Rogers 2007 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 107

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

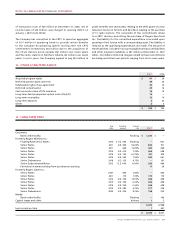

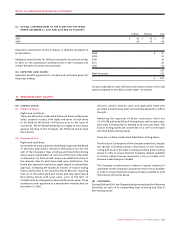

At December 31, 2007, a summary of the stock option plans is

as follows:

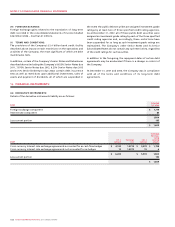

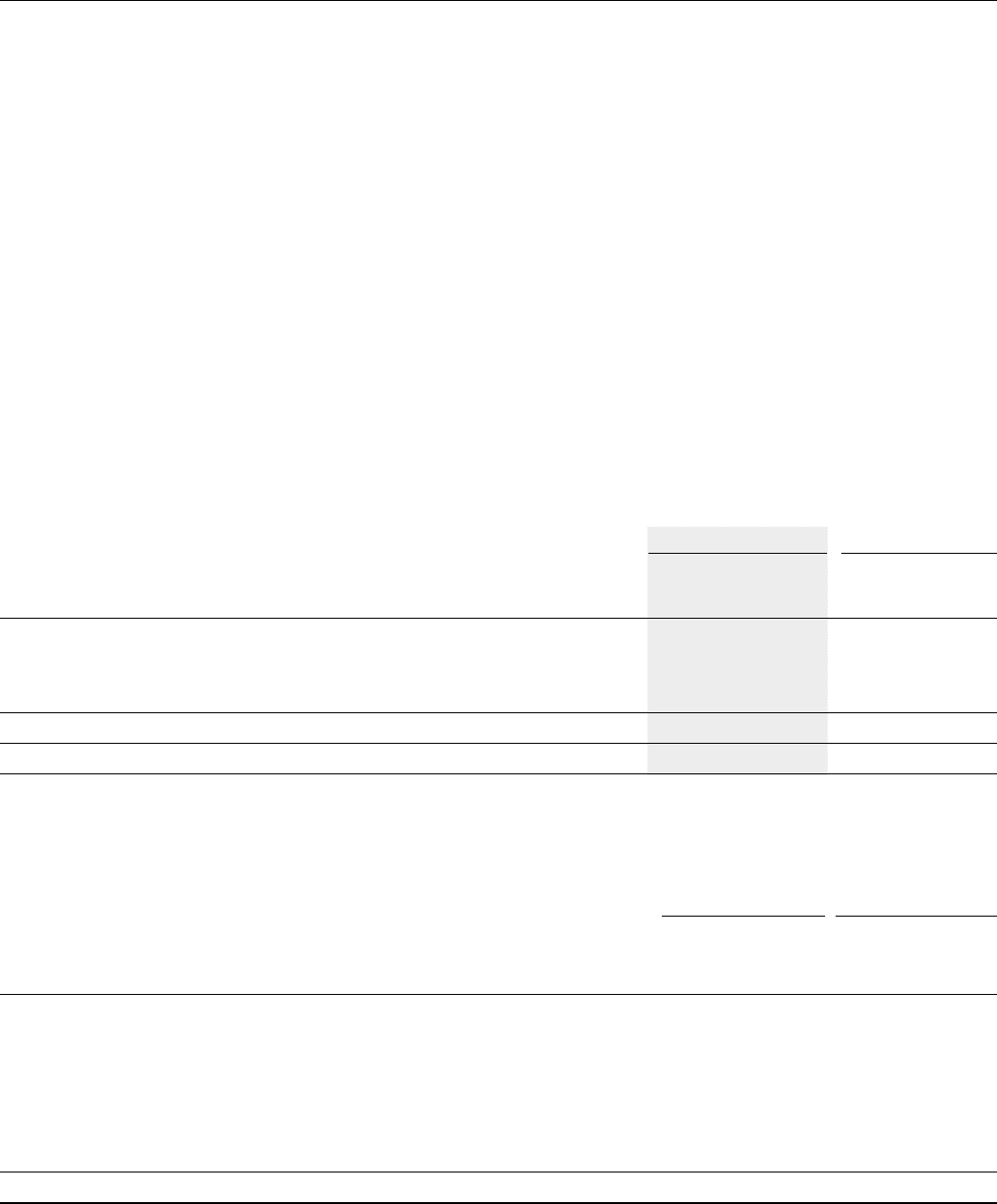

At December 31, 2007, the range of exercise prices, the weighted

average exercise price and the weighted average remaining

contractual life are as follows:

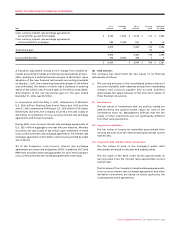

Effective March 1, 2006, the Company amended certain provisions

of its stock option plans, which resulted in a new measurement date

for purposes of determining compensation cost. The amendment

provides that on the death or retirement of an option holder, or the

resignation of a director, options would continue to be exercisable

until the original expiry date in accordance with their original

terms and the vesting would not be accelerated. The amendment

resulted in additional compensation cost of $7 million, of which

$1 million was recorded as stock-based compensation expense in

2007 (2006 – $4 million).

(ii) Stock option plans:

Options to purchase Class B Non-Voting shares of the Company on

a one-for-one basis may be granted to employees, directors and

officers of the Company and its affiliates by the Board of Directors

or by the Company’s Management Compensation Committee.

There are 30 million options authorized under the 2000 Plan,

25 million options authorized under the 1996 Plan, and 9.5 million

options authorized under the 1994 Plan. The term of each option

is 7 to 10 years and the vesting period is generally four years but

may be adjusted by the Management Compensation Committee on

the date of grant. The exercise price for options is equal to the fair

market value of the Class B Non-Voting shares determined as the

five-day average before the grant date as quoted on The Toronto

Stock Exchange.

Effective July 1, 2006, non-executive directors no longer receive

stock options.

2007 2006

Weighted Weighted

average average

Number of exercise Number of exercise

options price options price

Outstanding, beginning of year 19,694,860 $ 11.17 26,478,848 $ 9.62

Granted 1,886,088 39.19 2,043,900 22.71

Exercised (5,847,046) 7.17 (7,826,982) 8.80

Forfeited (147,836) 20.16 (1,000,906) 12.22

Outstanding, end of year 15,586,066 $ 15.96 19,694,860 $ 11.17

Exercisable, end of year 11,409,666 $ 11.41 14,160,866 $ 9.65

Options outstanding Options exercisable

Weighted

average Weighted Weighted

remaining average average

Range of Number contractual exercise Number exercise

exercise prices outstanding life (years) price exercisable price

$ 1.36 – $ 6.99 2,087,886 1.9 $ 5.82 2,087,886 $ 5.82

$ 7.00 – $ 9.99 1,743,670 5.1 8.44 1,743,670 8.44

$ 10.00 – $ 10.99 2,598,025 5.8 10.43 2,258,025 10.43

$ 11.00 – $ 11.99 1,715,831 3.7 11.85 1,715,831 11.85

$ 12.00 – $ 16.99 2,031,094 3.6 13.92 1,606,911 13.41

$ 17.00 – $ 18.99 1,498,028 2.3 17.63 1,484,316 17.63

$ 19.00 – $ 37.99 2,066,239 5.2 22.90 513,027 22.72

$ 38.00 – $ 47.99 1,845,293 6.2 39.22 – –

15,586,066 3.6 $ 15.96 11,409,666 $ 11.41