US Airways 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

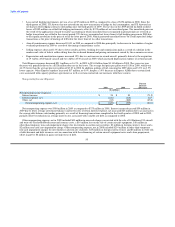

Citicorp Credit Facility

On March 23, 2007, US Airways Group entered into a term loan credit facility with Citicorp North America, Inc., as administrative

agent, and a syndicate of lenders pursuant to which US Airways Group borrowed an aggregate principal amount of $1.6 billion. US

Airways and certain other subsidiaries of US Airways Group are guarantors of the Citicorp credit facility.

The Citicorp credit facility bears interest at an index rate plus an applicable index margin or, at our option, LIBOR plus an applicable

LIBOR margin for interest periods of one, two, three or six months. The applicable index margin, subject to adjustment, is 1.00%, 1.25%

or 1.50% if the adjusted loan balance is less than $600 million, between $600 million and $1 billion, or greater than $1 billion,

respectively. The applicable LIBOR margin, subject to adjustment, is 2.00%, 2.25% or 2.50% if the adjusted loan balance is less than

$600 million, between $600 million and $1 billion, or greater than $1 billion, respectively. In addition, interest on the Citicorp credit

facility may be adjusted based on the credit rating for the Citicorp credit facility as follows: (i) if the credit ratings of the Citicorp credit

facility by Moody's and S&P in effect as of the last day of the most recently ended fiscal quarter are both at least one subgrade better than

the credit ratings in effect on March 23, 2007, then (A) the applicable LIBOR margin will be the lower of 2.25% and the rate otherwise

applicable based upon the adjusted Citicorp credit facility balance and (B) the applicable index margin will be the lower of 1.25% and the

rate otherwise applicable based upon the Citicorp credit facility principal balance, and (ii) if the credit ratings of the Citicorp credit

facility by Moody's and S&P in effect as of the last day of the most recently ended fiscal quarter are both at least two subgrades better

than the credit ratings in effect on March 23, 2007, then (A) the applicable LIBOR margin will be 2.00% and (B) the applicable index

margin will be 1.00%. As of December 31, 2010, the interest rate on the Citicorp credit facility was 2.79% based on a 2.50% LIBOR

margin.

The Citicorp credit facility matures on March 23, 2014, and is repayable in seven annual installments with each of the first six

installments to be paid on each anniversary of the closing date in an amount equal to 1% of the initial aggregate principal amount of the

loan and the final installment to be paid on the maturity date in the amount of the full remaining balance of the loan.

In addition, the Citicorp credit facility requires certain mandatory prepayments upon the occurrence of specified events, establishes

certain financial covenants, including minimum cash requirements and maintenance of certain minimum ratios, contains customary

affirmative covenants and negative covenants and contains customary events of default. The Citicorp credit facility requires us to

maintain consolidated unrestricted cash and cash equivalents of not less than $850 million, with not less than $750 million (subject to

partial reductions upon certain reductions in the outstanding principal amount of the loan) of that amount held in accounts subject to

control agreements, which would become restricted for use by us if certain adverse events occur per the terms of the agreement. In

addition, the Citicorp credit facility provides that we may issue debt in the future with a second lien on the assets pledged as collateral

under the Citicorp credit facility. The principal amount outstanding under the Citicorp credit facility was $1.15 billion as of December 31,

2010. As of December 31, 2010, we were in compliance with all debt covenants under the Citicorp credit facility.

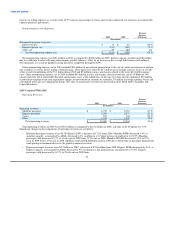

7% Senior Convertible Notes

Prior to September 30, 2010, we had outstanding $74 million principal amount of 7% notes. Holders had the right to require us to

purchase for cash or shares or a combination thereof, at our election, all or a portion of their 7% notes on September 30, 2010 at a

purchase price equal to 100% of the principal amount of the 7% notes to be repurchased plus accrued and unpaid interest, if any, to the

purchase date. As of September 30, 2010, $69 million of the 7% notes outstanding were validly surrendered for purchase and we paid

$69 million in cash to satisfy the aggregate repurchase price. The principal amount of the remaining 7% notes outstanding as of

December 31, 2010 was $5 million.

2010 Financing Transactions

In 2010, US Airways borrowed $181 million to finance Airbus aircraft deliveries. These financings bear interest at a rate of LIBOR

plus an applicable margin and contain default provisions and other covenants that are typical in the industry.

60