US Airways 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

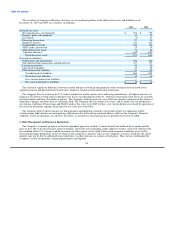

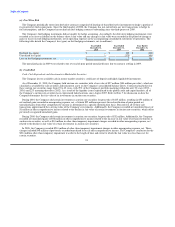

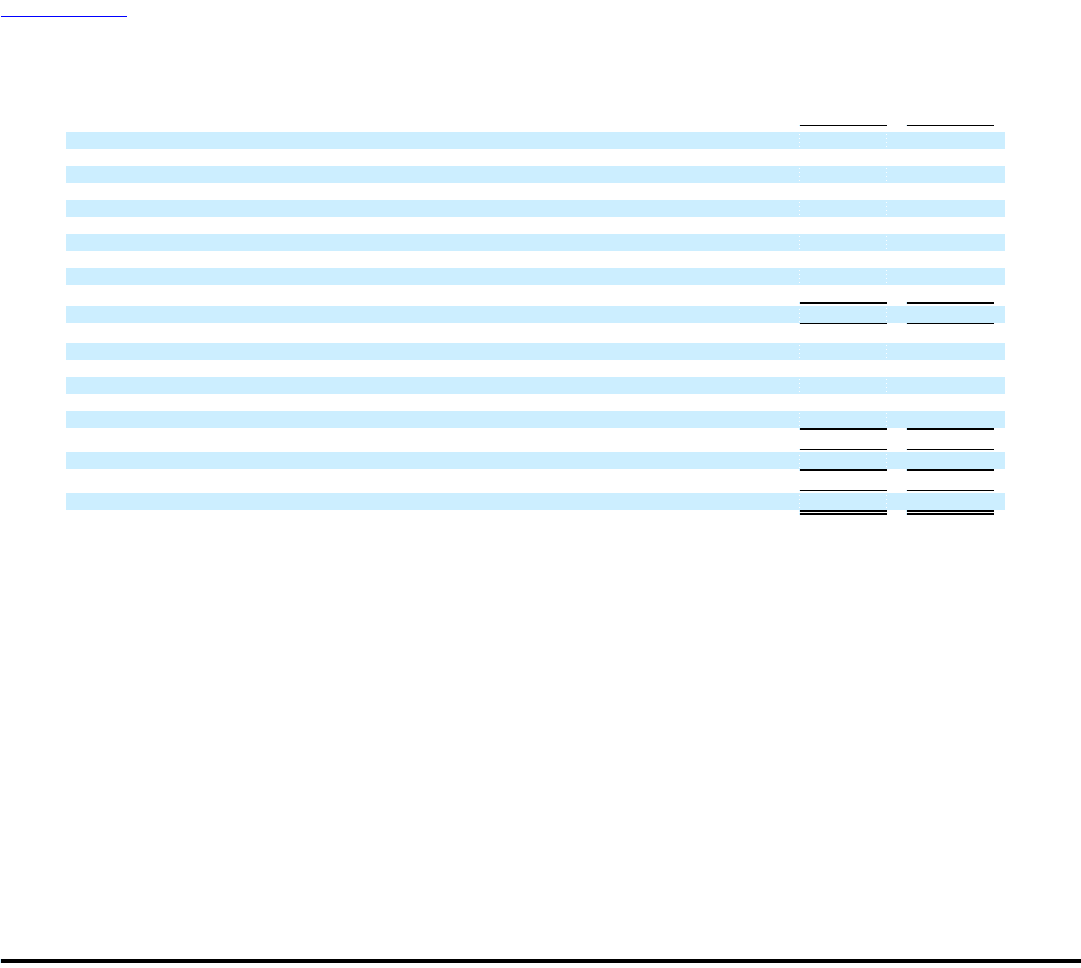

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and liabilities as of

December 31, 2010 and 2009 are as follows (in millions):

2010 2009

Deferred tax assets:

Net operating loss carryforwards $ 701 $ 779

Property, plant and equipment 38 30

Investments (3) 63

Financing transactions 27 41

Employee benefits 322 346

Dividend Miles awards 120 126

AMT credit carryforward 25 25

Other deferred tax assets 71 26

Valuation allowance (430) (623)

Net deferred tax assets 871 813

Deferred tax liabilities:

Depreciation and amortization 642 582

Sale and leaseback transactions and deferred rent 127 137

Leasing transactions 59 45

Long-lived intangibles 25 25

Other deferred tax liabilities 33 40

Total deferred tax liabilities 886 829

Net deferred tax liabilities 15 16

Less: current deferred tax liabilities — —

Non-current deferred tax liabilities $ 15 $ 16

The reason for significant differences between taxable and pre-tax book income primarily relates to depreciation on fixed assets,

employee pension and postretirement benefit costs, employee-related accruals and leasing transactions.

The Company files tax returns in the U.S. federal jurisdiction, and in various states and foreign jurisdictions. All federal and state tax

filings for US Airways Group and its subsidiaries for fiscal years through December 31, 2009 have been timely filed. There are currently

no federal audits and three state audits in process. The Company's federal income tax year 2006 was closed by operation of the statute of

limitations expiring, and there were no extensions filed. The Company files tax returns in 44 states, and its major state tax jurisdictions

are Arizona, California, Pennsylvania and North Carolina. Tax years up to 2005 for these state tax jurisdictions are closed by operation of

the statute of limitations expiring. Extensions for two states have been filed.

The Company believes that its income tax filing positions and deductions related to tax periods subject to examination will be

sustained upon audit and does not anticipate any adjustments that will result in a material adverse effect on the Company's financial

condition, results of operations, or cash flow. Therefore, no accruals for uncertain income tax positions have been recorded.

6. Risk Management and Financial Instruments

The Company's economic prospects are heavily dependent upon two variables it cannot control: the health of the economy and the

price of fuel. Due to the discretionary nature of business and leisure travel spending, airline industry revenues are heavily influenced by

the condition of the U.S. economy and the economies in other regions of the world. Unfavorable economic conditions may result in

decreased passenger demand for air travel, which in turn could have a negative effect on the Company's revenues. Similarly, the airline

industry may not be able to sufficiently raise ticket prices to offset increases in aviation jet fuel prices. These factors could impact the

Company's results of operations, financial performance and liquidity.

90