US Airways 2010 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

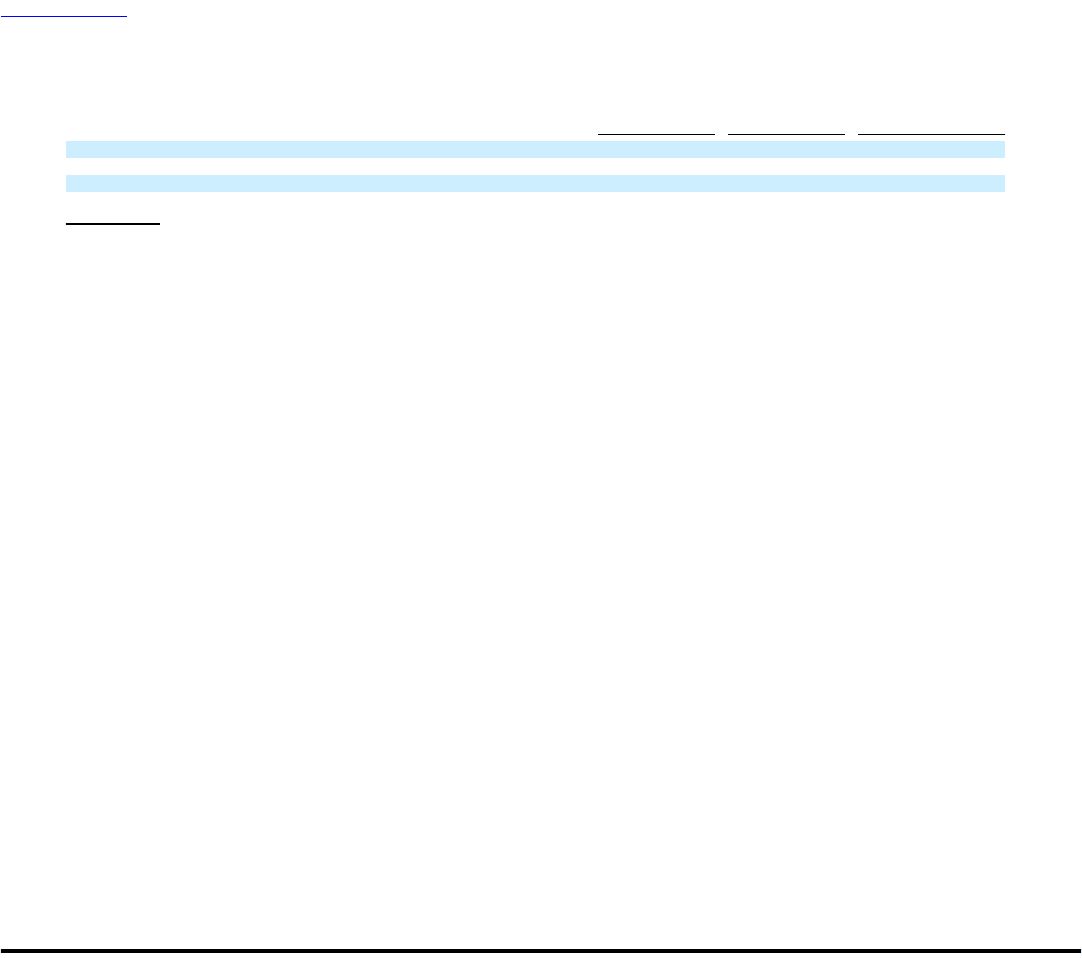

We reported the following operating statistics to the DOT for mainline operations for the years ended December 31, 2010 and 2009:

Percent

Better

2010 2009 (Worse)

On-time performance (a) 83.0 80.9 2.6

Completion factor (b) 98.5 98.8 (0.3)

Mishandled baggage (c) 2.56 3.03 15.5

Customer complaints (d) 1.53 1.31 (16.8)

(a) Percentage of reported flight operations arriving on time as defined by the DOT.

(b) Percentage of scheduled flight operations completed.

(c) Rate of mishandled baggage reports per 1,000 passengers.

(d) Rate of customer complaints filed with the DOT per 100,000 passengers.

Frequent Traveler Program

All major United States airlines offer frequent flyer programs to encourage travel on their respective airlines and customer loyalty. Our

Dividend Miles frequent flyer program allows participants to earn mileage credits for each paid flight segment on US Airways, Star

Alliance carriers and certain other airlines that participate in the program. Participants flying in first class or Envoy class may receive

additional mileage credits. Participants can also receive mileage credits through special promotions that we periodically offer and may

also earn mileage credits by utilizing certain credit cards and purchasing services from non-airline partners such as hotels and rental car

agencies. We sell mileage credits to credit card companies, hotels, car rental agencies and others that participate in the Dividend Miles

program. Mileage credits can be redeemed for travel awards on US Airways, Star Alliance carriers or other participating airlines.

We and the other participating airline partners limit the number of seats per flight that are available for redemption by award recipients

by using various inventory management techniques. Award travel is generally not permitted on blackout dates, which correspond to

certain holiday periods or peak travel dates. We charge various fees for issuing awards dependent upon destination and booking method

and for issuing awards within 14 days of the travel date. We reserve the right to terminate Dividend Miles or portions of the program at

any time. Program rules, partners, special offers, blackout dates, awards and requisite mileage levels for awards are subject to change.

Ticket Distribution

Passengers can book tickets for travel on US Airways through several distribution channels including our direct website

(www.usairways.com), our reservations centers and third party distribution channels, including those provided by or through global

distribution systems (e.g., Amadeus, Sabre and Travelport), conventional travel agents and online travel agents (e.g., Expedia, Orbitz and

Travelocity). In 2010, internal channels of distribution accounted for 31% of our ticketed passenger segments. Internet sites accounted for

63% of our ticketed passenger segments, of which 26% originated from our website, while 37% originated from online travel agent sites.

To remain competitive, we will need to manage successfully our distribution costs and rights, increase our distribution flexibility and

improve the functionality of third party distribution channels, while maintaining an industry-competitive cost structure. For more

discussion, see Part 1, Item 1A, "Risk Factors – We rely on third party distribution channels and must manage effectively the costs, rights

and functionality of these channels."

Seasonality

Our results are seasonal. Due to the greater demand for air and leisure travel during the summer months, revenues in the airline

industry in the second and third quarters of the year tend to be greater than revenues in the first and fourth quarters of the year.

14