US Airways 2010 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

stock options was granted on January 31, 2006 with an exercise price of $33.65. The second tranche of 0.3 million stock options was

granted on January 31, 2007 with an exercise price of $56.90. The third and final tranche of 0.3 million stock options was granted on

January 31, 2008 with an exercise price of $12.50. The stock options granted to pilots do not reduce the shares available for grant under

any equity incentive plan. Any of these pilot stock options that are forfeited or that expire without being exercised will not become

available for grant under any of US Airways' plans.

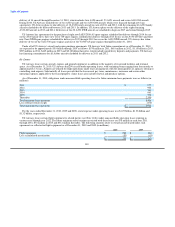

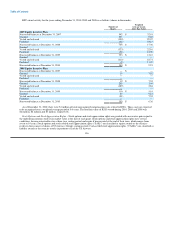

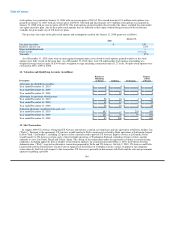

The per share fair value of the pilot stock options and assumptions used for the January 31, 2008 grant was as follows:

January 31,

2008

Per share fair value $ 3.02

Risk free interest rate 2.2%

Expected dividend yield —

Expected life 2.0 years

Volatility 55%

As of December 31, 2010, there were no unrecognized compensation costs related to stock options granted to pilots as the stock

options were fully vested on the grant date. As of December 31, 2010, there were 0.8 million pilot stock options outstanding at a

weighted average exercise price of $34.48 and a weighted average remaining contractual term of 1.27 years. No pilot stock options were

exercised in 2010, 2009 or 2008.

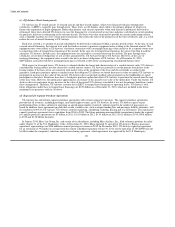

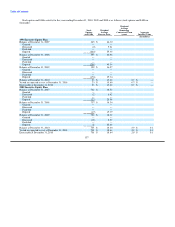

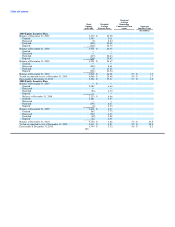

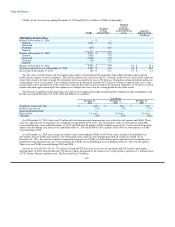

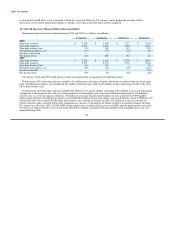

14. Valuation and Qualifying Accounts (in millions)

Balance at Balance

Beginning at End

Description of Period Additions Deductions of Period

Allowance for doubtful receivables:

Year ended December 31, 2010 $ 8 $ 4 $ 3 $ 9

Year ended December 31, 2009 $ 6 $ 7 $ 5 $ 8

Year ended December 31, 2008 $ 4 $ 10 $ 8 $ 6

Allowance for inventory obsolescence:

Year ended December 31, 2010 $ 58 $ 18 $ 2 $ 74

Year ended December 31, 2009 $ 48 $ 12 $ 2 $ 58

Year ended December 31, 2008 $ 38 $ 18 $ 8 $ 48

Valuation allowance on deferred tax asset, net:

Year ended December 31, 2010 $ 653 $ — $ 203 $ 450

Year ended December 31, 2009 $ 643 $ 29 $ 19 $ 653

Year ended December 31, 2008 $ 83 $ 560 $ — $ 643

15. Slot Transaction

In August 2009, US Airways Group and US Airways entered into a mutual asset purchase and sale agreement with Delta Airlines, Inc.

("Delta"). Pursuant to the agreement, US Airways would transfer to Delta certain assets related to flight operations at LaGuardia Airport

in New York ("LaGuardia"), including 125 pairs of slots currently used to provide US Airways Express service at LaGuardia. Delta

would transfer to US Airways certain assets related to flight operations at Washington National, including 42 pairs of slots, and the

authority to serve Sao Paulo, Brazil and Tokyo, Japan. The closing of the transactions under the agreement is subject to certain closing

conditions, including approvals from a number of government agencies. In a final decision dated May 4, 2010, the Federal Aviation

Administration ("FAA") rejected an alternative transaction proposed by Delta and US Airways. On July 2, 2010, US Airways and Delta

jointly filed with the United States Circuit Court of Appeals for the District of Columbia Circuit a notice of appeal of the regulatory

action taken by the FAA with respect to this transaction. US Airways is presently in discussions with Delta and the relevant government

agencies regarding a possible

140