US Airways 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

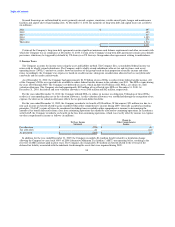

Table of Contents

December. The Company may repurchase any or all of the pre-purchased miles at any time, from time to time, without penalty. The

agreement expires in 2017.

(e) On October 20, 2008, US Airways and Airbus entered into amendments to the A320 Family Aircraft Purchase Agreement, the A330

Aircraft Purchase Agreement, and the A350 XWB Purchase Agreement. In exchange for US Airways' agreement to enter into these

amendments, Airbus advanced US Airways $200 million in consideration of aircraft deliveries under the various related purchase

agreements. Under the terms of each of the amendments, US Airways has agreed to maintain a level of unrestricted cash in the same

amount required by the Citicorp credit facility. This transaction was treated as a financing transaction for accounting purposes using

an effective interest rate commensurate with US Airways' credit rating. There are no stated interest payments.

(f) In May 2009, US Airways Group issued $172 million aggregate principal amount of the 7.25% notes for net proceeds of

approximately $168 million. The 7.25% notes bear interest at a rate of 7.25% per annum, which shall be payable semi-annually in

arrears on each May 15 and November 15. The 7.25% notes mature on May 15, 2014.

Holders may convert their 7.25% notes at their option at any time prior to the close of business on the second scheduled trading day

immediately preceding the maturity date for the 7.25% notes. Upon conversion, the Company will pay or deliver, as the case may

be, cash, shares of US Airways Group common stock or a combination thereof at the Company's election. The initial conversion

rate for the 7.25% notes is 218.8184 shares of US Airways Group common stock per $1,000 principal amount of notes (equivalent

to an initial conversion price of $4.57 per share). Such conversion rate is subject to adjustment in certain events.

If the Company undergoes a fundamental change, holders may require the Company to purchase all or a portion of their

7.25% notes for cash at a price equal to 100% of the principal amount of the 7.25% notes to be purchased plus any accrued and

unpaid interest to, but excluding, the purchase date. A fundamental change includes a person or group (other than the Company or

its subsidiaries) becoming the beneficial owner of more than 50% of the voting power of the Company's capital stock, certain

merger or combination transactions, a substantial turnover of the Company's directors, stockholder approval of the liquidation or

dissolution of the Company and the Company's common stock ceasing to be listed on at least one national securities exchange.

The 7.25% notes rank equal in right of payment to all of the Company's other existing and future unsecured senior debt and senior

in right of payment to the Company's debt that is expressly subordinated to the 7.25% notes, if any. The 7.25% notes impose no

limit on the amount of debt the Company or its subsidiaries may incur. The 7.25% notes are structurally subordinated to all debt and

other liabilities and commitments (including trade payables) of the Company's subsidiaries. The 7.25% notes are also effectively

junior to the Company's secured debt, if any, to the extent of the value of the assets securing such debt.

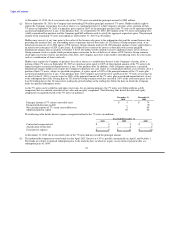

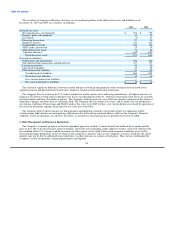

As the 7.25% notes can be settled in cash upon conversion, for accounting purposes, the 7.25% notes were bifurcated into a debt

component that was initially recorded at fair value and an equity component. The following table details the debt and equity

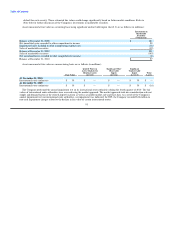

components recognized related to the 7.25% notes (in millions):

December 31, December 31,

2010 2009

Principal amount of 7.25% convertible senior notes $ 172 $ 172

Unamortized discount on debt (80) (92)

Net carrying amount of 7.25% convertible senior notes 92 80

Additional paid-in capital 96 96

At December 31, 2010, the remaining period over which the unamortized discount will be recognized is 3.4 years.

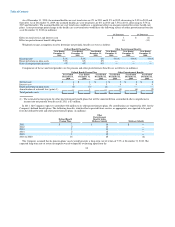

The following table details interest expense recognized related to the 7.25% notes (in millions):

Year Ended December 31,

2010 2009

Contractual coupon interest $ 13 $ 8

Amortization of discount 12 6

Total interest expense $ 25 $ 14

86