US Airways 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

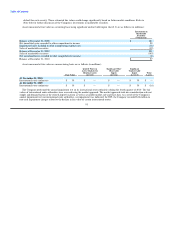

plans' investment consultants, including their review of asset class return expectations and long-term inflation assumptions.

The Company's overall investment strategy is to achieve long-term investment growth. The Company's targeted asset allocation as of

December 31, 2010 is approximately 65% equity securities and 35% fixed-income securities. Equity securities primarily include mutual

funds invested in large-cap, mid-cap and small-cap U.S. and international companies. Fixed-income securities primarily include mutual

funds invested in U.S. treasuries and corporate bonds. The Company believes that its long-term asset allocation on average will

approximate the targeted allocation. The Company regularly reviews its actual asset allocation and periodically rebalances its investments

to its targeted allocation when considered appropriate.

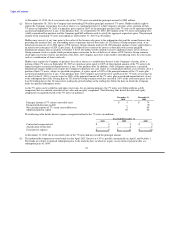

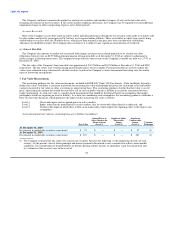

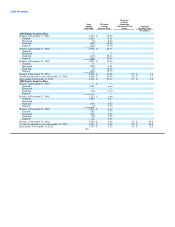

The fair value of pension plan assets by asset category is as follows (in millions):

Quoted Prices in Significant Other Significant

Active Markets for Observable Unobservable

Identical Assets Inputs Inputs

Fair Value (Level 1) (Level 2) (Level 3)

At December 31, 2010

Mutual funds $ 40 $ 40 $ — $ —

At December 31, 2009

Mutual funds $ 38 $ 38 $ — $ —

As of December 31, 2010, the plan's mutual funds were invested 54% in equity securities of large-cap, mid-cap and small-cap.

U.S. companies, 33% in U.S. treasuries and corporate bonds, 13% in equity securities of international companies. The mutual fund shares

are classified as Level 1 instruments and valued at quoted prices in an active market exchange, which represents the net asset value of

shares held by the pension plan.

As of December 31, 2009, the plan's mutual funds were invested 53% in equity securities of large-cap and mid-cap U.S. companies,

33% in U.S. treasuries and corporate bonds, 11% in equity securities of large-cap international companies and 3% in equity securities of

emerging market companies.

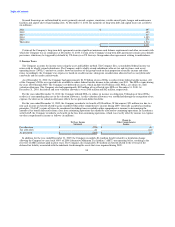

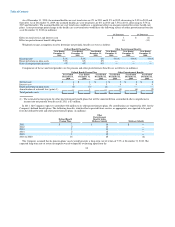

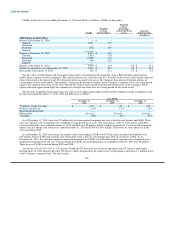

(b) Defined Contribution Plans

The Company sponsors several defined contribution plans which cover a majority of its employee groups. The Company makes

contributions to these plans based on the individual plan provisions, including an employer non-discretionary contribution and an

employer match. These contributions are generally made based upon eligibility, eligible earnings and employee group. Expenses related

to these plans were $102 million, $98 million and $96 million for the years ended December 31, 2010, 2009, and 2008, respectively.

(c) Postemployment Benefits

The Company provides certain postemployment benefits to its employees. These benefits include disability-related and workers'

compensation benefits for certain employees. The Company accrues for the cost of such benefit expenses once an appropriate triggering

event has occurred.

(d) Profit Sharing Plans

Most non-executive employees of US Airways are eligible to participate in a profit sharing plan. Awards are paid as a lump sum after

the end of each fiscal year. The Company recorded $47 million for profit sharing in 2010, which is recorded in salaries and related costs

on the consolidated statement of operations and included in accrued compensation and vacation on the consolidated balance sheet. In

2009 and 2008, no amounts were recorded for profit sharing.

96