Rogers 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

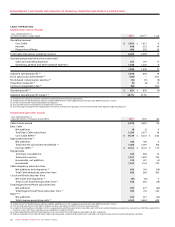

Wireless Operating Highlights for the Year Ended

December 31, 2007

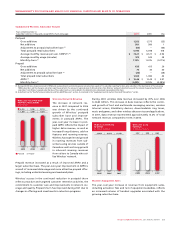

• Networkrevenueincreasedby19%to$5,154millionin2007from

$4,313 million in 2006.

• Strongsubscribergrowthcontinuedin2007,withnetpostpaid

additions of 581,000 and net prepaid additions of 70,000.

• Postpaidsubscribermonthlychurnwas1.15%,comparedto1.32%

in 2006.

• Postpaidmonthlyaveragerevenueperuser(“ARPU”)increased

7% from 2006 to $72.21, aided by strong increases in wireless data

revenue.

• Revenuesfromwirelessdataservicesgrewapproximately49%

year-over-year to $683 million in 2007 from $459 million in 2006,

and represented approximately 13.3% of network revenue com-

pared to 10.6% in 2006.

• Wireless’adjustedoperatingprotmarginincreasedto50.2%in

2007, compared to 46.1% in 2006.

• WirelesslaunchedtheRogersVisionsuiteofservicesonWireless’

new HSPA 3G wireless network, the fastest wireless network in

Canada, including the first wireless video calling service in North

America. This powerful 3G technology significantly improves

data download speeds on wireless devices, providing a user

experience similar to broadband high-speed wireline services.

• WirelessdecommissioneditsTDMAandanalogwirelessnetworks

effective May 31, 2007 and moved the remaining customers on

these networks onto its more advanced GSM network.

• The Fido wireless brand was recognized by J.D. Power and

Associates as being the number one rated Canadian wireless

carrier for postpaid wireless service customer satisfaction. This

independently conducted research determined that Fido out-

ranked all six of the other Canadian wireless brands in terms of

customer perceptions of billing, call quality, cost of service, cus-

tomer service and service plan options. Fido also earned the top

score in the wireless retailer category.

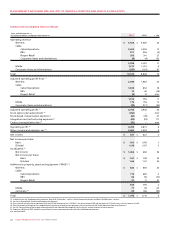

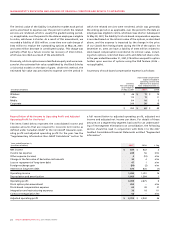

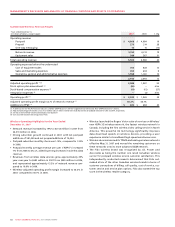

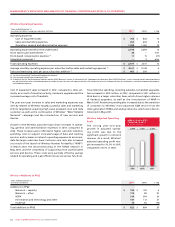

Summarized Wireless Financial Results

Years ended December 31,

(In millions of dollars, except margin) 2007 2006 % Chg

Operating revenue

Postpaid $ 4,868 $ 4,084 19

Prepaid 273 214 28

One-way messaging 13 15 (13)

Network revenue 5,154 4,313 19

Equipment sales 349 267 31

Total operating revenue 5,503 4,580 20

Operating expenses before the undernoted

Cost of equipment sales 703 628 12

Sales and marketing expenses 653 604 8

Operating, general and administrative expenses 1,558 1,361 14

2,914 2,593 12

Adjusted operating profit (1)(2) 2,589 1,987 30

Stock option plan amendment (3) (46) – n/m

Stock-based compensation expense (3) (11) (15) (27)

Integration expenses (4) – (3) n/m

Operating profit (1) $ 2,532 $ 1,969 29

Adjusted operating profit margin as % of network revenue (1) 50.2% 46.1%

Additions to PP&E (1) $ 822 $ 684 20

(1) As defined. See the “Key Performance Indicators and Non-GAAP Measures” and the “Supplementary Information: Non-GAAP Calculations” sections.

(2) Adjusted operating profit includes a loss of $31 million and $25 million related to the Inukshuk wireless broadband initiative for 2007 and 2006, respectively.

(3) See the section entitled “Stock-based Compensation Expense”.

(4) Costs incurred related to the integration of Fido.