Rogers 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 67

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The Special Committee was advised by independent counsel and

engaged an accounting firm as part of their review to ensure that

the sale price was within a range that would be fair from a financial

point of view. Further to this arrangement, on April 7, 2006, a com-

pany controlled by our controlling shareholder purchased the shares

in one of these wholly owned subsidiaries for cash of $7 million.

On July 24, 2006, the shares of the second wholly owned subsidiary

were purchased by a company controlled by the controlling share-

holder for cash of $6 million.

These transactions are measured at the exchange amount, being

the amount agreed to by the related parties and are reviewed by

the Audit Committee.

In 2005, with the approval of a Special Committee of the Board of

Directors and the Board of Directors, we entered into an arrange-

ment to sell to our controlling shareholder, for $13 million in cash,

the shares in two wholly owned subsidiaries whose only asset

will consist of tax losses aggregating approximately $100 million.

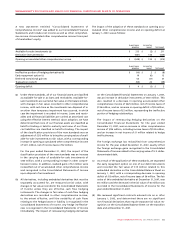

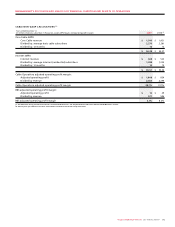

Years ended December 31,

(In millions of dollars) 2007 2006

Access fees paid to broadcasters accounted for by the equity method $ 18 $ 19

We have entered into certain transactions with companies, the partners or senior officers of which are or have been Directors of our

Company and/or its subsidiary companies. Total amounts paid to these related parties, directly or indirectly, are as follows:

Years ended December 31,

(In millions of dollars) 2007 2006

Legal services and commissions paid on premiums for insurance coverage $ 2 $ 2

We have entered into certain transactions with our controlling shareholder and companies controlled by the controlling shareholder.

These transactions are subject to formal agreements approved by the Audit Committee. Total amounts paid (received) by us to (from) these

related parties are as follows:

Years ended December 31,

(In millions of dollars) 2007 2006

Charges (recoveries) for use of aircraft and other administrative services $ (1) $ 1

6. ADDITIONAL FINANCIAL INFORMATION

RELATED PARTY TRANSACTIONS

We have entered into certain transactions in the normal course

of business with certain broadcasters in which we have an equity

interest. The amounts paid to these broadcasters are as follows: