Rogers 2007 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 105

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

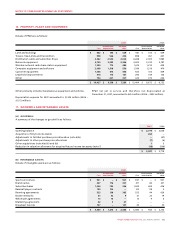

(A) CAPITAL STOCK:

(i) Preferred shares:

Rights and conditions:

There are 400 million authorized Preferred shares without par

value, issuable in series, with rights and terms of each series

to be fixed by the Board of Directors prior to the issue of

such series. The Preferred shares have no rights to vote at any

general meeting of the Company. No Preferred shares have

been issued.

(ii) Common shares:

Rights and conditions:

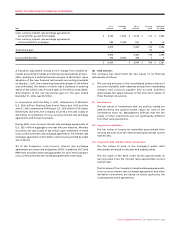

On Oc tobe r 30 , 20 06 , subj ec t to sha reholde r approval, the Board

of Directors approved a resolution effecting a two-for-one

split of the Company’s Class A Voting and Class B Non-Voting

shares where shareholders of record as of the close of business

on December 29, 2006, would receive one additional share of

the relevant class for each share held upon distribution. The

Board also approved resolutions, again subject to shareholder

approval, increasing the maximum number of Class A Voting

shares authorized to be issued by 56,233,894 and requiring

that all of the authorized and issued and fully paid Class B

Non-Voting shares with a par value, prior to the split, of

$1.62478 each be changed into shares without par value. These

resolutions were approved at a shareholder meeting held on

December 15, 2006.

All prior period common stock and applicable share and

per share amounts have been retroactively adjusted to reflect

the split.

Reflecting the approval of these resolutions, there are

112,474,388 authorized Class A Voting shares without par value.

Each Class A Voting share is entitled to 50 votes per share. The

Class A Voting shares are convertible on a one-for-one basis

into Class B Non-Voting shares.

There are 1.4 billion authorized Class B Non-Voting shares.

T he A rt icl es o f C ont inu an ce o f t he C om pan y u nd er t he C om pa ny

Act (British Columbia) impose restrictions on the transfer,

voting and issue of the Class A Voting and Class B Non-Voting

shares in order to ensure that the Company remains qualified

to hold or obtain licences required to carry on certain of its

business undertakings in Canada.

The Company is authorized to refuse to register transfers of

any shares of the Company to any person who is not a Canadian

in order to ensure that the Company remains qualified to hold

the licences referred to above.

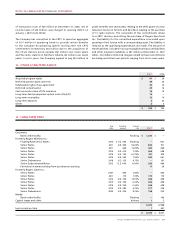

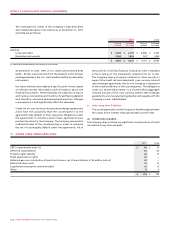

(B) DIVIDENDS:

During 2006 and 2007, the Company declared and paid the following

dividends on each of its outstanding Class A Voting and Class B

Non-Voting shares:

19. SHAREHOLDERS’ EQUITY:

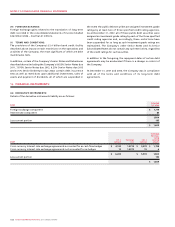

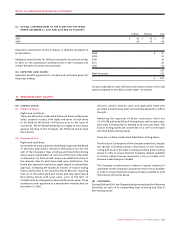

(C) ACTUAL CONTRIBUTIONS TO THE PL ANS FOR THE YEARS

ENDED DECEMBER 31, 2007 AND 2006 ARE AS FOLLOWS:

Employer Employee Total

2007 $ 29 $ 18 $ 47

2 0 0 6 28 15 43

Expected contributions by the Company in 2008 are estimated to

be $35 million.

Employee contributions for 2008 are assumed to be at levels similar

to 2007 on the assumption staffing levels in the Company will

remain the same on a year-over-year basis.

(D) EXPECTED CASH FLOWS:

Expected benefit payments for funded and unfunded plans for

fiscal year ending:

Certain subsidiaries have defined contribution plans with total

pension expense of $2 million in 2007 (2006 – $2 million).

2008 $ 31

2009 31

2010 32

2011 32

2012 33

159

Next five years 175

$ 334