US Airways 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

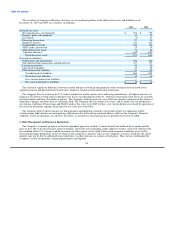

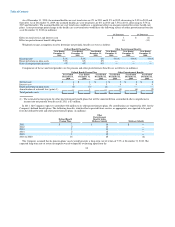

8. Employee Pension and Benefit Plans

Substantially all of the Company's employees meeting certain service and other requirements are eligible to participate in various

pension, medical, dental, life insurance, disability and survivorship plans.

(a) Defined Benefit and Other Postretirement Benefit Plans

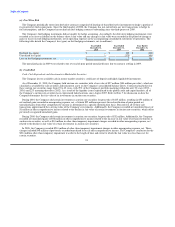

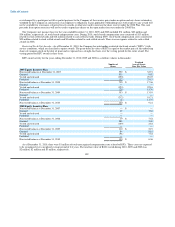

The following table sets forth changes in the fair value of plan assets, benefit obligations and the funded status of the plans and the

amounts recognized in the Company's consolidated balance sheets as of December 31, 2010 and 2009 (in millions).

Defined Benefit Pension Plans Other Postretirement Benefits

Year Ended Year Ended Year Ended Year Ended

December 31, December 31, December 31, December 31,

2010 2009 2010 2009

Fair value of plan assets at beginning of period $ 38 $ 33 $ — $ —

Actual return on plan assets 5 7 — —

Employer contributions — — 14 19

Plan participants' contributions — — 16 17

Gross benefits paid (3) (2) (30) (36)

Fair value of plan assets at end of period 40 38 — —

Benefit obligation at beginning of period 57 59 143 122

Service cost 1 1 3 2

Interest cost 3 3 8 9

Plan participants' contributions — — 16 17

Actuarial (gain) loss 3 (4) 16 11

Gross benefits paid (3) (2) (30) (36)

Plan amendments — — — 18

Benefit obligation at end of period 61 57 156 143

Funded status of the plan $ (21) $ (19) $ (156) $ (143)

Liability recognized in the consolidated balance sheet $ (21) $ (19) $ (156) $ (143)

Net actuarial loss (gain) recognized in accumulated other comprehensive

income $ 8 $ 5 $ (40) $ (60)

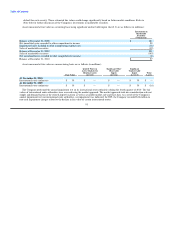

The Company maintains two defined benefit pension plans sponsored by Piedmont. Piedmont closed one plan to new participants in

2002 and froze the accrued benefits for the other plan for all participants in 2003. The aggregate accumulated benefit obligations,

projected benefit obligations and plan assets were $56 million, $61 million and $40 million, as of December 31, 2010 and $52 million,

$57 million and $38 million, as of December 31, 2009, respectively.

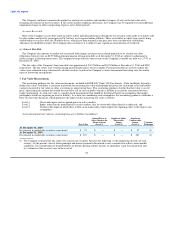

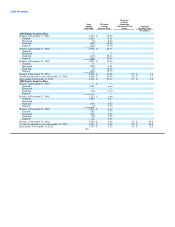

The following table presents the weighted average assumptions used to determine benefit obligations:

Defined Benefit Pension Plans Other Postretirement Benefits

Year Ended Year Ended Year Ended Year Ended

December 31, December 31, December 31, December 31,

2010 2009 2010 2009

Discount rate 5.25% 5.5% 4.93% 5.51%

Rate of compensation increase 4% 4% — —

As of December 31, 2010 and 2009, the Company discounted its pension obligations based on the current rates earned on high quality

Aa rated long-term bonds.

The Company assumed discount rates for measuring its other postretirement benefit obligations, based on a hypothetical portfolio of

high quality corporate bonds denominated in U.S. currency (Aa rated, non-callable or callable with make-whole provisions), for which

the timing and cash outflows approximate the estimated benefit payments of the other postretirement benefit plans.

94