US Airways 2010 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

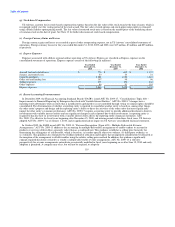

(j) Other Assets

Other assets consist of the following as of December 31, 2010 and 2009 (in millions):

2010 2009

Aircraft leasehold interest, net $ 71 $ 77

Deferred rent 47 59

Deposits 38 36

Debt issuance costs, net 24 26

Long-term investments 10 9

Total other assets $ 190 $ 207

Aircraft leasehold interest, net represents assets established for leasehold interests in aircraft subject to operating leases with rental

rates deemed to be below-market rates in connection with the application of purchase accounting for US Airways in 2005. These

leasehold interests are amortized on a straight-line basis as an increase to aircraft rent expense over the applicable remaining lease

periods. US Airways expects to amortize $6 million per year in 2011 to 2015 and $41 million thereafter to aircraft rent expense related to

these leasehold interests.

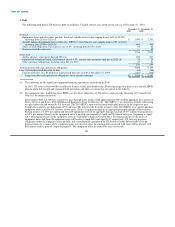

(k) Frequent Traveler Program

The Dividend Miles frequent traveler program awards mileage credits to passengers who fly on US Airways and Star Alliance carriers

and certain other partner airlines that participate in the program. Mileage credits can be redeemed for travel on US Airways or other

participating partner airlines, in which case US Airways pays a fee. US Airways uses the incremental cost method to account for the

portion of the frequent traveler program liability related to mileage credits earned by Dividend Miles members through purchased flights.

US Airways has an obligation to provide future travel when these mileage credits are redeemed and therefore has recognized an expense

and recorded a liability for mileage credits outstanding.

The liability for outstanding mileage credits earned by Dividend Miles members through the purchase of travel includes all mileage

credits that are expected to be redeemed, including mileage credits earned by members whose mileage account balances have not yet

reached the minimum mileage credit level required to redeem an award. Additionally, outstanding mileage credits are subject to

expiration if unused. In calculating the liability, US Airways estimates how many mileage credits will never be redeemed for travel and

excludes those mileage credits from the estimate of the liability. Estimates are also made for the number of miles that will be used per

award redemption and the number of travel awards that will be redeemed on partner airlines. These estimates are based on historical

program experience as well as consideration of enacted program changes, as applicable. Changes in the liability resulting from members

earning additional mileage credits or changes in estimates are recorded in the statement of operations.

The liability for outstanding mileage credits is valued based on the estimated incremental cost of carrying one additional passenger.

Incremental cost includes unit costs incurred for fuel, credit card fees, insurance, denied boarding compensation, food and beverages as

well as fees incurred when travel awards are redeemed on partner airlines. In addition, US Airways also includes in the determination of

incremental cost the amount of certain fees related to redemptions expected to be collected from Dividend Miles members. These

redemption fees reduce incremental cost. No profit or overhead margin is included in the accrual of incremental cost.

As of December 31, 2010 and 2009, the incremental cost liability for outstanding mileage credits expected to be redeemed for future

travel awards accrued on the balance sheets within other accrued expenses was $149 million and $130 million, respectively.

US Airways also sells frequent flyer program mileage credits to participating airline partners and non-airline business partners. Sales

of mileage credits to business partners is comprised of two components, transportation and marketing. US Airways uses the residual

method of accounting to determine the values of each component. The transportation component represents the fair value of future travel

awards and is determined based on the equivalent value of purchased tickets that have similar restrictions as frequent traveler awards. The

determination of the

116