Rogers 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 91

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

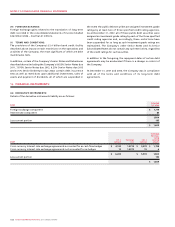

(iii) Other:

On January 1, 2007, the Company acquired five Alberta

radio stations for cash consideration of $43 million including

acquisition costs. The acquisition was accounted for using the

purchase method with $13 million allocated to net tangible

assets acquired, $29 million allocated to broadcast licences

acquired and $1 million allocated to goodwill, which is tax

deductible, within the Media reporting segment.

During 2007, the Company made various other acquisitions for

cash consideration of approximately $3 million.

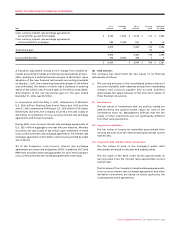

On July 6, 20 07, the Company announced an agreement to acquire

Vancouver multicultural television station Channel M from

Multivan Broadcast Corporation. This transaction is subject to

Canadian Radio-television and Telecommunications Commission

(“CRTC”) approval and is expected to close in early 2008.

During 2007, the Company announced that it had reached an

agreement to acquire the remaining two-thirds ownership in

Outdoor Life Network to bring its ownership to 100%. This

transaction has not yet closed, pending CRTC approval, which

is expected in 2008.

(B) 2006 ACQUISITIONS:

During 2006, the Company made various acquisitions, accounted for

by the purchase method, for cash consideration totalling $6 million.

During 2006, the Company finalized the purchase price allocation

of certain 2005 acquisitions upon receipt of the final valuations of

certain tangible and intangible assets acquired. These adjustments

included an increase in the fair value assigned to PP&E of $22 million

from that recorded and disclosed in the 2005 consolidated financial

statements. Additionally, the fair value of the subscriber bases

acquired increased by $24 million from that recorded and disclosed

in the 2005 consolidated financial statements. Accompanied with a

$1 million adjustment to accrued transaction costs, these adjustments

resulted in a decrease in goodwill acquired of $47 million.

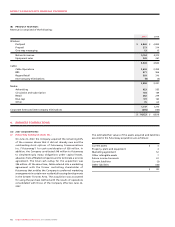

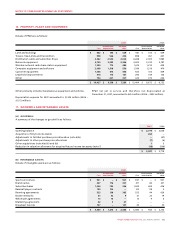

(ii) Citytv:

On October 31, 2007, the Company acquired certain real

properties and 100% of the shares of the legal entities holding

the operations of the Citytv network of five television stations

in Canada, from CTVglobemedia Inc. for cash consideration of

$405 million, including acquisition costs. The purchase price is

subject to working capital adjustments. The acquisition was

accounted for using the purchase method, with the results of

operations consolidated with those of the Company effective

October 31, 2007. The purchase price allocation is preliminary

pending finalization of valuations of the net identifiable

assets acquired. The preliminary estimated fair values of the

assets acquired and liabilities assumed in the Citytv acquisition

are as follows:

Purchase price $ 405

Current assets $ 33

Program inventory 25

PP&E 32

Brand name 26

Broadcast licences 86

Future income tax liabilities (15)

Current liabilities (32)

Other liabilities (14)

Preliminary fair value of net assets acquired $ 141

Goodwill $ 264

The goodwill has been allocated to the Media reporting

segment and is not tax deductible.

The Company has developed a plan to restructure and integrate

the operations of Citytv and has accrued $6 million as a liability

assumed on acquisition in the allocation of the purchase price

at December 31, 2007, which is included in current liabilities.

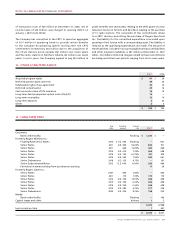

The Company has contributed certain assets to joint ventures

involved in the provision of wireless broadband Internet service

and in certain mobile commerce initiatives (note 11(b)). As at

December 31, 2007 and 2006 and for the years then ended,

proportionately consolidating these joint ventures resulted in the

following increases (decreases) in the accounts of the Company:

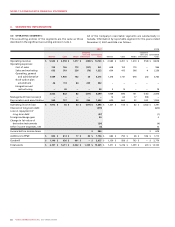

5. INVESTMENT IN JOINT VENTURES:

2007 2006

Current assets $ 7 $ 11

Long-term assets 73 42

Current liabilities 6 3

Expenses 25 20

Net income for the year (25) (20)