Rogers 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 61

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The wireless communications industry in Canada continues to grow

and the costs of acquiring new subscribers are significant. Because

a substantial portion of subscriber activation costs are variable in

nature, such as commissions paid for each new activation, and due

to fluctuations in the number of activations of new subscribers

from period-to-period and the seasonal nature of these subscriber

additions, we experience material fluctuations in sales and mar-

keting expenses and, accordingly, in the overall level of operating

expenses.

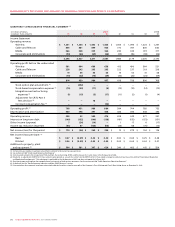

Operating Expense per Subscriber

Operating expense per subscriber, expressed as a monthly average,

is calculated by dividing total operating, general and administrative

expenses, plus costs related to equipment provided to existing sub-

scribers, by the average number of subscribers during the period.

Operating expense per subscriber is tracked by Wireless as a mea-

sure of our ability to leverage our operating cost structure across a

growing subscriber base, and we believe that it is an important mea-

sure of our ability to achieve the benefits of scale as we increase the

size of our business. Refer to the section entitled “Supplementary

Information: Non-GAAP Calculations” for further details on this

Wireless calculation.

Operating Profit and Operating Profit Margin

We define operating profit as net income before depreciation and

amortization, interest expense, income taxes and non-operating

items, which include foreign exchange gains (losses), loss on

repayment of long-term debt, change in fair value of derivative

instruments, and other income. Operating profit is a standard

measure used in the communications industry to assist in under-

standing and comparing operating results and is often referred to

by our peers and competitors as EBITDA (earnings before interest,

taxes, depreciation and amortization) or OIBDA (operating income

before depreciation and amortization). We believe this is an impor-

tant measure as it allows us to assess our ongoing businesses

without the impact of depreciation or amortization expenses as

well as non-operating factors. It is intended to indicate our ability

to incur or service debt, invest in PP&E and allows us to compare

our Company to our peers and competitors who may have different

capital or organizational structures. This measure is not a defined

term under Canadian GAAP or U.S. GAAP.

We calculate operating profit margin by dividing operating profit

by total revenue, except in the case of Wireless. For Wireless,

operating profit margin is calculated by dividing operating profit

by network revenue. Network revenue is used in the calculation,

instead of total revenue, because network revenue better reflects

Wireless’ core business activity of providing wireless services. Refer

to the section entitled “Supplementary Information: Non-GAAP

Calculations” for further details on this Wireless, Cable and Media

calculation.

Adjusted Operating Profit, Adjusted Operating Profit Margin,

Adjusted Net Income, and Adjusted Basic and Diluted Net Income

Per Share

Beginning in 2007, we have included certain non-GAAP measures

that we believe provide useful information to management and

readers of this MD&A in measuring our financial performance.

These measures, which include adjusted operating profit, adjusted

operating profit margin, adjusted net income and adjusted basic

and diluted net income per share, do not have a standardized

meaning under GAAP and, therefore, may not be comparable to

similarly titled measures presented by other publicly traded com-

panies, nor should they be construed as an alternative to other

financial measures determined in accordance with GAAP. We define

adjusted operating profit as operating profit less: (i) the impact

of the one-time non-cash charge resulting from the introduction

of a cash settlement feature related to employee stock options;

(ii) stock-based compensation expense; (iii) integration and restruc-

turing expenses; and (iv) the impact of a one-time charge resulting

from the renegotiation of an Internet-related services agreement.

In addition, adjusted net income and net income per share excludes

losses on repayment of long-term debt and the related income tax

impacts of the above items.

We believe that these non-GAAP financial measures provide for a

more effective analysis of our operating performance. In addition,

the items mentioned above could potentially distort the analysis

of trends due to the fact that they are either volatile or unusual or

non-recurring, can vary widely from company-to-company and can

impair comparability. The exclusion of these items does not mean

that they are unusual, infrequent or non-recurring.

We use these non-GAAP measures internally to make strategic deci-

sions, forecast future results and evaluate our performance from

period-to-period and compared to forecasts on a consistent basis.

We believe that these measures present trends that are useful to

investors and analysts in enabling them to assess the underlying

changes in our business over time.

Adjusted operating profit and adjusted operating profit margins,

which are reviewed regularly by management and our Board of

Directors, are also useful in assessing our performance and in mak-

ing decisions regarding the ongoing operations of the business and

the ability to generate cash flows.

These non-GAAP measures should be viewed as a supplement to,

and not a substitute for, our results of operations. A reconciliation

of these non-GAAP financial measures to operating profit, net

income and net income per share is included in the section entitled

“Supplementary Information: Non-GAAP Calculations”.

Additions to PP&E

Additions to PP&E include those costs associated with acquiring and

placing our PP&E into service. Because the communications busi-

ness requires extensive and continual investment in equipment,

including investment in new technologies and expansion of geo-

graphical reach and capacity, additions to PP&E are significant and

management focuses continually on the planning, funding and

management of these expenditures. We focus more on managing

additions to PP&E than we do on managing depreciation and amor-

tization expense because additions to PP&E have a direct impact on

our cash flow, whereas depreciation and amortization are non-cash

accounting measures required under Canadian and U.S. GAAP.