Rogers 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 83

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

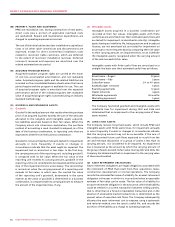

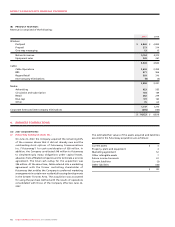

(F) INCOME TAXES:

Future income tax assets and liabilities are recognized for the future

income tax consequences attributable to differences between

the financial statement carrying amounts of existing assets and

liabilities and their respective tax bases. Future income tax assets

and liabilities are measured using enacted or substantively enacted

tax rates expected to apply to taxable income in the years in

which those temporary differences are expected to be recovered

or settled. A valuation allowance is recorded against any future

income tax asset if it is not more likely than not that the asset

will be realized. Income tax expense is generally the sum of the

Company’s provision for current income taxes and the difference

between opening and ending balances of future income tax assets

and liabilities.

(G) FOREIGN CURRENCY TRANSLATION:

Monetary assets and liabilities denominated in a foreign currency

are translated into Canadian dollars at the exchange rate in effect

at the balance sheet dates and non-monetary assets and liabilities

and related depreciation and amortization expenses are translated

at the historical exchange rate. Revenue and expenses, other than

depreciation and amortization, are translated at the average rate

for the month in which the transaction was recorded. Exchange

gains or losses on translating long-term debt are recognized in the

consolidated statements of income. Foreign exchange gains are

primarily related to the translation of long-term debt.

Unearned revenue includes subscriber deposits, cable installation

fees and amounts received from subscribers related to services and

subscriptions to be provided in future periods.

(C) SUBSCRIBER ACQUISITION AND RETENTION COSTS:

Except as described in note 2(b)(iv), as it relates to cable installation

costs, the Company expenses the costs related to the acquisition or

retention of subscribers.

(D) STOCK-BASED COMPENSATION AND OTHER STOCK-

BASED PAYMENTS:

On May 28, 2007, the Company’s employee stock option plans were

amended to attach cash settled share appreciation rights (“SARs”)

to all new and previously granted options. The SAR feature allows

the option holder to elect to receive in cash an amount equal to

the intrinsic value, being the excess market price of the Class B

Non-Voting share over the exercise price of the option, instead of

exercising the option and acquiring Class B Non-Voting shares. All

outstanding stock options are now classified as liabilities and are

carried at their intrinsic value, as adjusted for vesting, measured

as the difference between the current stock price and the option

exercise price. The intrinsic value of the liability is marked-to-market

each period and is amortized to expenses over the period in which

the related services are rendered, which is usually the graded

vesting period, or, as applicable, over the period to the date an

employee is eligible to retire, whichever is shorter.

The Company accounts for stock-based awards that are settled by

issuance of equity instruments using the fair value method. The

estimated fair value is amortized to expense over the period in which

the related services are rendered, which is usually the vesting period

or, as applicable, over the period to the date an employee is eligible

to retire, whichever is shorter. Effective May 28, 2007, the Company

no longer has stock-based awards that are classified as equity.

The employee share accumulation plan allows employees to

voluntarily participate in a share purchase plan. Under the terms

of the plan, employees of the Company can contribute a specified

percentage of their regular earnings through payroll deductions

and the Company makes certain defined contribution matches,

which are recorded as compensation expense in the period made.

(E) DEPRECIATION:

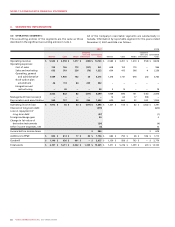

PP&E are depreciated over their estimated useful lives as follows:

Asset Basis Rate

Buildings Mainly diminishing balance 5% to 62/3%

Towers, head-ends and transmitters Straight line 62/3% to 25%

Distribution cable and subscriber drops Straight line 5% to 20%

Network equipment Straight line 62/3% to 331/3%

Wireless network radio base station equipment Straight line 121/2% to 141/3%

Computer equipment and software Straight line 141/3% to 331/3%

Customer equipment Straight line 20% to 331/3%

Leasehold improvements Straight line Over shorter of

estimated useful life

and lease term

Other Mainly diminishing balance 5% to 331/3%