US Airways 2010 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

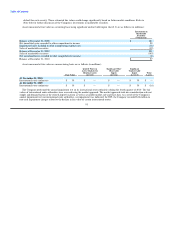

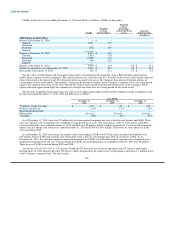

Stock Options and Stock Appreciation Rights – Stock options and stock appreciation rights are granted with an exercise price equal to

the underlying common stock's fair market value at the date of each grant. Stock options and stock appreciation rights have service

conditions, become exercisable over a three-year vesting period and expire if unexercised at the end of their term, which ranges from

seven to 10 years. Stock options and stock-settled stock appreciation rights ("SARs") are classified as equity awards as the exercise

results in the issuance of shares of the Company's common stock. Cash-settled stock appreciation rights ("CSARs") are classified as

liability awards as the exercise results in payment of cash by the Company.

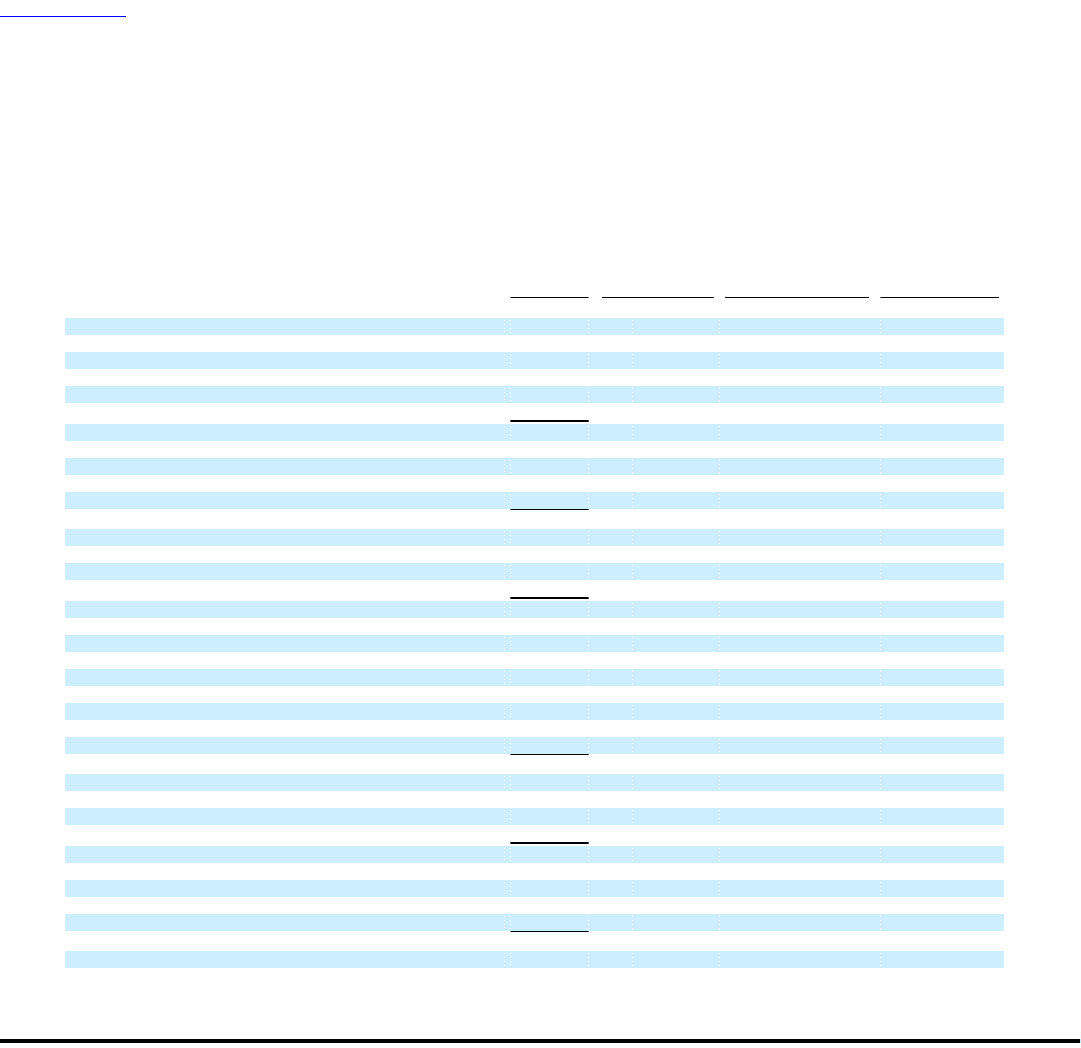

Stock option and SARs activity for the years ending December 31, 2010, 2009 and 2008 is as follows (stock options and SARs in

thousands):

Weighted

Average

Stock Weighted Remaining

Options Average Contractual Term Aggregate

and SARs Exercise Price (years) Intrinsic Value

(In millions)

1994 Incentive Equity Plan

Balance at December 31, 2007 645 $ 46.30

Granted — —

Exercised (2) 9.21

Forfeited — —

Expired (244) 55.35

Balance at December 31, 2008 399 $ 40.96

Granted — —

Exercised — —

Forfeited — —

Expired (200) 45.34

Balance at December 31, 2009 199 $ 36.57

Granted — —

Exercised — —

Forfeited — —

Expired (176) 39.34

Balance at December 31, 2010 23 $ 15.60 0.7 $ —

Vested or expected to vest at December 31, 2010 23 $ 15.60 0.7 $ —

Exercisable at December 31, 2010 23 $ 15.60 0.7 $ —

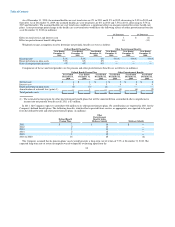

2002 Incentive Equity Plan

Balance at December 31, 2007 762 $ 18.52

Granted — —

Exercised (2) 6.42

Forfeited — —

Expired (23) 25.08

Balance at December 31, 2008 737 $ 18.34

Granted — —

Exercised — —

Forfeited — —

Expired (17) 19.39

Balance at December 31, 2009 720 $ 18.32

Granted — —

Exercised (18) 5.57

Forfeited — —

Expired (1) 25.60

Balance at December 31, 2010 701 $ 18.64 2.9 $ 0.1

Vested or expected to vest at December 31, 2010 701 $ 18.64 2.9 $ 0.1

Exercisable at December 31, 2010 701 $ 18.64 2.9 $ 0.1

103