Rogers 2007 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112 ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(D) The CRTC collects two different types of fees from broadcast

licencees. These are known as Part I and Part II fees. In 2003 and

2004, lawsuits were commenced in the Federal Court, alleging

that the Part II licence fees are taxes rather than fees and that the

regulations authorizing them are unlawful. On December 14, 2006,

the Federal Court ruled that the CRTC did not have the jurisdiction

to charge Part II fees. The Court ruled that licencees were not

entitled to a refund of past fees paid. Both the Crown and the

applicants have appealed this case to the Federal Court of Appeal.

The applicants are seeking an order requiring a refund of past fees

paid. The Crown is seeking to reverse the finding that Part II fees

are unlawful. On October 15, 2007, the CRTC sent a letter to all

broadcast licencees, including the Company, stating that the CRTC

The consolidated financial statements of the Company have been

prepared in accordance with GAAP as applied in Canada. In the

following respects, GAAP, as applied in the United States, differs

from that applied in Canada.

If United States GAAP were employed, comprehensive income for

the year ended December 31, 2007, would be adjusted as follows:

will not collect Part II licence fees due on November 30, 2007 and

subsequent years unless the Federal Court of Appeal or the Supreme

Court of Canada (should the case be appealed to that level) reverses

the Federal Court’s decision. The Federal Court of Appeal heard

the appeal on December 4 and 5, 2007, but has not yet rendered a

decision. The Company believes that it is unlikely that the Federal

Court’s decision will be reversed. As a result, an operating expense

recovery of $18 million, representing Part II fees accrued to June 30,

2007, and a future income tax charge of $7 million were recorded

during the year ended December 31, 2007.

(E) There exist certain other claims and potential claims against

the Company, none of which is expected to have a material adverse

effect on the consolidated financial position of the Company.

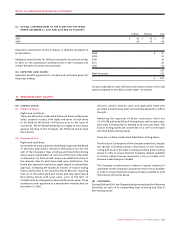

If United States GAAP were employed, net income for the years

ended December 31, 2007 and 2006 would be adjusted as follows:

26. CANADIAN AND UNITED STATES ACCOUNTING POLICY DIFFERENCES:

2007 2006

Net income for the year based on Canadian GAAP $ 637 $ 622

Gain on sale of cable systems (b) (4) (4)

Pre-operating costs capitalized (c) 4 5

Capitalized interest, net of related depreciation (d) 10 14

Financial instruments (f) 210 19

Stock-based compensation (g) 3 (2)

Income taxes (i) 125 128

Installation revenues and costs, net (j) (4) 1

Other 3 (3)

Net income for the year based on United States GAAP $ 984 $ 780

Net income per share based on United States GAAP:

Basic $ 1.54 $ 1.23

Diluted 1.53 1.22

2007

Comprehensive income for the year based on Canadian GAAP $ 901

Impact of United States GAAP differences on net income 347

Change in fair value of derivative instruments, net of income taxes of $100 (f) (126)

Change in funded status of pension plans for unrecognized amounts, net of income taxes of $6 (h) (15)

Comprehensive income for the year based on United States GAAP $ 1,107