US Airways 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

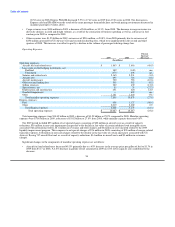

inflows were offset in part by debt repayments that totaled $407 million in 2009. Financing activities in 2009 also included net proceeds

from the issuance of common stock of $66 million from a May 2009 public offering of 17.5 million shares and $137 million from a

September 2009 public offering of 29 million shares. Principal financing activities in 2008 included proceeds from the issuance of debt of

$1.59 billion, of which $800 million was from the series of financing transactions completed in October 2008, including the Barclays pre-

purchased miles, Airbus advance and spare parts and engine loans. Proceeds also included the financing associated with the purchase of

14 Embraer aircraft and five Airbus aircraft and $145 million in proceeds from the refinancing of certain aircraft equipment notes. These

cash inflows were offset in part by debt repayments that totaled $734 million in 2008, including a $400 million paydown at par of our

Citicorp credit facility, a $100 million prepayment of certain indebtedness incurred as part of our October 2008 financing transactions and

$97 million related to the $145 million aircraft equipment note refinancing discussed above. Financing activities in 2008 also included

$179 million in net proceeds from the issuance of common stock as a result of a public offering of 21.85 million shares during the third

quarter of 2008.

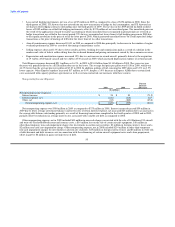

US Airways

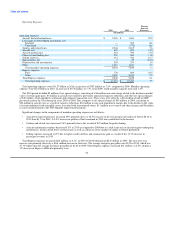

2010 Compared to 2009

Net cash provided by operating activities was $821 million and $326 million in 2010 and 2009, respectively, a year-over-year

improvement of $495 million. Growth in operating cash flows resulted from a $1.45 billion increase in total operating revenues driven

primarily by higher yields as a result of the improved economy and industry capacity discipline. The increase in revenues was offset in

part by increases in mainline and Express fuel expense, which was $701 million, or 28.4% higher than the 2009 period on a 0.9%

increase in total system capacity. In addition, US Airways' 2009 operating cash flows also benefited from $257 million of net

intercompany cash transfers received from US Airways Group. US Airways' 2010 operating cash flows were not materially impacted by

net intercompany cash transfers.

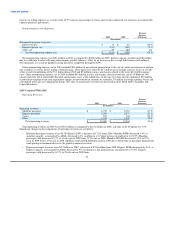

Net cash provided by investing activities was $77 million in 2010 as compared to net cash used in investing activities of $489 million

in 2009. Principal investing activities in 2010 included proceeds from sales of marketable securities of $325 million, including sales of

auction rate securities of $145 million, and a $116 million decrease in restricted cash. These cash inflows were offset in part by purchases

of marketable securities of $180 million and expenditures for property and equipment totaling $187 million. Expenditures for property

and equipment related primarily to the purchase of Airbus aircraft and payments of equipment purchase deposits for certain aircraft on

order. Restricted cash decreased primarily due to a change in the amount of holdback held by certain credit card processors for advance

ticket sales for which US Airways has not yet provided air transportation. Principal investing activities in 2009 included expenditures for

property and equipment totaling $677 million primarily related to the purchase of Airbus aircraft. These cash outflows were offset in part

by $76 million in proceeds from dispositions of property and equipment, a $60 million decrease in restricted cash and proceeds from sales

of investments in marketable securities of $52 million. The $76 million in proceeds from dispositions of property and equipment was the

result of the swap of one of US Airways' owned aircraft in exchange for the leased aircraft involved in the Flight 1549 accident and sale-

leaseback transactions involving four aircraft and five engines. Restricted cash decreased during 2009 due to a change in the amount of

holdback held by certain credit card processors for advance ticket sales for which US Airways has not yet provided air transportation.

Net cash used in financing activities was $251 million in 2010 as compared to net cash provided by financing activities of $346 million

in 2009. Principal financing activities in 2010 included debt repayments of $679 million, including the repayment of existing debt

associated with eight Airbus aircraft refinanced by a December 2010 EETC issuance. These cash outflows were offset in part by proceeds

from the issuance of debt of $437 million, which included $340 million of proceeds from the issuance of equipment notes associated with

the 2010 EETC issuance as well as the financing associated with the purchase of Airbus aircraft. Principal financing activities in 2009

included proceeds from the issuance of debt of $747 million, which primarily included the financing associated with the purchase of

Airbus aircraft, as well as additional loans under a spare parts loan agreement, a loan secured by certain airport landing slots and an

unsecured financing with one of US Airways' third party Express carriers. These cash inflows were offset in part by debt repayments that

totaled $391 million in 2009.

58