Rogers 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

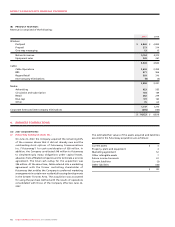

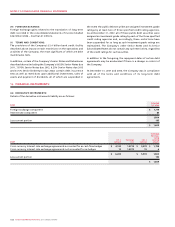

In March 2007, the Company contributed its 2.3 GHz and 3.5 GHz

spectrum licences with a carrying value of $11 million to a 50%

owned joint venture for non-cash consideration of $58 million.

Accordingly, the carrying value of spectrum licences has been

reduced by $5 million in 2007. A deferred gain of $24 million, being

the portion of the excess of fair value over carrying value related to

the other non-related venturer’s interest in the spectrum licences

contributed by the Company, was recorded on contribution of these

spectrum licences. This deferred gain is recorded in other long-term

liabilities and is being amortized to income over seven years, of which

$2 million was recognized in 2007. In addition to a cash contribution

of $8 million, the other venturer also contributed its 2.3 GHz and

3.5 GHz spectrum licences valued at $50 million to the joint venture.

The Company recorded an increase in spectrum licences and cash of

$25 million and $4 million, respectively, related to its proportionate

share of the contribution by the other venturer.

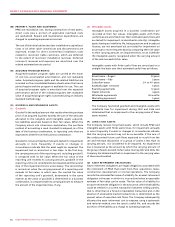

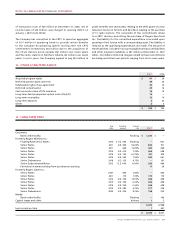

6. INTEGRATION AND RESTRUCTURING EXPENSES:

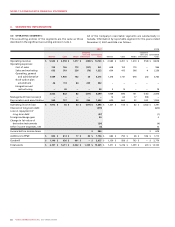

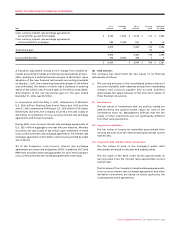

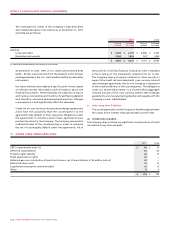

7. INCOME TAXES:

2007 2006

Future income tax assets:

Non-capital income tax loss carryforwards $ 680 $ 981

Capital loss carryforwards 16 21

Deductions relating to long-term debt and other transactions denominated in foreign currencies 100 41

Investments – 52

PP&E and inventory 11 46

Liability for stock-based compensation 148 –

Other deductible differences 131 125

Total future income tax assets 1,086 1,266

Less valuation allowance 119 150

967 1,116

Future income tax liabilities:

Investments (6) –

Goodwill and intangible assets (441) (407)

Other taxable differences (30) (23)

Total future income tax liabilities (477) (430)

Net future income tax asset 490 686

Less current portion 594 387

Long-term future income tax assets (liabilities) $ (104) $ 299

As a result of the 2005 acquisition of Call-Net Enterprises Inc.

(“Call-Net”) and the 2004 acquisition of Fido Inc. (“Fido”), the

Company has incurred certain integration costs that did not qualify

to be included as part of the purchase price allocation as a liability

assumed on acquisition. As a result, these costs are recorded within

operating expenses. These expenses include various severance,

consulting and other incremental restructuring costs directly related

to the acquisitions. During 2007, the Company incurred integration

expenses of $14 million related to the Call-Net acquisition. During

2006, the Company incurred $9 million in integration expenses

related to the Call-Net acquisition and $3 million in integration

expenses related to the Fido acquisition.

The income tax effects of temporary differences that give rise to

significant portions of future income tax assets and liabilities are

as follows:

During 2007, the Company incurred $24 million of restructuring

expenses related to RBS, of which $20 million is related to severances

resulting from staff reductions to reflect a reduction in customer

acquisition efforts related to enterprise and larger business

segments. Included in accounts payable and accrued liabilities as

at December 31, 2007, is $12 million related to the severances, which

will be paid in 2008.

During 2006, the Company closed 21 of its Rogers Retail stores in

Ontario and Quebec. The costs to exit these stores included lease

terminations and involuntary severance costs totalling $3 million, as

well as a write-down of the related PP&E totalling $3 million for the

year ended December 31, 2006.