US Airways 2010 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2010 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

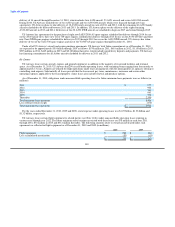

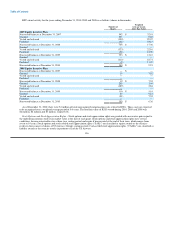

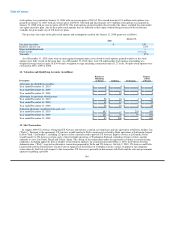

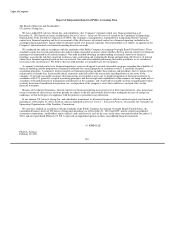

RSU award activity for the years ending December 31, 2010, 2009 and 2008 is as follows (shares in thousands):

Weighted

Number of Average Grant-

Shares Date Fair Value

2005 Equity Incentive Plan

Nonvested balances at December 31, 2007 592 $ 32.91

Granted 535 9.02

Vested and released (390) 29.07

Forfeited (32) 23.15

Nonvested balance at December 31, 2008 705 $ 17.36

Granted — —

Vested and released (323) 22.16

Forfeited (29) 15.76

Nonvested balance at December 31, 2009 353 $ 13.10

Granted — —

Vested and released (212) 18.71

Forfeited (1) 11.37

Nonvested balance at December 31, 2010 140 $ 9.21

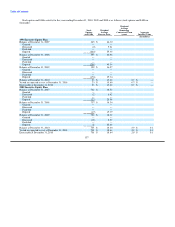

2008 Equity Incentive Plan

Nonvested balance at December 31, 2007 — $ —

Granted 19 7.52

Vested and released — —

Forfeited — —

Nonvested balance at December 31, 2008 19 $ 7.52

Granted 280 3.44

Vested and released (189) 2.84

Forfeited — —

Nonvested balance at December 31, 2009 110 $ 5.19

Granted 84 9.14

Vested and released (91) 7.52

Forfeited — —

Nonvested balance at December 31, 2010 103 $ 6.36

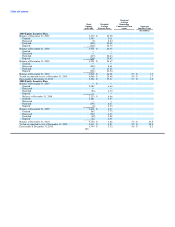

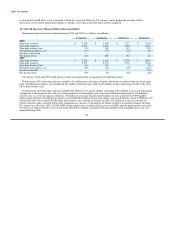

As of December 31, 2010, there were $1 million of total unrecognized compensation costs related to RSUs. These costs are expected

to be recognized over a weighted average period of 0.6 years. The total fair value of RSUs vested during 2010, 2009 and 2008 was

$2 million, $2 million and $3 million, respectively.

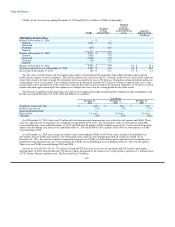

Stock Options and Stock Appreciation Rights – Stock options and stock appreciation rights are granted with an exercise price equal to

the underlying common stock's fair market value at the date of each grant. Stock options and stock appreciation rights have service

conditions, become exercisable over a three-year vesting period and expire if unexercised at the end of their term, which ranges from

seven to 10 years. Stock options and stock-settled stock appreciation rights ("SARs") are classified as equity awards as the exercise

results in the issuance of shares of US Airways Group's common stock. Cash-settled stock appreciation rights ("CSARs") are classified as

liability awards as the exercise results in payment of cash by US Airways.

136