 21 (21)

As presented $ (140) $ 16

In addition, for the year ended December 31, 2009, US Airways recorded a $14 million benefit related to a legislation change allowing

it to carry back 100% of 2008 Alternative Minimum Tax liability ("AMT") net operating losses, resulting in the recovery of AMT

amounts paid in prior years. US Airways also recognized a $3 million tax benefit related to the reversal of the deferred tax liability

associated with the indefinite lived intangible assets that were impaired during 2009.

For the year ended December 31, 2008, US Airways reported a loss, which increased its NOLs, and it did not record a tax provision.

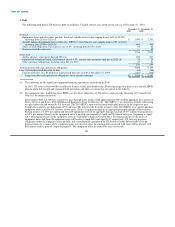

The components of the provision (benefit) for income taxes are as follows (in millions):

Year Ended December 31,

2010 2009 2008

Current provision:

Federal $ — $ — $ 1

State 1 — —

Total current 1 — 1

Deferred benefit:

Federal — (38) —

State — — (1)

Total deferred — (38) (1)

Provision (benefit) for income taxes $ 1 $ (38) $ —

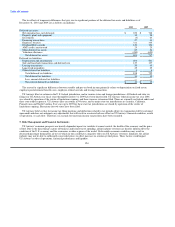

Income tax expense (benefit) differs from amounts computed at the federal statutory income tax rate as follows (in millions):

Year Ended December 31,

2010 2009 2008

Income tax expense (benefit) at the federal statutory income tax rate $ 210 $ (62) $ (752)

Book expenses not deductible for tax purposes 13 17 229

State income tax expense, net of federal income tax expense (benefit) 16 (4) (38)

Change in valuation allowance (238) 49 560

AMT provision (benefit) — (14) 1

Allocation to other comprehensive income — (21) —

Long-lived intangibles — (3) —

Other, net — — —

Total $ 1 $ (38) $ —

Effective tax rate 0.11% (21.5)% —%

123