Rogers 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 97

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

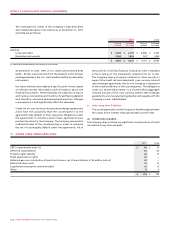

of transaction costs of $39 million at December 31, 2006, net of

income taxes of $20 million, was charged to opening deficit on

January 1, 2007 (note 2(h)(i)).

The Company has committed to the CRTC to spend an aggregate

of $137 million in operating funds to provide certain benefits

to the Canadian broadcasting system. During 2007, the CRTC

commitment increased by $63 million due to the acquisition of

five Citytv stations across Canada ($61 million over seven years)

and five radio stations in Northern Alberta ($2 million over seven

years). In prior years, the Company agreed to pay $50 million in

public benefits over seven years relating to the CRTC grant of a new

television licence in Toronto and $6 million relating to the purchase

of 13 radio stations. The remainder of the commitments relate

to a CRTC decision permitting the purchase of Rogers Sportsnet

Inc. The liability for this committed expenditure is recorded upon

granting of the licence with a corresponding asset. The liability is

reduced as the qualifying expenditures are made. The amount of

these liabilities, included in accounts payable and accrued liabilities

and other long-term liabilities, is $87 million at December 31, 2007

(2006 – $32 million). Deferred charges related to these commitments

are being amortized over periods ranging from six to seven years.

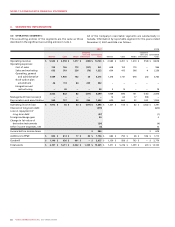

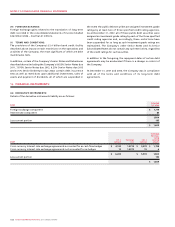

14. OTHER LONG-TERM ASSETS:

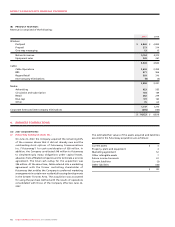

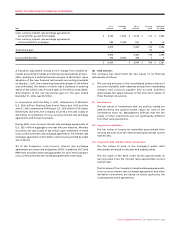

15. LONG-TERM DEBT:

2007 2006

Acquired program rights $ 41 $ 26

Deferred pension asset (note 18) 39 34

Indefeasible right of use agreement 30 16

Deferred compensation 29 16

Cash surrender value of life insurance 16 14

Long-term debt prepayment option (note 2(h)(i)(C)) 13 –

Long-term receivables 12 10

Long-term deposits 2 32

Other 2 4

$ 184 $ 152

Due Principal Interest

date amount rate 2007 2006

Corporate:

Bank credit facility Floating $ 1,240 $ –

Formerly Rogers Wireless Inc.:

Floating Rate Senior Notes 2010 $ U.S. 550 Floating – 641

Senior Notes 2011 U.S. 490 9.625% 484 571

Senior Notes 2011 460 7.625% 460 460

Senior Notes 2012 U.S. 470 7.25% 464 548

Senior Notes 2014 U.S. 750 6.375% 741 874

Senior Notes 2015 U.S. 550 7.50% 543 641

Senior Debentures 2016 U.S. 155 9.75% – 181

Senior Subordinated Notes 2012 U.S. 400 8.00% 395 466

Fair value increment arising from purchase accounting 17 36

Formerly Rogers Cable Inc.:

Senior Notes 2007 450 7.60% – 450

Senior Notes 2011 175 7.25% 175 175

Senior Notes 2012 U.S. 350 7.875% 346 408

Senior Notes 2013 U.S. 350 6.25% 346 408

Senior Notes 2014 U.S. 350 5.50% 346 408

Senior Notes 2015 U.S. 280 6.75% 277 326

Senior Debentures 2032 U.S. 200 8.75% 198 233

Media:

Bank credit facility Floating – 160

Capital leases and other Various 1 2

6,033 6,988

Less current portion 1 451

$ 6,032 $ 6,537