Rogers 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94 ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Employee stock options are not considered dilutive after the

May 28, 2007, amendment to stock option plans (note 20(a)(i)).

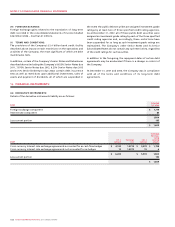

Amortization expense for Rogers Retail rental inventory is charged

to cost of sales and amounted to $46 million in 2007 (2006 –

$48 million). The costs of acquired program rights are amortized to

operating, general and administrative expenses over the expected

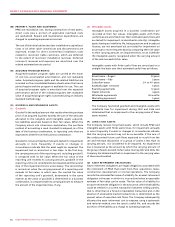

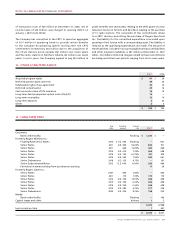

8. NET INCOME PER SHARE:

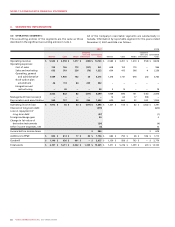

9. OTHER CURRENT ASSETS:

2007 2006

Numerator:

Net income for the year, basic and diluted $ 637 $ 622

Denominator (in millions):

Weighted average number of shares outstanding – basic 638 632

Effect of dilutive securities:

Employee stock options 4 10

Weighted average number of shares outstanding – diluted 642 642

Net income per share:

Basic $ 1.00 $ 0.99

Diluted 0.99 0.97

2007 2006

Inventories $ 110 $ 113

Prepaid expenses 86 93

Acquired program rights 45 23

Rogers Retail rental inventory 32 35

Income taxes receivable 15 –

Deferred compensation 10 2

Other 6 4

$ 304 $ 270

The following table sets forth the calculation of basic and diluted

net income per share:

performances of the related programs and amounted to $46 million

in 2007 (2006 – $27 million). Cost of sales includes $915 million

(2006 – $908 million) of inventory costs.