US Airways 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

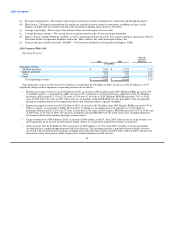

The 2008 period included a $622 million non-cash charge to write off all of the goodwill created by the merger of US Airways

Group and America West Holdings in September 2005, as well as $496 million of net unrealized losses on fuel hedging instruments.

In addition, the 2008 period included $35 million of merger-related transition expenses, $18 million in non-cash charges related to

the decline in fair value of certain spare parts associated with our Boeing 737 aircraft fleet and, as a result of capacity reductions,

$14 million in aircraft costs and $9 million in severance charges.

The 2007 period included $187 million of net unrealized gains on fuel hedging instruments, $7 million in tax credits due to an IRS

rule change allowing us to recover certain fuel usage tax amounts for years 2003-2006, $9 million of insurance settlement proceeds

related to business interruption and property damages incurred as a result of Hurricane Katrina in 2005 and a $5 million Piedmont

pilot pension curtailment gain related to the FAA-mandated pilot retirement age change. These credits were offset by $99 million of

merger-related transition expenses, a $99 million charge for an increase to long-term disability obligations for US Airways' pilots as

a result of the FAA-mandated pilot retirement age change and $5 million in charges related to reduced flying from Pittsburgh.

The 2006 period included $131 million of merger-related transition expenses and $70 million of net unrealized losses on fuel

hedging instruments, offset by a $90 million gain associated with the return of equipment deposits upon forgiveness of a loan and

$14 million of gains associated with the settlement of bankruptcy claims.

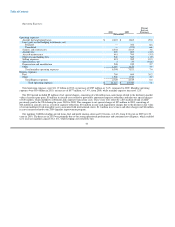

(b) The 2010 period included $53 million of net realized gains related to the sale of certain investments in auction rate securities as well

as an $11 million settlement gain, offset by $5 million in non-cash charges related to the write off of debt issuance costs.

The 2009 period included $49 million in non-cash charges associated with the sale of 10 Embraer 190 aircraft and write off of

related debt discount and issuance costs, $10 million in other-than-temporary non-cash impairment charges for investments in

auction rate securities and a $2 million non-cash asset impairment charge. In addition, the period included a tax benefit of

$38 million. Of this amount, $21 million was due to a non-cash income tax benefit related to gains recorded within other

comprehensive income during 2009. In addition, we recorded a $14 million tax benefit related to a legislation change allowing us to

carry back 100% of 2008 Alternative Minimum Tax liability ("AMT") net operating losses, resulting in the recovery of AMT

amounts paid in prior years. We also recognized a $3 million tax benefit related to the reversal of the deferred tax liability

associated with the indefinite lived intangible assets that were impaired during 2009.

The 2008 period included $214 million in other-than-temporary non-cash impairment charges for investments in auction rate

securities as well as $7 million in write offs of debt discount and debt issuance costs in connection with the refinancing of certain

aircraft equipment notes and certain loan prepayments, offset by $8 million in gains on forgiveness of debt.

The 2007 period included an $18 million write off of debt issuance costs in connection with the refinancing of the $1.25 billion

senior secured credit facility with General Electric Capital Corporation ("GECC"), referred to as the GE loan, in March 2007 and

$10 million in other-than-temporary non-cash impairment charges for investments in auction rate securities, offset by a $17 million

gain recognized on the sale of stock in ARINC Incorporated. In addition, the period also included a non-cash expense for income

taxes of $7 million related to the utilization of NOLs acquired from US Airways. The valuation allowance associated with these

acquired NOLs was recognized as a reduction of goodwill rather than a reduction in tax expense.

The 2006 period included a non-cash expense for income taxes of $85 million related to the utilization of NOLs acquired from US

Airways. In addition, the period included $6 million of prepayment penalties and $5 million in accelerated amortization of debt

issuance costs in connection with the refinancing of the loan previously guaranteed by the Air Transportation Stabilization Board

("ATSB") and two loans previously provided to AWA by GECC, $17 million in payments in connection with the inducement to

convert $70 million of US Airways Group's 7% Senior Convertible Notes to common stock and a $14 million write off of debt

discount and issuance costs associated with those converted notes, offset by $8 million of interest income earned on certain prior

year federal income tax refunds.

33