Rogers 2007 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 45

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

• additionstoprogramrightsof$67million;

• nancingcostsincurredof$4million;and

• therepaymentof$2millionofcapitalleases.

Taking into account the cash deficiency of $19 million at the begin-

ning of the year and the cash sources and uses described above, the

cash deficiency at December 31, 2007 was $61 million.

Financing

Our long-term debt is described in Note 15 to the 2007 Audited

Consolidated Financial Statements. During 2007, the following

financing activities took place.

During 2007, $1,080 million aggregate net advances were bor-

rowed under our bank credit facility. In addition, during 2007

$1,227 million aggregate principal amount of other debt was repaid,

comprised of $450 million aggregate principal amount of Cable’s

7.60% Senior Notes due 2007 repaid at maturity in February, $609 mil-

lion (US$550 million) aggregate principal amount of Wireless’ Floating

Rate Senior Notes due 2010 redeemed in May at a redemption pre-

mium of 2%, or $12 million, for a total of $621 million (US$561 million),

$166 million (US$155 million) aggregate principal amount of Wireless’

9.75% Senior Debentures due 2016 redeemed in June at a redemp-

tion premium of 28.416%, or $47 million, for a total of $213 million

(US$199 million) and $2 million repayment of capital leases. As a

result, we incurred a net loss on repayment of long-term debt

aggregating $47 million, which is expensed in the income state-

ment. Included in this amount are the aggregate redemption

premiums of $59 million offset by a $12 million non-cash writedown

of the fair value increment arising from purchase accounting, which

is included in long-term debt. In addition, in conjunction with these

redemptions we made aggregate net payments on settlement

of cross-currency interest rate

exchange agreements and for-

ward contracts of $35 million.

We may choose to participate in

the upcoming auction of wire-

less spectrum licences that will

take place commencing May 27,

2008, and, as such, we may

arrange for the issuance of a

letter of credit pursuant to the

terms and conditions of the auc-

tion. If issued, the letter of credit

would be a utilization under our

$2.4 billion bank credit facility.

See “Wireless Regulation and

Regulatory Developments –

Advanced Wireless Ser vices

(“AWS”) Auction”.

RCI’s $2.4 Billion Bank Credit Facility

On June 29, 2007, the $1 billion Cable bank credit facility, the

$700 million Wireless bank credit facility and the $600 million Media

bank credit facility were cancelled and RCI entered into a new unse-

cured $2.4 billion bank credit facility. At December 31, 2007, RCI had

borrowed $1.240 billion under this new bank credit facility.

RCI’s new bank credit facility provides RCI with up to $2.4 billion

from a consortium of Canadian financial institutions. The bank

credit facility is available on a fully revolving basis until maturity

on July 2, 2013, and there are no scheduled reductions prior to

maturity. The interest rate charged on the bank credit facility

ranges from nil to 0.50% per annum over the bank prime rate or

base rate or 0.475% to 1.75% over the bankers’ acceptance rate or

London Inter-bank Offered Rate (“LIBOR”). RCI’s bank credit facility

is unsecured and ranks pari passu with RCI’s senior public debt and

cross-currency interest rate exchange agreements. The bank credit

facility requires that RCI satisfy certain financial covenants, includ-

ing the maintenance of certain financial ratios.

Pari Passu Debt and Intracompany Amalgamation completed

July 1, 2007

On July 1, 2007, RCI completed an intracompany amalgamation of

RCI and certain of its wholly owned subsidiaries, including Rogers

Cable Inc. (“RCAB”) and Rogers Wireless Inc. (“RWI”). The amal-

gamated entity continues as RCI, and RCAB and RWI are no longer

separate corporate entities and have ceased to be reporting issuers.

This intracompany amalgamation did not impact the consolidated

results previously reported by RCI, and the operating subsidiaries

of RCAB and RWI were not part of and were not impacted by the

amalgamation.

As a result of the amalgamation, on July 1, 2007, RCI assumed all

of the rights and obligations under all of the outstanding RCAB

and RWI public debt indentures and cross-currency interest rate

exchange agreements. As part of the amalgamation process, on

June 29, 2007, RCAB and RWI released all security provided by

bonds issued under the RCAB deed of trust and the RWI deed of

trust for all of the then outstanding RCAB and RWI senior public

debt and cross-currency interest rate exchange agreements. As a

result, none of the senior public debt or cross-currency interest rate

exchange agreements remain secured by such bonds effective as of

June 29, 2007.

As a result of these actions, the outstanding public debt and

cross-currency interest rate exchange agreements and the new

$2.4 billion bank credit facility now reside at RCI on an unsecured

basis. The RCI public debt originally issued by Cable has RCCI as

a co-obligor and RWP as an unsecured guarantor while the RCI

public debt originally issued by RWI has RWP as a co-obligor and

RCCI as an unsecured guarantor. Similarly, RCCI and RWP have

provided unsecured guarantees for the new bank credit facility

and the cross-currency interest rate exchange agreements.

Accordingly, RCI’s bank debt, senior public debt and cross-currency

interest rate exchange agreements now rank pari passu on an unse-

cured basis. Our subordinated public debt remains subordinated to

our senior debt.

Shelf Prospectuses

In order to maintain financial flexibility, in November 2007 RCI filed

shelf prospectuses with securities regulators to qualify debt securi-

ties of RCI for sale in Canada and/or in the U.S. A previously filed

shelf prospectus expired during 2006. The notice set forth in this

paragraph does not constitute an offer of any securities for sale.

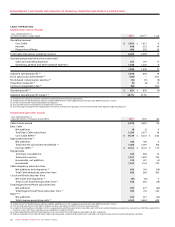

20072006

2.1x2.7x3.8x

RATIO OF DEBT TO

ADJUSTED OPERATING PROFIT*

200

6

2007

2005

* Includes debt and the foreign exchange

component of the fair value of derivative

instruments.