US Airways 2010 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

carryforwards. A valuation allowance is established, if necessary, for the amount of any tax benefits that, based on available evidence, are

not expected to be realized.

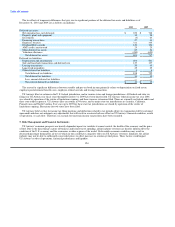

(i) Goodwill and Other Intangibles, Net

Goodwill

In 2008, US Airways recorded a $622 million impairment charge to write off all the goodwill created by the merger of US Airways

Group and America West Holdings in September 2005. US Airways performed an interim goodwill impairment test during 2008 as a

result of a significant increase in fuel prices, declines in US Airways Group's stock price and mainline capacity reductions, which led to

no implied fair value of goodwill.

Other intangible assets

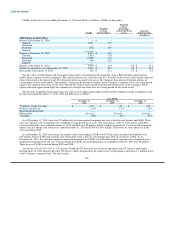

Other intangible assets consist primarily of trademarks, international route authorities, airport take-off and landing slots and airport

gates. Intangible assets with estimable useful lives are amortized over their respective estimated useful lives to their estimated residual

values and reviewed for impairment whenever events or changes in circumstances indicate that the carrying value may not be

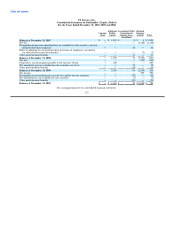

recoverable. The following table provides information relating to US Airways' intangible assets subject to amortization as of

December 31, 2010 and 2009 (in millions):

2010 2009

Airport take-off and landing slots $ 452 $ 452

Airport gate leasehold rights 52 52

Accumulated amortization (130) (106)

Total $ 374 $ 398

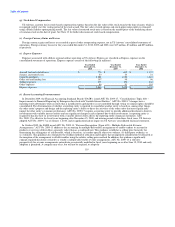

The intangible assets subject to amortization generally are amortized over 25 years for airport take-off and landing slots and over the

term of the lease for airport gate leasehold rights on a straight-line basis and are included in depreciation and amortization on the

consolidated statements of operations. For the years ended December 31, 2010, 2009 and 2008, US Airways recorded amortization

expense of $24 million, $25 million and $23 million, respectively, related to its intangible assets. US Airways expects to record annual

amortization expense of $21 million in year 2011, $20 million in year 2012, $20 million in year 2013, $20 million in year 2014,

$20 million in year 2015 and $273 million thereafter related to these intangible assets.

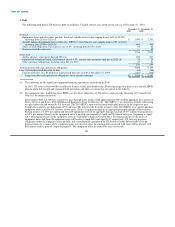

Indefinite lived assets are not amortized but instead are reviewed for impairment annually and more frequently if events or

circumstances indicate that the asset may be impaired. As of December 31, 2010 and 2009, US Airways had $39 million of international

route authorities and $30 million of trademarks on its balance sheets.

US Airways performed the annual impairment test on its international route authorities and trademarks during the fourth quarter of

2010. The fair values of international route authorities were assessed using the market approach. The market approach took into

consideration relevant supply and demand factors at the related airport locations as well as available market sale and lease data. For

trademarks, US Airways utilized a form of the income approach known as the relief-from-royalty method. As a result of the US Airways'

annual impairment test on international route authorities and trademarks, no impairment was indicated. In 2009, US Airways recorded

$16 million in non-cash impairment charges related to the decline in fair value of certain international routes. US Airways will perform

its next annual impairment test on October 1, 2011.

115