Rogers 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 43

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

five Citytv television stations located in Toronto, Ontario;

Winnipeg, Manitoba; Edmonton and Calgary, Alberta; and

Vancouver, British Columbia.

MEDIA’S STRATEGY

Media seeks to maximize revenues, operating profit and return on

invested capital across each of its businesses. Media’s strategies to

achieve this objective include:

• Focusingonspecializedcontentandaudiencesthroughradio,

publication and sports properties, as well as continued develop-

ment of its portfolio of specialty channel investments;

• Continuingtoleverageitsstrongmediabrandnamestoincrease

advertising and subscription revenues, assisted by the cross-

promotion of its properties across its media formats and in

association with the “Rogers” brand;

• Focusingongrowthandcontinuingtocross-selladvertisingand

share content across its properties and over its multiple media

platforms; and

• EnhancingtheSportsEntertainmentfanexperiencebyadding

talented players to improve the Blue Jays win-loss record and by

making physical upgrades to the Rogers Centre.

RECENT MEDIA INDUSTRY TRENDS

Increased Fragmentation of Radio and TV

In recent years, Canadian radio and television broadcasters have had

to operate in increasingly fragmented markets. Canadian consum-

ers have a growing number of radio and television services available

to them, providing them with an increasing number of different

programming formats. In the radio industry, since the introduc-

tion of its Commercial Radio Policy in 1998, the CRTC has licenced

numerous new radio stations through competitive processes

in most markets across Canada. In that time, the CRTC has also

licenced a large number of additional new FM stations through

AM to FM station conversions. In 2005, the CRTC licenced two satel-

lite radio providers, both of which are affiliated with U.S. satellite

operators and both of which began offering service in Canada. In

the television industry, the CRTC has licenced a number of new,

over-the-air stations and a significant number of new digital tele-

vision services. The new services and the new formats combine to

fragment the market for existing radio and television operators.

Ownership of Canadian radio and TV stations has consolidated

through the recent acquisitions by CTVglobemedia of CHUM

Limited, by Canwest Global Communications Corp. of Alliance

Atlantis Communications Inc., and by Astral Media Inc. of Standard

Radio Inc. This results in the Canadian industry being left with

fewer owners but larger competitors in the media marketplace.

MEDIA OPERATING AND FINANCIAL RESULTS

Media’s revenues primarily consist of:

• Advertisingrevenues;

• Circulationrevenues;

• Subscriptionrevenues;

• Retailproductsales;and

• Salesoftickets,receiptsofleaguerevenuesharingandconces-

sion sales associated with Rogers Sport Entertainment.

Media’s operating expenses consist of:

• Costofsales,whichisprimarilycomprisedofthecostofretail

product sold by The Shopping Channel;

• Salesandmarketingexpenses;and

• Operating,generalandadministrativeexpenses,whichinclude

programming costs, production expenses, circulation expenses,

player salaries and other back-office support functions.

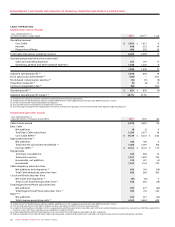

Summarized Media Financial Results

Effective June, 2006, due to increased ownership, the results of

operations of The Biography Channel Canada and G4TechTV Canada

are consolidated with the results of Media. The operating results of

five Alberta radio stations and Citytv, which were acquired in 2007,

are included in Media’s results of operations from the dates of

acquisition on January 1, 2007, and October 31, 2007, respectively.

2007 MEDIA REVENUE MIX

(%)

Radio 20%

The Shopping Channel 21%

Television 22%

Publishing 23%

Sports Entertainment 14%

Years ended December 31,

(In millions of dollars, except margin) 2007 (1) 2006 % Chg

Operating revenue $ 1,317 $ 1,210 9

Operating expenses before the undernoted 1,141 1,054 8

Adjusted operating profit (2) 176 156 13

Stock option plan amendment (3) (84) – n/m

Stock-based compensation expense(3) (10) (5) 100

Operating profit (2) $ 82 $ 151 (46)

Adjusted operating profit margin (2) 13.4% 12.9%

Additions to property, plant and equipment (2) $ 77 $ 48 60

(1) The operating results of Citytv are included in Media’s results of operations from the date of acquisition on October 31, 2007.

(2) As defined. See the “Key Performance Indicators and Non-GAAP Measures” section.

(3) See the section entitled “Stock-based Compensation Expense”.