Rogers 2007 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

local telephone service by Canadian cable companies using their

own last mile facilities in 2005. Until 2005, competitors to the ILECs

made use of resold ILEC facilities and services to provide retail ser-

vice in these markets. There has been limited local facilities-based

competition in the large enterprise market.

Growth of Internet Protocol-Based Services

Another development has been the launch of Voice-over-Internet

Protocol (“VoIP”) local services by non-facilities-based providers

in 2005 and 2006. These companies’ VoIP services are marketed to

the subscribers of ILEC, cable and other companies’ high-speed

Internet services and the providers include Vonage, Primus, Babytel

and others.

In the enterprise market, there is a continuing shift to IP-based

services, in particular from asynchronous transfer mode (“ATM”)

and frame relay (two common data networking technologies) to IP

delivered through virtual private networking (“VPN”) services. This

transition results in lower costs for both users and carriers.

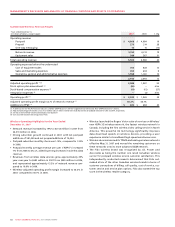

CABLE OPERATING AND FINANCIAL RESULTS

For purposes of this discussion, revenue has been classified accord-

ing to the following categories:

• Cable,whichincludesrevenuederivedfrom:

• analogcableservice,consistingofbasiccableservicefeesplus

extended basic (or tier) service fees, and access fees for use of

channel capacity by third and related parties; and

• digitalcableservicerevenue,consistingofdigitalchannelser-

vice fees, including premium and specialty service subscription

fees, PPV service fees, VOD service fees, and revenue earned

on the sale and rental of set-top terminals;

• Internet, which includes service revenues from residential

Internet access service and modem sale and rental fees;

• RogersHomePhone,whichincludesrevenuesfromresidential

local telephony service, long-distance and additional calling

features;

• RBS,whichincludeslocalandlong-distancerevenues,enhanced

voice and data services revenue from business customers, as well

as the sale of these offerings on a wholesale basis to other tele-

communications providers; and

• RogersRetail,whichincludescommissionsearnedwhileactingas

an agent to sell other Rogers’ services, such as wireless, Internet,

digital cable and cable telephony, as well as the sale and rental

of DVDs and video games and confectionary sales.

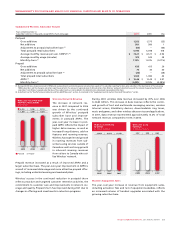

Operating expenses are segregated into the following categories

for assessing business performance:

• Salesandmarketingexpenses,whichincludesalesandretention-

related advertising and customer communications as well as

other customer acquisition costs, such as sales support and com-

missions as well as costs of operating, advertising and promoting

the Rogers Retail chain;

• Operating,generalandadministrativeexpenses,whichinclude

all other expenses incurred to operate the business on a day-to-

day basis and to service subscriber relationships, including:

• themonthlycontractedpaymentsfortheacquisitionofpro-

gramming paid directly to the programming suppliers as well

as to copyright collectives and the Canadian Programming

Production Funds;

• Internetinterconnectivityandusagechargesandthecostof

operating Cable’s Internet service;

• intercarrierpaymentsforinterconnecttothelocalaccessand

long-distance carriers related to cable and circuit-switched

telephony service;

• technicalserviceexpenses,whichincludesthecostsofoperat-

ing and maintaining cable networks as well as certain customer

service activities, such as installations and repair;

• customercare expenses,whichincludethecostsassociated

with customer order-taking and billing inquiries;

• communitytelevisionexpenses,whichconsistofthecoststo

operate a series of local community-based television stations

in Cable’s licenced systems;

• othergeneralandadministrativeexpenses;and

• expensesrelatedtothecorporatemanagementoftheRogers

Retail stores;

• CostofRogersRetailsales,whichiscomposedofstoremerchan-

dise and depreciation related to the acquisition of DVDs and

game rental assets.

In the cable industry in Canada, the demand for services, particularly

Internet, digital television and cable telephony services, continues

to grow and the variable costs associated with this growth, such

as commissions for subscriber activations, as well as the fixed costs

of acquiring new subscribers are significant. As such, fluctuations

in the number of activations of new subscribers from period-to-

period result in fluctuations in sales and marketing expenses.