Rogers 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

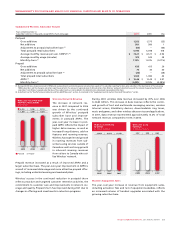

Cost of equipment sales increased in 2007, compared to 2006, pri-

marily as a result of retention activity, hardware upgrades and the

increased average cost of handsets.

The year-over-year increase in sales and marketing expenses was

directly related to Wireless’ largely successful sales and marketing

efforts targeted at acquiring high value postpaid voice and data

customers as well as the continuation of Wireless’ “Most Reliable

Network” campaign and the introduction of new services and

devices.

Growth in the Wireless subscriber base drove increases in operat-

ing, general and administrative expenses in 2007, compared to

2006. These increases were reflected in higher customer retention

spending, costs to support increased usage of data and roaming

services, and increases in network operating expenses to accommo-

date the larger subscriber base. Customer care costs also increased

as a result of the launch of Wireless Number Portability (“WNP”)

in March 2007, the decommissioning of the TDMA network in

May 2007, and the complexity of supporting more sophisticated

services and devices. These costs were partially offset by savings

related to operating and scale efficiencies across various functions.

Total retention spending, including subsidies on handset upgrades,

has increased to $403 million in 2007, compared to $321 million in

2006 due to a larger subscriber base, which drove higher volumes

of handset upgrades, as well as the introduction of WNP in

March 2007. Retention spending also increased due to the transition

of customers to Wireless’ more advanced GSM service from the

older generation TDMA and analog networks, which were decom-

missioned in May 2007.

