Rogers 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82 ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Rogers Communications Inc. (“RCI”) is a diversified Canadian

communications and media company, with substantially all of

its operations and sales in Canada. RCI is engaged in wireless

voice and data communications services through its Wireless

segment (“Wireless”); cable television, high-speed Internet access,

telephony, data networking and retailing of wireless, cable

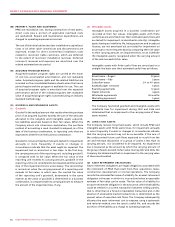

(A) BASIS OF PRESENTATION:

The consolidated financial statements are prepared in accordance

with Canadian generally accepted accounting principles (“GAAP”)

and differ in certain significant respects from accounting principles

generally accepted in the United States of America (“United States

GAAP”) as described in note 26.

The consolidated financial statements include the accounts of

RCI and its subsidiary companies. Intercompany transactions and

balances are eliminated on consolidation.

Investments over which the Company is able to exercise significant

influence are accounted for by the equity method. Investments

over which the Company has joint control are accounted for by the

proportionate consolidation method. Publicly traded investments

are classified as available-for-sale investments and are recorded at

fair value. Changes in fair value are recorded in other comprehensive

income until such time as the investments are disposed of or

impaired. Other investments are recorded at cost. Investments are

written down when there is evidence that a decline in value that is

other than temporary has occurred.

Certain of the comparative figures have been reclassified to

conform with the financial statement presentation adopted in the

current year.

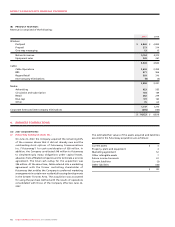

(B) REVENUE RECOGNITION:

The Company’s principal sources of revenue and recognition of

these revenues for financial statement purposes are as follows:

(i) Monthly subscriber fees in connection with wireless and

wireline services, cable, telephony, Internet services, rental

of equipment, network services and media subscriptions

are recorded as revenue on a pro rata basis as the service is

provided;

(ii) Revenue from airtime, roaming, long-distance and optional

services, pay-per-use services, video rentals and other sales of

products are recorded as revenue as the services or products

are delivered;

(iii) Revenue from the sale of wireless and cable equipment is

recorded when the equipment is delivered and accepted by

the independent dealer or subscriber in the case of direct sales.

Equipment subsidies related to new and existing subscribers

are recorded as a reduction of equipment revenues;

(iv) Installation fees and activation fees charged to subscribers do

not meet the criteria as a separate unit of accounting. As a

result, in Wireless these fees are recorded as part of equipment

and video products and services (“Rogers Retail”) through its

Cable segment (“Cable”); and radio and television broadcasting,

televised shopping, magazines and trade publications, and sports

entertainment through its Media segment (“Media”). RCI and

its subsidiary companies are collectively referred to herein as

the “Company”.

revenue and, in Cable, are deferred and amortized over the

related service period. The related service period for Cable

ranges from 26 to 48 months, based on subscriber disconnects,

transfers of service and moves. Incremental direct installation

costs related to reconnects are deferred to the extent of

deferred installation fees and amortized over the same period

as these related installation fees. New connect installation

costs are capitalized to property, plant and equipment (“PP&E”)

and amortized over the useful life of the related assets;

(v) Advertising revenue is recorded in the period the advertising

airs on the Company’s radio or television stations and the

period in which advertising is featured in the Company’s

publications;

(vi) Monthly subscription revenues received by television stations

for subscriptions from cable and satellite providers are

recorded in the month in which they are earned;

(vii) The Toronto Blue Jays Baseball Club’s (“Blue Jays”) revenue from

home game admission and concessions is recognized as the

related games are played during the baseball regular season.

Revenue from radio and television agreements is recorded at

the time the related games are aired. The Blue Jays also receive

revenue from the Major League Baseball Revenue Sharing

Agreement, which distributes funds to and from member clubs,

based on each club’s revenues. This revenue is recognized in the

season in which it is earned, when the amount is estimable and

collectibility is reasonably assured; and

(viii) Discounts provided to customers related to combined

purchases of Wireless, Cable and Media products and services

are charged directly to the revenue for the products and

services to which they relate.

The Company offers certain products and services as part of multiple

deliverable arrangements. The Company divides multiple deliverable

arrangements into separate units of accounting. Components of

multiple deliverable arrangements are separately accounted for

provided the delivered elements have stand-alone value to the

customers and the fair value of any undelivered elements can be

objectively and reliably determined. Consideration for these units is

measured and allocated amongst the accounting units based upon

their fair values and the Company’s relevant revenue recognition

policies are applied to them. The Company recognizes revenue once

persuasive evidence of an arrangement exists, delivery has occurred

or services have been rendered, fees are fixed and determinable and

collectibility is reasonably assured.

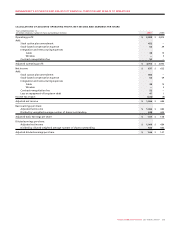

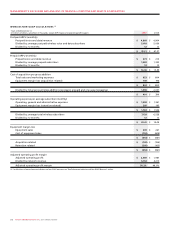

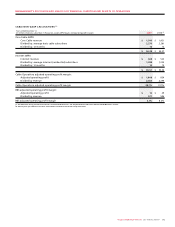

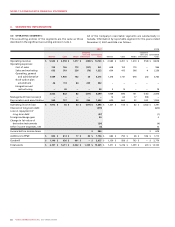

(TABULAR AMOUNTS IN MILLIONS OF CANADIAN DOLLARS, EXCEPT PER SHARE AMOUNTS)

YEARS ENDED DECEMBER 31, 2007 AND 2006

1. NATURE OF THE BUSINESS

2. SIGNIFICANT ACCOUNTING POLICIES