US Airways 2010 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

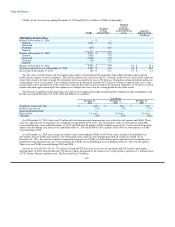

carrier basis. The objective in making resource allocation decisions is to maximize consolidated financial results, not the individual

results of US Airways and US Airways Express.

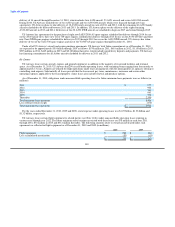

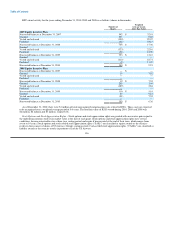

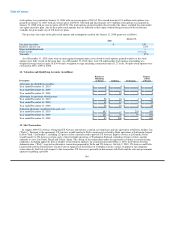

Information concerning operating revenues in principal geographic areas is as follows (in millions):

Year Ended Year Ended Year Ended

December 31, December 31, December 31,

2010 2009 2008

United States $ 9,305 $ 8,405 $ 9,760

Foreign 2,750 2,204 2,484

Total $ 12,055 $ 10,609 $ 12,244

US Airways attributes operating revenues by geographic region based upon the origin and destination of each flight segment. US

Airways' tangible assets consist primarily of flight equipment, which are mobile across geographic markets and, therefore, have not been

allocated.

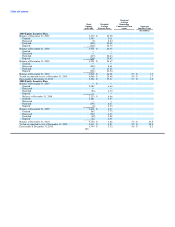

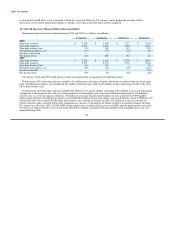

13. Stock-based Compensation

In June 2008, the stockholders of US Airways Group approved the 2008 Equity Incentive Plan (the "2008 Plan"). The 2008 Plan

replaces and supersedes the 2005 Equity Incentive Plan (the "2005 Plan"). No additional awards will be made under the 2005 Plan,

although outstanding awards previously made under the 2005 Plan will continue to be governed by the terms and conditions of the 2005

Plan. Any shares subject to an award under the 2005 Plan outstanding as of the date on which the 2008 Plan was approved by the Board

that expire, are forfeited or otherwise terminate unexercised will increase the shares reserved for issuance under the 2008 Plan by (i) one

share for each share of stock issued pursuant to a stock option or stock appreciation right and (ii) three shares for each share of stock

issued pursuant to a restricted stock unit, which corresponds to the reduction originally made with respect to each award in the 2005 Plan.

The 2008 Plan authorizes the grant of awards for the issuance of up to a maximum of 6,700,000 shares of US Airways Group's

common stock. Awards may be in the form of performance grants, bonus awards, performance shares, restricted stock awards, vested

shares, restricted stock units, vested units, incentive stock options, nonstatutory stock options and stock appreciation rights. The number

of shares of US Airways Group's common stock available for issuance under the 2008 Plan is reduced by (i) one share for each share of

stock issued pursuant to a stock option or a stock appreciation right, and (ii) one and one-half (1.5) shares for each share of stock issued

pursuant to all other stock awards. Cash settled awards do not reduce the number of shares available for issuance under the 2008 Plan.

Stock awards that are terminated, forfeited or repurchased result in an increase in the share reserve of the 2008 Plan corresponding to the

reduction originally made in respect of the award. Any shares of US Airways Group's stock tendered or exchanged by a participant as full

or partial payment to US Airways Group of the exercise price under an option and any shares retained or withheld by US Airways Group

in satisfaction of an employee's obligations to pay applicable withholding taxes with respect to any award will not be available for

reissuance, subjected to new awards or otherwise used to increase the share reserve under the 2008 Plan. The cash proceeds from option

exercises will not be used to repurchase shares on the open market for reuse under the 2008 Plan.

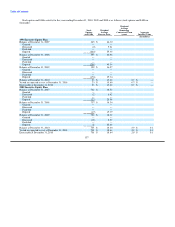

US Airways' net income (loss) for the years ended December 31, 2010, 2009 and 2008 included $31 million, $23 million and

$34 million, respectively, of stock-based compensation costs. During 2010, stock-based compensation costs consisted of $13 million

related to stock settled awards and $18 million related to cash settled awards. During 2009, stock-based compensation costs consisted of

$20 million related to stock settled awards and $3 million related to cash settled awards. There was no expense related to cash settled

awards in 2008.

Restricted Stock Unit Awards – As of December 31, 2010, US Airways Group has outstanding restricted stock unit awards ("RSUs")

with service conditions, which are classified as equity awards. The grant-date fair value of RSUs is equal to the market price of the

underlying shares of US Airways Group's common stock on the date of grant and is expensed on a straight-line basis over the vesting

period for the entire award. The vesting period for RSU awards is three years.

135