Rogers 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 99

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(ii) The Company’s U.S. $400 million Senior Subordinated Notes

are redeemable in whole or in part, at the Company’s option,

at any time up to December 15, 2008, subject to a certain

prepayment premium and at any time on or after December

15, 2008, at 104.0% of the principal amount, declining ratably to

100.0% of the principal amount on or after December 15, 2010.

At December 31, 2007, the fair value of this prepayment option

is $13 million (note 2(h)(i)(C)).

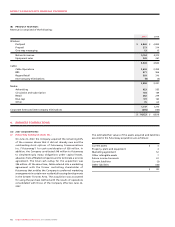

(D) FAIR VALUE INC REMENT ARISING FROM PURCHASE

ACCOUNTING:

The fair value increment on long-term debt is a purchase accounting

adjustment required by GAAP as a result of the acquisition of

the minority interest of Wireless during 2004. Under GAAP, the

purchase method of accounting requires that the assets and

liabilities of an acquired enterprise be revalued to fair value when

allocating the purchase price of the acquisition. The fair value

increment is amortized over the remaining term of the related debt

and recorded as part of interest expense. The fair value increment,

applied against the specific debt instruments to which it relates,

results in the following carrying values at December 31, 2007 and

2006 of the debt in the Company’s consolidated accounts:

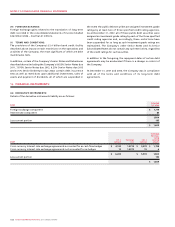

(C) SENIOR NOTES AND DEBENTURES AND SENIOR

SUBORDINATED NOTES:

Interest is paid semi-annually on all of the Company’s notes and

debentures, with the exception of the Floating Rate Senior Notes,

for which interest was paid on a quarterly basis.

Each of the Company’s Senior Notes and Debentures and Senior

Subordinated Notes is redeemable, in whole or in part, at the

Company’s option, at any time, subject to a certain prepayment

premium. The following two note issues have specific prepayment

premiums:

(i) The Company’s U.S. $550 million of Floating Rate Senior

Notes were redeemable in whole or in part, at the Company’s

option, at any time on or after December 15, 2006, at 102.0%

of the principal amount, declining ratably to 100.0% of the

principal amount on or after December 15, 2008, plus, in each

case, interest accrued to the redemption date. The Company

paid interest on the Floating Rate Notes at LIBOR plus 3.125%,

reset quarterly. These notes were redeemed by the Company

on May 3, 2007.

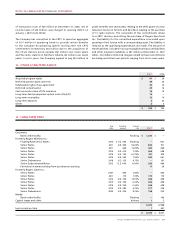

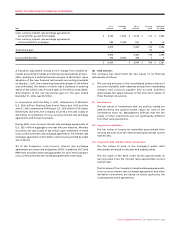

2007 2006

Floating Rate Senior Notes, due 2010 Floating $ – $ 643

Senior Notes, due 2011 9.625% 507 600

Senior Notes, due 2011 7.625% 461 461

Senior Notes, due 2012 7.25% 466 551

Senior Notes, due 2014 6.375% 728 859

Senior Notes, due 2015 7.50% 545 644

Senior Debentures, due 2016 9.75% – 192

Senior Subordinated Notes, due 2012 8.00% 397 468

Total $ 3,104 $ 4,418

(E) DEBT REPAYMENTS:

(i) On February 6, 2007, the Company repaid at maturity,

the aggregate principal amount outstanding of Cable’s

$450 million 7.60% Senior Notes.

On May 3, 2007, the Company redeemed the aggregate

principal amount outstanding of Wireless’ U.S. $550 million

($609 million) Floating Rate Senior Notes due 2010 at a

redemption premium of 2%, or $12 million.

On June 21, 2007, the Company redeemed the aggregate

principal amount outstanding of Wireless’ U.S. $155 million

($166 million) 9.75% Senior Debentures due 2016 at a

redemption premium of 28.416%, or $47 million.

The Company incurred a net loss on repayment of long-term

debt in 2007 aggregating $47 million, including aggregate

redemption premiums of $59 million offset by a write down

of a previously recorded fair value increment of $12 million. In

addition, in conjunction with these redemptions, the Company

made aggregate net payments on settlement of cross-currency

interest rate exchange agreements and forward contracts of

$35 million (note 16(a)).

(ii) During 2006, the Company redeemed or repaid an aggregate

$261 million principal amount of Senior Notes and Senior

Secured Notes as well as a mortgage and capital leases in the

aggregate principal amount of $25 million. A prepayment

premium of $1 million was also incurred as part of these

repayments.

(F) WEIGHTED AVERAGE INTEREST RATE:

The Company’s effective weighted average interest rate on all

long-term debt, as at December 31, 2007, including the effect of

all of the derivative instruments, was 7.53% (2006 – 7.98%).

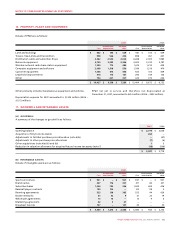

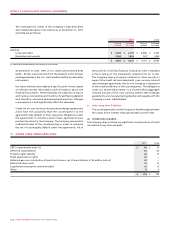

(G) PRINCIPAL REPAYMENTS:

As at December 31, 2007, principal repayments due within each

of the next five years and thereafter on all long-term debt are

as follows:

2008 $ 1

2009 –

2010 –

2011 1,119

2012 1,206

Thereafter 3,690