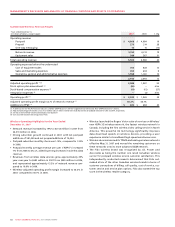

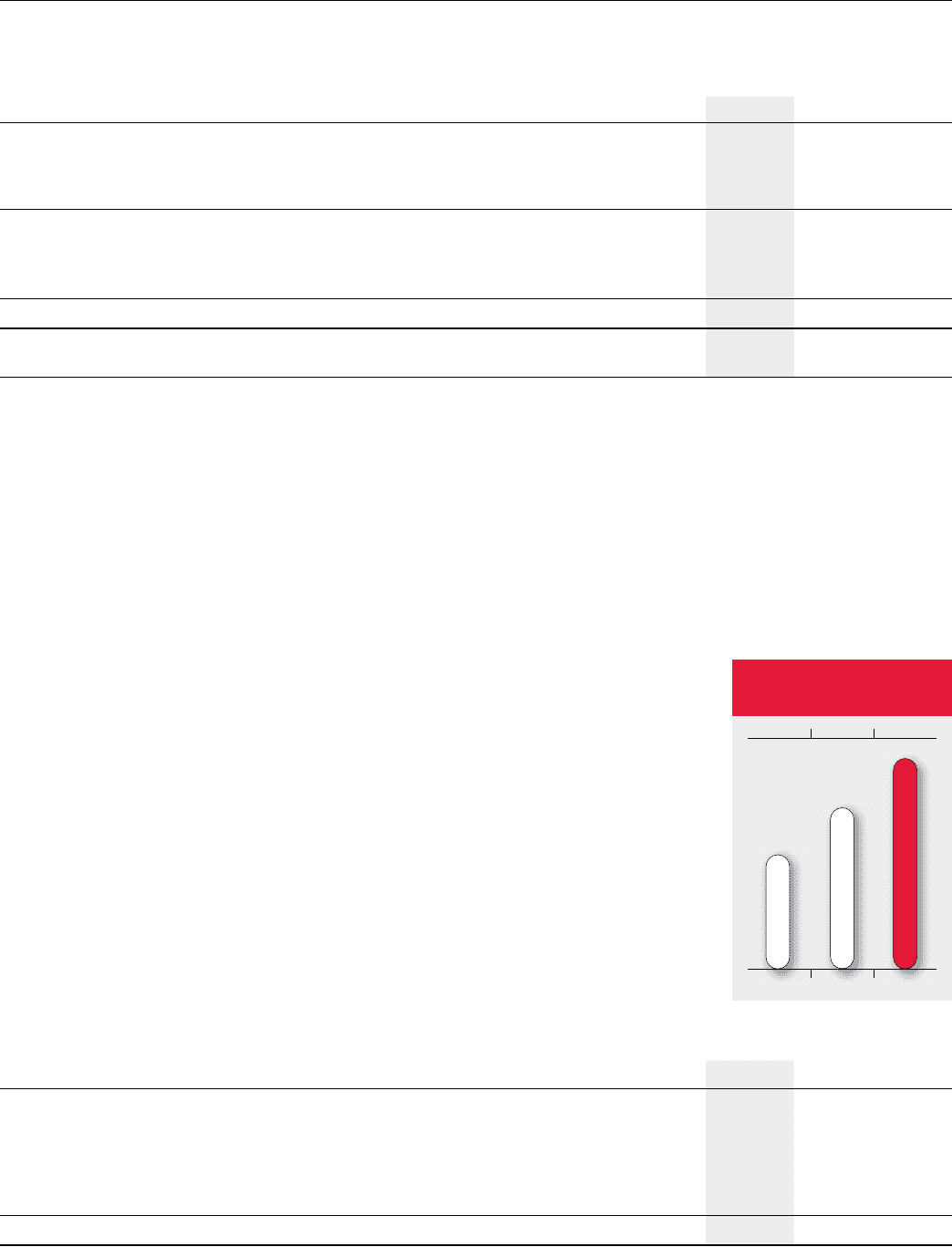

Wireless Adjusted Operating

Profit

The s trong year-over-year

growth in adjusted operat-

ing profit was due to the

significant growth in network

revenue. As a result, Wireless’

adjusted operating profit mar-

gin increased to 50.2% in 2007,

compared to 46.1% in 2006.

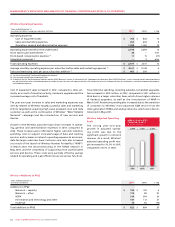

Wireless Operating Expenses

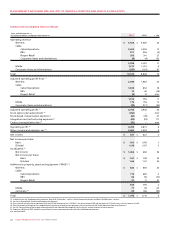

Years ended December 31,

(In millions of dollars, except per subscriber statistics) 2007 2006 % Chg

Operating expenses

Cost of equipment sales $ 703 $ 628 12

Sales and marketing expenses 653 604 8

Operating, general and administrative expenses 1,558 1,361 14

Operating expenses before the undernoted 2,914 2,593 12

Stock option plan amendment (1) 46 – n/m

Stock-based compensation expense (1) 11 15 (27)

Integration expenses (2) – 3 n/m

Total operating expenses $ 2,971 $ 2,611 14

Average monthly operating expense per subscriber before sales and marketing expenses (3) $ 20.61 $ 19.48 6

Sales and marketing costs per gross subscriber addition (3) $ 401 $ 399 1

(1) See the section entitled “Stock-based Compensation Expense”.

(2) Costs incurred related to the integration of Fido.

(3) As defined. See the “Key Performance Indicator and Non-GAAP Measures” section. As calculated in the “Supplementary Information: Non-GAAP Calculations” section. Average monthly operating expense

per subscriber before sales and marketing expenses excludes the one-time non-cash expense related to the introduction of a cash settlement feature for stock options, stock-based compensation expense

and integration expenses.

20072006

$2,589$1,987$1,409

WIRELESS ADJUSTED

OPERATING PROFIT

(In millions of dollars)

2006

2007

2005

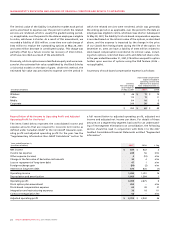

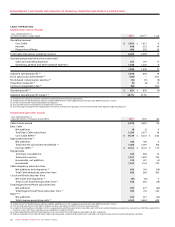

Wireless Additions to PP&E

Years ended December 31,

(In millions of dollars) 2007 2006 % Chg

Additions to PP&E

Network – capacity $ 169 $ 159 6

Network – other 175 89 97

HSPA 316 264 20

Information and technology and other 147 112 31

Inukshuk 15 60 (75)

Total additions to PP&E $ 822 $ 684 20