Rogers 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 35

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Cable’s voice-over-cable telephony services are offered over an

advanced broadband IP multimedia network layer deployed across

the cable service areas. This network platform provides for a scalable

primary line quality digital voice-over-cable telephony service utiliz-

ing Packet Cable and Data Over Cable Service Interface Specification

(“DOCSIS”) standards, including network redundancy as well as

multi-hour network and customer premises backup powering.

To serve telephony customers on circuit-switched platforms, Cable

co-locates its equipment in the switch centres of the incumbent

local phone companies (“ILECs”). At December 31, 2007, Cable was

active in 179 co-locations in 63 municipalities in five of Canada’s

most populous metropolitan areas in and around Vancouver,

Calgary, Toronto, Ottawa and Montréal. Many of these co-locations

are connected to its local switches by metro area fibre networks

(“MANs”). Cable also operates a North American transcontinental

fibre-optic network extending over 16,000 route kilometres provid-

ing a significant North American geographic footprint connecting

Canada’s largest markets while also reaching key U.S. markets for

the exchange of data and voice traffic. In Canada, the network

extends from Vancouver in the west to Québec City in the east.

Cable also acquired various competitive local exchange carrier

(“CLEC”) assets of Futureway Communications Inc. (“Futureway”) in

the Greater Toronto Area during 2007. The assets include local and

regional fibre, transmission electronics and systems, hubs, points of

presence (“POPs”), ILEC co-locations and switching infrastructure.

Cable’s network extends into the U.S. from Vancouver south to

Seattle in the west, from the Manitoba-Minnesota border, through

Minneapolis, Milwaukee and Chicago in the mid-west and from

Toronto through Buffalo and Montréal through Albany to New York

City in the east. Cable has connected its North American network

with Europe through international gateway switches in New York

City, London, England, and a leased trans-Atlantic fibre facility.

Where Cable doesn’t have its own local facilities directly to a busi-

ness customer’s premises, Cable provides its local services through

a hybrid carrier strategy utilizing unbundled local loops of the

ILECs. Cable has deployed its own scalable switching and intelligent

services infrastructure while using connections between its co-

located equipment and customer premises, provided largely by

other carriers.

CABLE’S STRATEGY

Cable seeks to maximize subscribers, revenue, operating profit,

and return on invested capital by leveraging its technologically

advanced cable network to meet the information, entertainment

and communications needs of its subscribers, from basic cable tele-

vision to advanced two-way cable services, including digital cable,

PPV, VOD, SVOD, PVR and HDTV, Internet access, voice-over-cable

telephony service, as well as the expansion of its services into the

business telecom and data networking market. The key elements

of the strategy are as follows:

• Clusteringofcablesystemsinandaroundmetropolitanareas;

• Offeringawideselectionofproductsandservices;

• Maintainingtechnologicallyadvancedcablenetworks;

• Continuingtofocusonincreasedqualityandreliabilityofser-

vice, and customer satisfaction;

• Tailoring services to the changing demographic of the Cable

customer base, including expansion of products directly serving

several multicultural communities;

• Continuingtoimproveproductfeatures,includingexpanding

available TV content, including HDTV and VOD selection, faster

tiers of Internet service and new telephony service offerings;

• Expandingtheavailabilityofhigh-qualitydigitalprimaryline

voice-over-cable telephony service into most of the markets in its

cable service areas; and

• Furtherexpandingintothebusinessmarketbyfocusingonsmall

businesses connected to the cable network.

RECENT CABLE INDUSTRY TRENDS

Investment in Improved Cable Television Networks and

Expanded Service Offerings

In recent years, North American cable television companies have

made substantial investments in the installation of fibre-optic

cable and electronics in their respective networks and in the devel-

opment of Internet, digital cable and voice-over-cable telephony

services. These investments have enabled cable television compa-

nies to offer expanded packages of digital cable television services,

including VOD and SVOD, pay television packages, PVR, HDTV pro-

gramming, multiple increasingly fast tiers of Internet services, and

telephony services.

Increased Competition from Alternative Broadcasting

Distribution Undertakings

As fully described in the Competition section of this MD&A,

Canadian cable television systems generally face legal and illegal

competition from several alternative multi-channel broadcasting

distribution systems.

Industry Consolidation and Growth of Facilities-Based

Competitors

The Canadian telecommunications industry has seen a consoli-

dation of players in the wireline industry with the acquisitions

in 2004 and 2005 of Group Telecom by Bell Canada, Allstream by

MTS and Call-Net by Rogers. Competition remains intense in the

long-distance markets with average price per minute continuing

to decline year-over-year. Facilities-based competitors in the local

telephone market have emerged in the residential and small and

medium-sized business markets with the launch of competitive

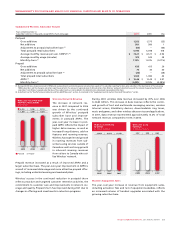

20072006

$3,558$3,201$2,925

CABLE TOTAL

REVENUE

(In millions of dollars)

2006

2007

2005

Pro Forma