US Airways 2010 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

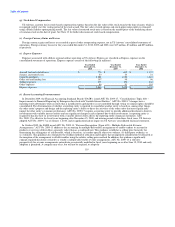

amendments in ASU No. 2009-13 retrospectively for all prior periods. US Airways' multiple-deliverable revenue arrangements consist

principally of sales of frequent flyer program mileage credits to business partners, which are comprised of two components,

transportation and marketing. See Note 1(k) for more information on US Airways' frequent traveler program. US Airways is required to

adopt and apply ASU No. 2009-13 to any new or materially modified multiple-deliverable revenue arrangements entered into on or after

January 1, 2011. It is not practical to estimate the impact of the new guidance on US Airways' consolidated financial statements because

US Airways will apply the guidance prospectively to agreements entered into or materially modified subsequent to January 1, 2011.

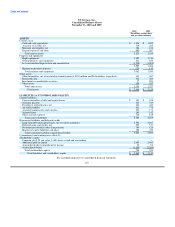

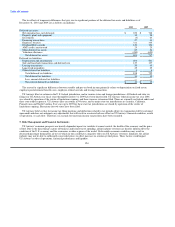

2. Special Items, Net

Special items, net as shown on the consolidated statements of operations include the following charges (credits) (in millions):

Year Ended December 31,

2010

2009

2008

Aviation Security Infrastructure Fee ("ASIF") refund (a) $ (16) $ — $ —

Other costs(b) 10 6 —

Asset impairment charges (c) 6 16 18

Aircraft costs (d) 5 22 14

Severance and other charges (e) — 11 9

Merger-related transition expenses (f) — — 35

Total $ 5 $ 55 $ 76

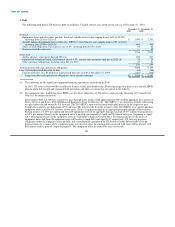

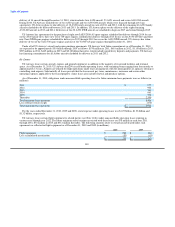

(a) In 2010, US Airways recorded a $16 million refund of ASIF previously paid to the Transportation Security Administration ("TSA")

during the years 2005 to 2009.

(b) In 2010, US Airways recorded other net special charges of $10 million, which included a settlement and corporate transaction costs.

In 2009, US Airways incurred $6 million in costs related to the 2009 liquidity improvement program, which primarily consisted of

professional and legal fees.

(c) In 2010, US Airways recorded a $6 million non-cash charge related to the decline in market value of certain spare parts. In 2009,

US Airways recorded $16 million in non-cash impairment charges due to the decline in fair value of certain indefinite lived

intangible assets associated with international routes. In 2008, US Airways recorded $18 million in non-cash charges related to the

decline in fair value of certain spare parts associated with its Boeing 737 aircraft fleet. See Notes 1(f), 1(g) and 1(i) for further

discussion of each of these charges.

(d) In 2010, 2009 and 2008, US Airways recorded $5 million, $22 million and $14 million, respectively, in aircraft costs as a result of

previously announced capacity reductions.

(e) In 2009 and 2008, US Airways recorded $11 million and $9 million, respectively, in severance and other charges.

(f) In 2008, in connection with the effort to consolidate functions and integrate organizations, procedures and operations with AWA,

US Airways incurred $35 million of merger-related transition expenses. These expenses included $12 million in uniform costs to

transition employees to the new US Airways uniforms; $5 million in applicable employment tax expenses related to contractual

benefits granted to certain current and former employees as a result of the merger; $6 million in compensation expenses for equity

awards granted in connection with the merger to retain key employees through the integration period; $5 million of aircraft livery

costs; $4 million in professional and technical fees related to the integration of airline operations systems and $3 million in other

expenses.

120