Rogers 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 101

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

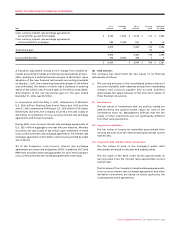

A transition adjustment arising on the change from marked-to-

market accounting to hedge accounting was calculated as at July 1,

2004, resulting in a deferred transitional gain of $80 million. Upon

adoption of the new financial instruments accounting standards

on January 1, 2007, the unamortized transitional gain of $54 million

was eliminated, the impact of which was a decrease in opening

deficit of $37 million, net of income taxes of $17 million (note 2(h)(i)).

Amortization of the net transitional gain for the year ended

December 31, 2006, was $9 million.

In conjunction with the May 3, 2007, redemption of Wireless’

U.S. $550 million Floating Rate Senior Notes due 2010 and the

June 21, 2007, redemption of Wireless’ U.S. $155 million 9.75% Senior

Debentures due 2016, the Company incurred a net cash outlay of

$35 million on settlement of cross-currency interest rate exchange

agreements and forward contracts.

During 2006, cross-currency interest rate exchange agreements of

U.S. $327 million aggregate notional amount matured. Wireless

incurred a net cash outlay of $20 million upon settlement of these

cross-currency interest rate exchange agreements. An interest rate

exchange agreement of $30 million notional amount held by Cable

also matured.

All of the Company’s cross-currency interest rate exchange

agreements are unsecured obligations of RCI. In addition, RCCI and

RWP have provided unsecured guarantees for all of the Company’s

cross-currency interest rate exchange agreements (note 15(a)).

(B) FAIR VALUES:

The Company has determined the fair values of its financial

instruments as follows:

(i) The carrying amounts in the consolidated balance sheets of

accounts receivable, bank advances arising from outstanding

cheques and accounts payable and accrued liabilities

approximate fair values because of the short-term nature of

these financial instruments.

(ii) Investments:

The fair values of investments that are publicly traded are

determined by the quoted market values for each of the

investments (note 12). Management believes that the fair

values of other investments are not significantly different

from their carrying amounts.

(iii) Long-term receivables:

The fair values of long-term receivables approximate their

carrying amounts since the interest rates approximate current

market rates.

(iv) Long-term debt and derivative instruments:

The fair values of each of the Company’s public debt

instruments are based on the year-end trading values.

The fair value of the bank credit facility approximates its

carrying value since the interest rates approximate current

market rates.

The fair values of the Company’s interest exchange agreements,

cross-currency interest rate exchange agreements and other

derivative instruments are based on values quoted by the

counterparties to the agreements.

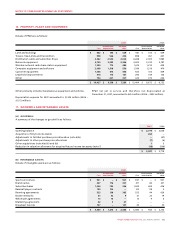

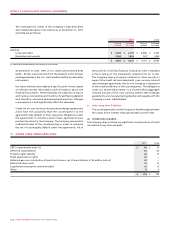

U.S. $ Exchange Cdn. $ Carrying Estimated

2006 notional rate notional value fair value

Cross-currency interest rate exchange agreements

accounted for as cash flow hedges $ 4,190 1.3313 $ 5,578 $ 710 $ 1,282

Cross-currency interest rate exchange agreements

not accounted for as hedges 285 1.1993 342 12 12

4,475 5,920 722 1,294

Transitional gain – – 54 –

4,475 5,920 776 1,294

Less current portion 275 1.1870 326 7 7

$ 4,200 $ 5,594 $ 769 $ 1,287