Rogers 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78 ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT

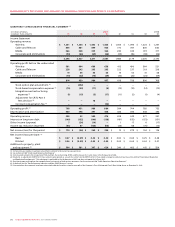

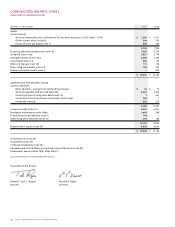

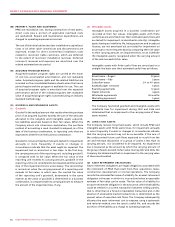

CONSOLIDATED BALANCE SHEETS

(IN MILLIONS OF CANADIAN DOLLARS)

December 31, 2007 and 2006 2007 2006

Assets

Current assets:

Accounts receivable, net of allowance for doubtful accounts of $151 (2006 – $114) $ 1,245 $ 1,077

Other current assets (note 9) 304 270

Future income tax assets (note 7) 594 387

2,143 1,734

Property, plant and equipment (note 10) 7,289 6,732

Goodwill (note 11(a)) 3,027 2,779

Intangible assets (note 11(b)) 2,086 2,152

Investments (note 12) 485 139

Deferred charges (note 13) 111 118

Other long-term assets (note 14) 184 152

Future income tax assets (note 7) – 299

$ 15,325 $ 14,105

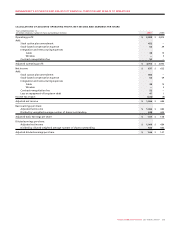

Liabilities and Shareholders’ Equity

Current liabilities:

Bank advances, arising from outstanding cheques $ 61 $ 19

Accounts payable and accrued liabilities 2,260 1,766

Current portion of long-term debt (note 15) 1 451

Current portion of derivative instruments (note 16(a)) 195 7

Unearned revenue 225 227

2,742 2,470

Long-term debt (note 15) 6,032 6,537

Derivative instruments (note 16(a)) 1,609 769

Future income tax liabilities (note 7) 104 –

Other long-term liabilities (note 17) 214 129

10,701 9,905

Shareholders’ equity (note 19) 4,624 4,200

$ 15,325 $ 14,105

Commitments (note 23)

Guarantees (note 24)

Contingent liabilities (note 25)

Canadian and United States accounting policy differences (note 26)

Subsequent events (notes 19(b), 25(a) and 27)

See accompanying notes to consolidated financial statements.

On behalf of the Board:

Edward “Ted” S. Rogers Ronald D. Besse

Director Director