US Airways 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

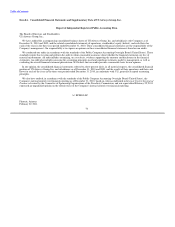

Table of Contents

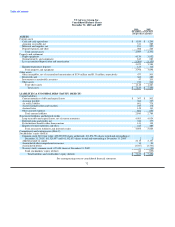

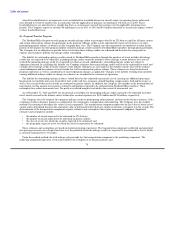

US Airways Group, Inc.

Consolidated Statements of Cash Flows

For the Years Ended December 31, 2010, 2009 and 2008

2010 2009 2008

(In millions)

Cash flows from operating activities:

Net income (loss) $ 502 $ (205) $ (2,215)

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities:

Depreciation and amortization 273 267 240

Loss on dispositions of property and equipment 8 61 7

Gain on forgiveness of debt — — (8)

Gain on sale of investments (53) — (1)

Goodwill impairment — — 622

Auction rate security impairment — 10 214

Asset impairment 6 21 13

Non-cash tax benefits — (24) —

Change in fair value of fuel hedging instruments, net — (375) 496

Amortization of deferred credits and rent (63) (62) (41)

Amortization of debt discount and issuance costs 61 56 25

Amortization of actuarial gains (4) (6) (2)

Stock-based compensation 13 20 34

Debt extinguishment costs 5 6 7

Other — (8) —

Changes in operating assets and liabilities:

Decrease (increase) in restricted cash — 186 (184)

Decrease (increase) in accounts receivable, net (34) 8 74

Decrease (increase) in materials and supplies, net (10) (29) 49

Decrease (increase) in prepaid expenses and other (57) 162 (259)

Decrease (increase) in other assets, net 18 (14) 4

Increase (decrease) in accounts payable 55 (78) 96

Increase (decrease) in air traffic liability 83 80 (134)

Increase (decrease) in accrued compensation and vacation 67 20 (67)

Increase (decrease) in accrued taxes 8 (1) (10)

Increase (decrease) in other liabilities (74) (36) 60

Net cash provided by (used in) operating activities 804 59 (980)

Cash flows from investing activities:

Purchases of property and equipment (201) (683) (1,068)

Purchases of marketable securities (180) — (299)

Sales of marketable securities 325 52 505

Proceeds from sale of other investments — — 4

Decrease (increase) in long-term restricted cash 116 60 (74)

Proceeds from sale-leaseback transactions and dispositions of property and equipment 3 76 17

Net cash provided by (used in) investing activities 63 (495) (915)

Cash flows from financing activities:

Repayments of debt and capital lease obligations (764) (407) (734)

Proceeds from issuance of debt 467 919 1,586

Deferred financing costs (10) (14) (50)

Proceeds from issuance of common stock, net — 203 179

Net cash provided (used in) financing activities (307) 701 981

Net increase (decrease) in cash and cash equivalents 560 265 (914)

Cash and cash equivalents at beginning of year 1,299 1,034 1,948

Cash and cash equivalents at end of year $ 1,859 $ 1,299 $ 1,034

See accompanying notes to consolidated financial statements.

73