US Airways 2010 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

misconduct. In aircraft financing agreements structured as leveraged leases, US Airways typically indemnifies the lessor with respect to

adverse changes in U.S. tax laws.

US Airways is a guarantor of US Airways Group's Citicorp credit facility, 7% senior convertible notes and $30 million loan to finance

airport construction activities in Philadelphia.

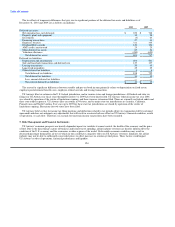

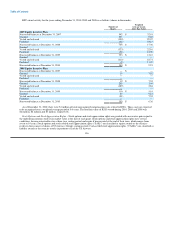

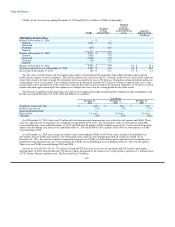

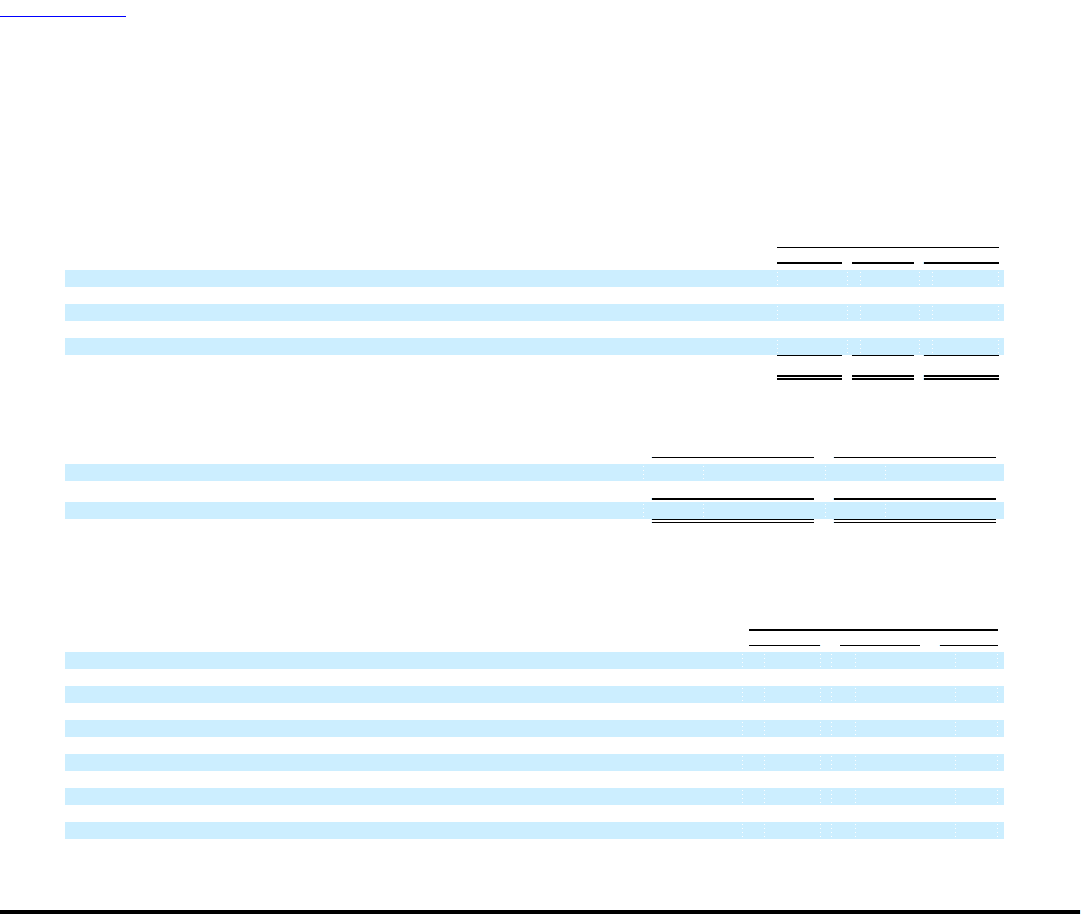

9. Other Comprehensive Income (Loss)

US Airways' other comprehensive income (loss) consisted of the following (in millions):

Year Ended December 31,

2010 2009 2008

Net income (loss) $ 599 $ (140) $ (2,148)

Recognition of net realized gains on sale of available-for-sale securities (52) — —

Net unrealized gains (losses) on available-for-sale securities, net of tax expense of $21 million in 2009 (1) 35 —

Recognition of previous unrealized losses now deemed other-than-temporary — — 48

Other postretirement benefits (21) (19) 31

Total comprehensive income (loss) $ 525 $ (124) $ (2,069)

The components of accumulated other comprehensive income were as follows (in millions):

December 31, December 31,

2010 2009

Other postretirement benefits $ 38 $ 59

Available-for-sale securities (18) 35

Accumulated other comprehensive income $ 20 $ 94

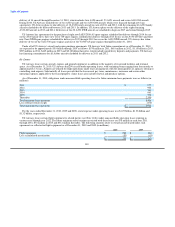

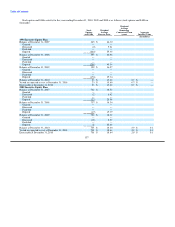

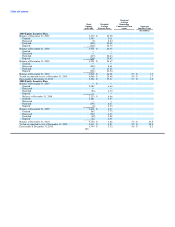

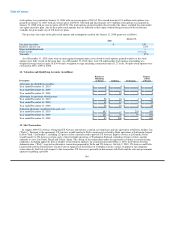

10. Supplemental Cash Flow Information

Supplemental disclosure of cash flow information and non-cash investing and financing activities are as follows (in millions):

Year Ended December 31,

2010 2009 2008

Non-cash transactions:

Note payables issued for aircraft purchases $ 118 $ 333 $ —

Interest payable converted to debt 40 40 7

Net unrealized loss (gain) on available-for-sale securities 1 (58) —

Prepayment applied to equipment purchase deposits (38) — —

Deposit applied to principal repayment on debt (31) — —

Forgiveness of intercompany payable to US Airways Group — 600 —

Debt extinguished from sale of aircraft — (251) —

Maintenance payable converted to debt — 8 33

Cash transactions:

Interest paid, net of amounts capitalized 164 145 124

Income taxes paid 1 — —

133