US Airways 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

primary purpose of which is to finance the acquisition of flight equipment. Rather than finance each aircraft separately when such aircraft

is purchased, delivered or refinanced, these trusts allowed US Airways to raise the financing for several aircraft at one time and place

such funds in escrow pending the purchase, delivery or refinancing of the relevant aircraft. The trusts were also structured to provide for

certain credit enhancements, such as liquidity facilities to cover certain interest payments, that reduce the risks to the purchasers of the

trust certificates and, as a result, reduce the cost of aircraft financing to US Airways.

Each trust covered a set amount of aircraft scheduled to be delivered or refinanced within a specific period of time. At the time of each

covered aircraft financing, the relevant trust used the funds in escrow to purchase equipment notes relating to the financed aircraft. The

equipment notes were issued, at US Airways' election in connection with a mortgage financing of the aircraft or by a separate owner trust

in connection with a leveraged lease financing of the aircraft. In the case of a leveraged lease financing, the owner trust then leased the

aircraft to US Airways. In both cases, the equipment notes are secured by a security interest in the aircraft. The pass through trust

certificates are not direct obligations of, nor are they guaranteed by, US Airways Group or US Airways. However, in the case of

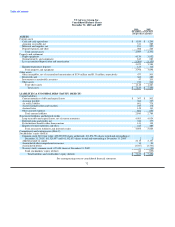

mortgage financings, the equipment notes issued to the trusts are direct obligations of US Airways. As of December 31, 2010,

$809 million associated with these mortgage financings is reflected as debt in the accompanying consolidated balance sheet.

With respect to leveraged leases, US Airways evaluated whether the leases had characteristics of a variable interest entity. US Airways

concluded the leasing entities met the criteria for variable interest entities. US Airways generally is not the primary beneficiary of the

leasing entities if the lease terms are consistent with market terms at the inception of the lease and do not include a residual value

guarantee, fixed-price purchase option or similar feature that obligates US Airways to absorb decreases in value or entitles US Airways to

participate in increases in the value of the aircraft. US Airways does not provide residual value guarantees to the bondholders or equity

participants in the trusts. Each lease does have a fixed price purchase option that allows US Airways to purchase the aircraft near the end

of the lease term. However, the option price approximates an estimate of the aircraft's fair value at the option date. Under this feature, US

Airways does not participate in any increases in the value of the aircraft. US Airways concluded it was not the primary beneficiary under

these arrangements. Therefore, US Airways accounts for its EETC leveraged lease financings as operating leases. US Airways' total

future obligations under these leveraged lease financings are $2.96 billion as of December 31, 2010.

Special Facility Revenue Bonds

US Airways guarantees the payment of principal and interest on certain special facility revenue bonds issued by municipalities to build

or improve certain airport and maintenance facilities which are leased to US Airways. Under such leases, US Airways is required to make

rental payments through 2023, sufficient to pay maturing principal and interest payments on the related bonds. As of December 31, 2010,

the remaining lease payments guaranteeing the principal and interest on these bonds are $121 million, of which $30 million of these

obligations is accounted for as a capital lease and reflected as debt in the accompanying consolidated balance sheet.

63