Rogers 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96 ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

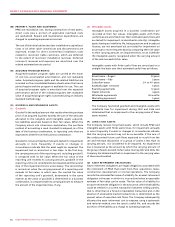

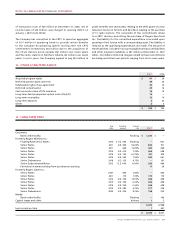

Amortization of brand names, subscriber bases, baseball player

contracts, roaming agreements, dealer networks, wholesale

agreements and marketing agreement amounted to $282 million

for the year ended December 31, 2007 (2006 – $387 million).

During 2007, the Company entered into a marketing agreement with

the former controlling shareholder of Futureway (note 4(a(i)). The

marketing agreement had a fair value of $52 million on acquisition.

During 2007, brand names increased by $26 million resulting from

the acquisition of Citytv (note 4(a)(ii)).

During 2007, broadcast licences increased by $117 million and

subscriber bases by $1 million as a result of acquisitions.

During 2007, the Company contributed its 2.3 GHz and 3.5 GHz

spectrum licences with a carrying value of $11 million to its 50%

owned joint venture (note 5). The Company also recorded an increase

in spectrum licenses of $25 million as a result of contributions by

the other venturer, related to the Company’s proportionate share

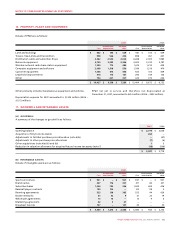

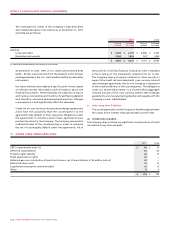

Refer to note 2(h) for the change in accounting policy related to

investments in publicly traded companies.

of the contribution. Accordingly, the carrying value of spectrum

licences has been increased by approximately $20 million.

During 2006, the Company contributed its 2.5 GHz spectrum licence

with a carrying value of $55 million to its 50% owned joint venture.

Accordingly, the carrying value of spectrum licences was reduced

by approximately $28 million.

During 2006, the valuation of intangible assets acquired as part of

the Call-Net acquisition was finalized (note 4(b)). This resulted in a

$24 million increase in subscriber bases acquired. The offset to this

adjustment was recorded as a reduction to goodwill.

During 2006, the Company reduced the value ascribed to subscriber

bases by $91 million as it reduced the valuation allowance related

to future income taxes arising on acquisition (note 7).

During 2006, broadcast licences increased by $7 million as a result of

acquisition and purchase price adjustments in Media.

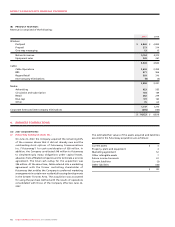

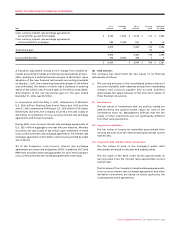

Amortization of deferred charges for 20 07 amounted to

$20 million (2006 – $25 million). Accumulated amortization as at

December 31, 2007, amounted to $77 million (2006 – $121 million).

Effective January 1, 2007, the Company records all transaction

costs related to financial assets and liabilities in the consolidated

statements of income as incurred. As a result, the carrying value

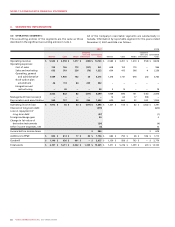

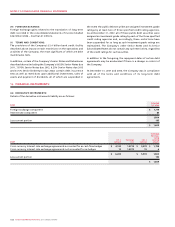

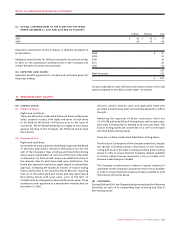

12. INVESTMENTS:

2007 2006

Quoted

Carrying market Carrying

Number Description value value value

Investments accounted for by

the equity method $ 12 $ 7

Publicly traded companies, at quoted

market value in 2007:

Cogeco Cable Inc. 6,595,675 Subordinate Voting Common shares 315 $ 214 69

Cogeco Inc. 3,399,800 Subordinate Voting Common shares 134 100 44

Other publicly traded companies 16 15 4

465 $ 329 117

Private companies 8 15

$ 485 $ 139

13. DEFERRED CHARGES:

2007 2006

CRTC commitments $ 72 $ 23

Deferred installation costs (note 2(b)(iv)) 18 17

Financing and transaction costs 4 59

Pre-operating costs 3 8

Deferred commissions and other 14 11

$ 111 $ 118