US Airways 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

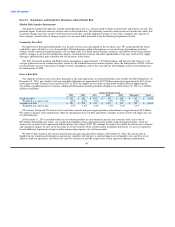

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Market Risk Sensitive Instruments

Our primary market risk exposures include commodity price risk (i.e., the price paid to obtain aviation fuel) and interest rate risk. The

potential impact of adverse increases in these risks is discussed below. The following sensitivity analyses do not consider the effects that

an adverse change may have on the overall economy nor do they consider additional actions we may take to mitigate our exposure to

these changes. Actual results of changes in prices or rates may differ materially from the following hypothetical results.

Commodity Price Risk

Fuel prices have fluctuated substantially over the past several years and sharply in the last three years. We cannot predict the future

availability, price volatility or cost of aircraft fuel. Natural disasters, political disruptions or wars involving oil-producing countries,

changes in fuel-related governmental policy, the strength of the U.S. dollar against foreign currencies, speculation in the energy futures

markets, changes in aircraft fuel production capacity, environmental concerns and other unpredictable events may result in fuel supply

shortages, additional fuel price volatility and cost increases in the future.

Our 2011 forecasted mainline and Express fuel consumption is approximately 1.43 billion gallons, and based on this forecast, a one

cent per gallon increase in aviation fuel price results in a $14 million increase in annual expense. Since the third quarter of 2008, we have

not entered into any new transactions to hedge our fuel consumption, and we have not had any fuel hedging contracts outstanding since

the third quarter of 2009.

Interest Rate Risk

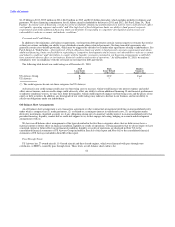

Our exposure to interest rate risk relates primarily to our cash equivalents, investment portfolios and variable-rate debt obligations. At

December 31, 2010, our variable-rate long-term debt obligations of approximately $2.97 billion represented approximately 64% of our

total long-term debt. If interest rates increased 10% in 2010, the impact on our results of operations would have been approximately

$11 million of additional interest expense. Additional information regarding our debt obligations as of December 31, 2010 is as follows

(dollars in millions):

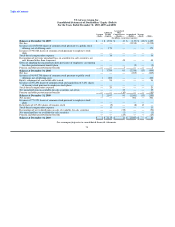

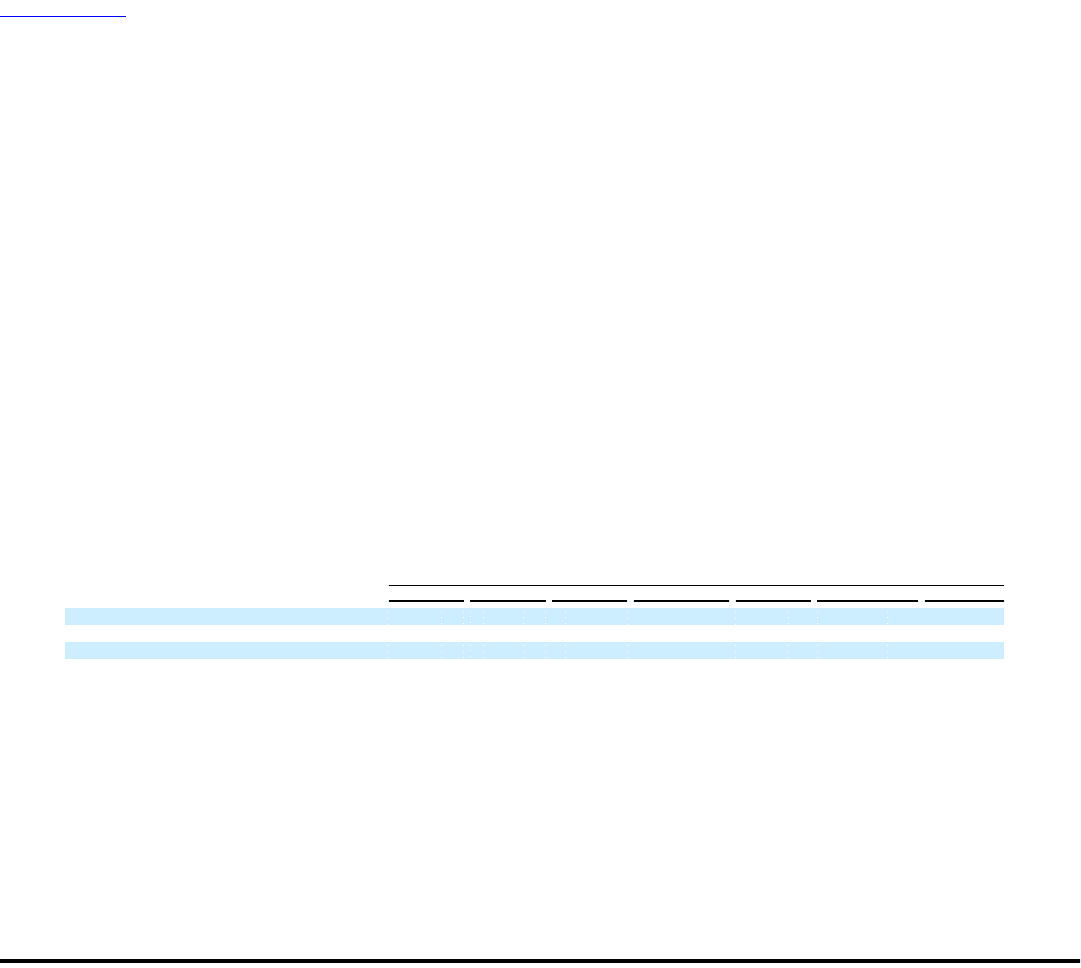

Expected Maturity Date

2011 2012 2013 2014 2015 Thereafter Total

Fixed-rate debt $ 195 $ 181 $ 104 $ 278 $ 158 $ 732 $ 1,648

Weighted avg. interest rate 8.5% 8.0% 7.8% 7.9% 7.9% 7.4%

Variable-rate debt $ 202 $ 274 $ 313 $ 1,277 $ 121 $ 782 $ 2,969

Weighted avg. interest rate 3.7% 3.5% 3.4% 3.3% 3.4% 3.1%

US Airways Group and US Airways have total future aircraft and spare engine purchase commitments of approximately $5.9 billion.

We expect to finance such commitments either by entering into leases or debt agreements. Changes in interest rates will impact the cost

of such financings.

At December 31, 2010, included within our investment portfolio are investments in auction rate securities with a fair value of

$57 million ($84 million par value). As a result of the liquidity issues experienced in the global credit and capital markets, all of our

auction rate securities have experienced failed auctions since August 2007. We continue to monitor the market for auction rate securities

and consider its impact (if any) on the fair value of our investments. If the current market conditions deteriorate, we may be required to

record additional impairment charges in other nonoperating expense, net in future periods.

We believe that, based on our current unrestricted cash and cash equivalents balance at December 31, 2010, the current lack of

liquidity in our remaining investments in auction rate securities will not have a material impact on our liquidity, our cash flow or our

ability to fund our operations. See Notes 6(b) and 5(b) in Items 8A and 8B, respectively, of this report for additional information.

69