Rogers 2007 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 41

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The increases in other operating, general and administrative

expenses of $35 million in 2007, compared to 2006, are primarily the

result of an increase in overall information technology and network

maintenance costs.

Sales and marketing expenses increased by $5 million in 2007, com-

pared to 2006, as marketing efforts have primarily targeted the

small and medium business markets since early 2007.

RBS Adjusted Operating Profit

The changes described above resulted in RBS adjusted operating

profit of $12 million in 2007, compared to adjusted operating profit

of $49 million in 2006.

Integration and Restructuring Expenses

During 2007, most RBS new customer acquisition efforts in the

enterprise and larger business segments and outside of Cable’s

footprint were suspended, resulting in certain staff reductions and

the incurrence of approximately $20 million in severance costs. In

addition, consulting and contract termination costs of $4 million

related to the restructuring and $5 million of integration expenses

related to the acquisition of Call-Net were incurred. Capital spend-

ing requirements on information technology and network builds

were also reduced. RBS will continue to maximize operating profit

through its existing customer base while Cable will increase its sales

efforts on the smaller business portion of the market within its

traditional cable television footprint where it is able to serve cus-

tomers with voice and data telephony services provisioned over its

own infrastructure.

ROGERS RETAIL

Summarized Financial Results

In January 2007, Rogers Retail acquired approximately 170 retail

locations from Wireless. The results of the activities of these stores

has been included in the Rogers Retail results of operations since

January 1, 2007.

RBS Revenue

The decrease in RBS revenues is a result of a decline in long-distance

revenues partially offset by an increase in local service and data

revenue. During 2007, long-distance revenues declined by $41 mil-

lion compared to 2006 due to a decrease in both usage and average

revenue per minute. Local service revenue grew by $15 million com-

pared to 2006. In addition, data revenues (including hardware sales)

increased by $1 million compared to 2006.

RBS ended the year with 237,000 local line equivalents and 35,000

broadband data circuits in service at December 31, 2007, representing

year-over-year growth rates of 16% in both cases.

RBS Operating Expenses

Carrier charges are included in operating, general and administrative

expenses and decreased by $28 million in 2007, compared to 2006,

due to the decrease in revenue and product mix changes. Carrier

charges represented approximately 55% of revenue in 2007, com-

pared to 57% in 2006.

20072006

237205172

BUSINESS SOLUTIONS

LOCAL LINE EQUIVALENTS

(In thousands)

200

6

2007

2005

20072006

353122

BUSINESS SOLUTIONS

BROADBAND DATA CIRCUITS

(In thousands)

200

6

2007

2005

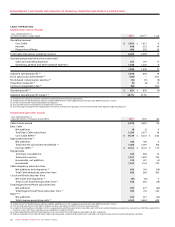

Years ended December 31,

(In millions of dollars) 2007 2006 % Chg

Rogers Retail operating revenue $ 393 $ 310 27

Operating expenses 397 297 34

Adjusted operating profit (loss) (1) (4) 13 n/m

Stock option plan amendment (2) (5) – n/m

Stock-based compensation expense (2) (1) – n/m

Restructuring expenses (3) – (6) n/m

Operating profit (loss) (1) $ (10) $ 7 n/m

Adjusted operating profit (loss) margin (1) (1.0%) 4.2%

(1) As defined. See the “Key Performance Indicators and Non-GAAP Measures” and “Supplementary Information: Non-GAAP Calculations” sections.

(2) See the section entitled “Stock-based Compensation Expense”.

(3) Costs related to the closure of 21 Retail stores in the first quarter of 2006.

Rogers Retail Revenue

The increase in Rogers Retail revenue of $83 million in 2007, com-

pared to 2006, was the result of the acquisition of 170 retail stores

from Wireless in January 2007, partially offset by a decline in video

rental and sales revenues of $8 million, resulting from fewer trans-

actions and customer visits, and a reduction in late fee revenue.

Rogers Retail Adjusted Operating Profit (Loss)

Rogers Retail recorded an adjusted operating loss of $4 million in

2007, compared to an adjusted operating profit of $13 million in

2006, which is the result of fewer customer visits and increased

sales and marketing expenses.