US Airways 2010 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

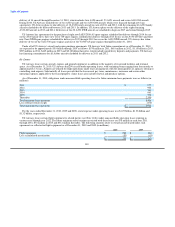

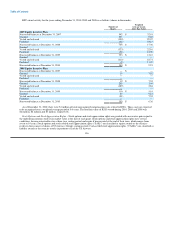

default for each security. These estimated fair values could change significantly based on future market conditions. Refer to

Note 5(b) for further discussion of US Airways' investments in marketable securities.

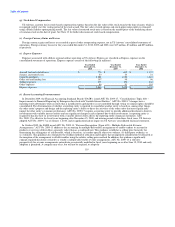

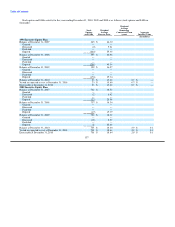

Assets measured at fair value on a recurring basis using significant unobservable inputs (Level 3) are as follows (in millions):

Investments in

Marketable

Securities

(Noncurrent)

Balance at December 31, 2008 $ 187

Net unrealized gains recorded to other comprehensive income 58

Impairment losses included in other nonoperating expense, net (10)

Sales of marketable securities (32)

Balance at December 31, 2009 203

Sales of marketable securities (145)

Net unrealized losses recorded to other comprehensive income (1)

Balance at December 31, 2010 $ 57

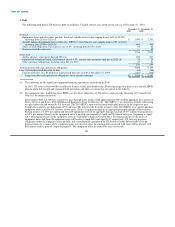

Assets measured at fair value on a nonrecurring basis are as follows (in millions):

Quoted Prices in Significant

Active Markets for Significant Other Unobservable

Identical Assets Observable Inputs Inputs Total

Fair Value (Level 1) (Level 2) (Level 3) Losses

At December 31, 2010

International route authorities $ 39 $ — $ — $ 39 $ —

At December 31, 2009

International route authorities $ 39 $ — $ — $ 39 $ (16)

US Airways performed the annual impairment test on its international route authorities during the fourth quarter of 2010. The fair

values of international route authorities were assessed using the market approach. The market approach took into consideration relevant

supply and demand factors at the related airport locations as well as available market sale and lease data. As a result of US Airways'

annual impairment test on international route authorities, no impairment was indicated. In 2009, US Airways recorded $16 million in

non-cash impairment charges related to the decline in fair value of certain international routes.

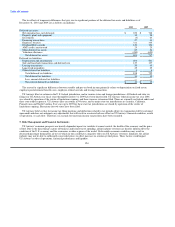

7. Employee Pension and Benefit Plans

Substantially all of US Airways' employees meeting certain service and other requirements are eligible to participate in various

pension, medical, dental, life insurance, disability and survivorship plans.

127