US Airways 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The Citicorp credit facility matures on March 23, 2014, and is repayable in seven annual installments with each of the first six

installments to be paid on each anniversary of the closing date in an amount equal to 1% of the initial aggregate principal amount of

the loan and the final installment to be paid on the maturity date in the amount of the full remaining balance of the loan.

In addition, the Citicorp credit facility requires certain mandatory prepayments upon the occurrence of specified events, establishes

certain financial covenants, including minimum cash requirements and maintenance of certain minimum ratios, contains customary

affirmative covenants and negative covenants and contains customary events of default. The Citicorp credit facility requires the

Company to maintain consolidated unrestricted cash and cash equivalents of not less than $850 million, with not less than

$750 million (subject to partial reductions upon certain reductions in the outstanding principal amount of the loan) of that amount

held in accounts subject to control agreements, which would become restricted for use by the Company if certain adverse events

occur per the terms of the agreement. In addition, the Citicorp credit facility provides that the Company may issue debt in the future

with a second lien on the assets pledged as collateral under the Citicorp credit facility.

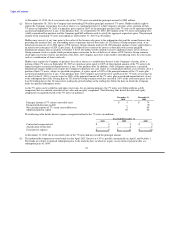

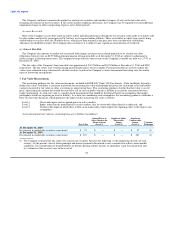

(b) The following are the significant equipment financing agreements entered into in 2010:

In 2010, US Airways borrowed $181 million to finance Airbus aircraft deliveries. These financings bear interest at a rate of LIBOR

plus an applicable margin and contain default provisions and other covenants that are typical in the industry.

In 2010, US Airways Group borrowed $30 million to finance airport construction activities in Philadelphia. These notes bear

interest at fixed rates and are secured by certain US Airways' leasehold interests. The notes payable mature from 2020 to 2029.

(c) The equipment notes underlying these EETCs are the direct obligations of US Airways and cover the financing of 27 aircraft. See

Note 9(c) for further discussion.

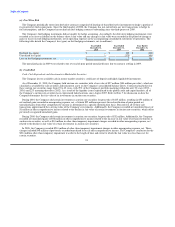

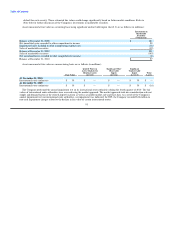

In December 2010, US Airways created two pass-through trusts which issued approximately $340 million aggregate face amount of

Series 2010-1A and Series 2010-1B Enhanced Equipment Trust Certificates (the "2010 EETCs") in connection with the refinancing

of eight Airbus aircraft owned by US Airways. The 2010 EETCs represent fractional undivided interests in the respective pass-

through trusts and are not obligations of US Airways. The net proceeds from the issuance of the 2010 EETCs were used to purchase

equipment notes issued by US Airways in two series: Series A equipment notes in an aggregate principal amount of $263 million

bearing interest at 6.25% per annum and Series B equipment notes in an aggregate principal amount of $77 million bearing interest

at 8.5% per annum. Interest on the equipment notes is payable semiannually in April and October of each year, beginning in April

2011. Principal payments on the equipment notes are scheduled to begin in October 2011. The final payments on the Series A

equipment notes and Series B equipment notes will be due in April 2023 and April 2017, respectively. US Airways' payment

obligations under the equipment notes are fully and unconditionally guaranteed by US Airways Group. Substantially all of the

proceeds from the issuance of the equipment notes were used to repay the existing debt associated with eight Airbus aircraft, with

the balance used for general corporate purposes. The equipment notes are secured by liens on aircraft.

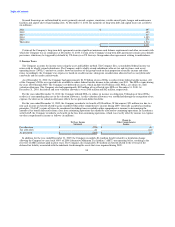

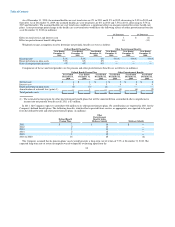

(d) US Airways Group is a party to a co-branded credit card agreement with Barclays Bank Delaware. The co-branded credit card

agreement provides for, among other things, the pre-purchase of frequent flyer miles in the aggregate amount of $200 million,

which amount was paid by Barclays in October 2008. The Company pays interest to Barclays on the outstanding dollar amount of

the pre-purchased miles at the rate of LIBOR plus a margin. This transaction was treated as a financing transaction for accounting

purposes using an effective interest rate commensurate with the Company's credit rating.

Barclays has agreed that for each month that specified conditions are met it will pre-purchase additional miles on a monthly basis in

an amount equal to the difference between $200 million and the amount of unused miles then outstanding. Commencing in January

2012, the $200 million will be reduced over a period of up to approximately two years. Among the conditions to this monthly

purchase of miles is a requirement that US Airways Group maintain an unrestricted cash balance, as defined in the agreement, of at

least $1.35 billion for the months of March through November and $1.25 billion for the months of January, February and

85