US Airways 2010 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

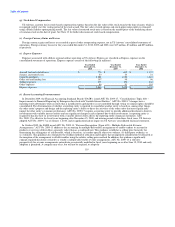

(n) Revenue Recognition

Passenger Revenue

Passenger revenue is recognized when transportation is provided. Ticket sales for transportation that has not yet been provided are

initially deferred and recorded as air traffic liability on the consolidated balance sheets. The air traffic liability represents tickets sold for

future travel dates and estimated future refunds and exchanges of tickets sold for past travel dates. The majority of tickets sold are

nonrefundable. A small percentage of tickets, some of which are partially used tickets, expire unused. Due to complex pricing structures,

refund and exchange policies, and interline agreements with other airlines, certain amounts are recognized in revenue using estimates

regarding both the timing of the revenue recognition and the amount of revenue to be recognized. These estimates are generally based on

the analysis of US Airways' historical data. US Airways and members of the airline industry have consistently applied this accounting

method to estimate revenue from forfeited tickets at the date travel was to be provided. Estimated future refunds and exchanges included

in the air traffic liability are routinely evaluated based on subsequent activity to validate the accuracy of US Airways' estimates. Any

adjustments resulting from periodic evaluations of the estimated air traffic liability are included in results of operations during the period

in which the evaluations are completed.

Passenger traffic commissions and related fees are expensed when the related revenue is recognized. Passenger traffic commissions

and related fees not yet recognized are included as a prepaid expense.

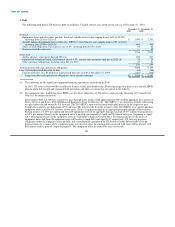

US Airways purchases capacity, or ASMs, generated by US Airways Group's wholly owned regional air carriers and the capacity of

Air Wisconsin Airlines Corporation ("Air Wisconsin"), Republic Airline Inc. ("Republic"), Mesa Airlines, Inc. ("Mesa") and Chautauqua

Airlines, Inc. ("Chautauqua") in certain markets. US Airways Group's wholly owned regional air carriers, Air Wisconsin, Republic, Mesa

and Chautauqua operate regional jet aircraft in these markets as part of US Airways Express. US Airways classifies revenues generated

from transportation on these carriers as Express passenger revenues. Liabilities related to tickets sold by US Airways for travel on these

air carriers are also included in US Airways' air traffic liability and are subsequently relieved in the same manner as described above.

US Airways collects various taxes and fees on its ticket sales. These taxes and fees are remitted to governmental authorities and are

accounted for on a net basis.

Cargo Revenue

Cargo revenue is recognized when shipping services for mail and other cargo are provided.

Other Revenue

Other revenue includes checked and excess baggage charges, beverage sales, ticket change and service fees, commissions earned on

tickets sold for flights on other airlines and sales of tour packages by the US Airways Vacations division, which are recognized when the

services are provided. Other revenues also include processing fees for travel awards issued through the Dividend Miles frequent traveler

program and the marketing component earned from selling mileage credits to partners, as discussed in Note 1(k).

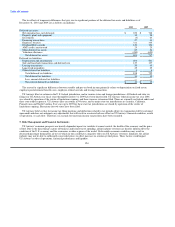

(o) Maintenance and Repair Costs

Maintenance and repair costs for owned and leased flight equipment are charged to operating expense as incurred.

(p) Selling Expenses

Selling expenses include commissions, credit card fees, computerized reservations systems fees, advertising and promotional expenses.

Advertising and promotional expenses are expensed when incurred. Advertising and promotional expenses for the years ended

December 31, 2010, 2009 and 2008 were $10 million, $11 million and $10 million, respectively.

118