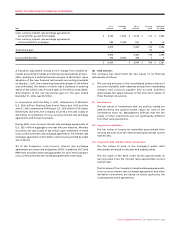

Rogers 2007 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2007 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2007 ANNUAL REPORT 103

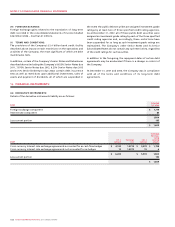

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The Company maintains both contributory and non-contributory

defined benefit pension plans that cover most of its employees.

The plans provide pensions based on years of service, years of

contributions and earnings. The Company does not provide any

non-pension postretirement benefits.

Actuarial estimates are based on projections of employees’

compensation levels at the time of retirement. Maximum retirement

benefits are primarily based upon career average earnings, subject

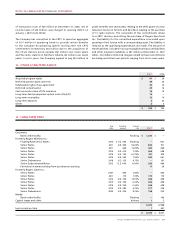

Pension fund assets consist primarily of fixed income and equity

securities, valued at fair value. The following information is

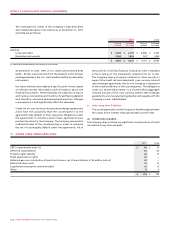

Accrued benefit obligations are outlined below measured at

September 30 for the year ended December 31:

to certain adjustments. The most recent actuarial valuations were

completed as at January 1, 2007, for all of the plans. The next

actuarial valuation for funding purposes must be of a date no later

than January 1, 2008, for certain of the plans and January 1, 2010,

for one of the plans.

The estimated present value of accrued plan benefits and the

estimated market value of the net assets available to provide

for these benefits measured at September 30 for the year ended

December 31 are as follows:

provided on pension fund assets measured at September 30 for the

year ended December 31:

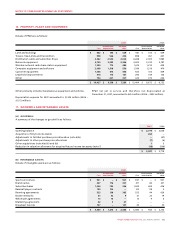

18. PENSIONS:

2007 2006

Plan assets, at fair value $ 606 $ 545

Accrued benefit obligations 689 612

Deficiency of plan assets over accrued benefit obligations (83) (67)

Employer contributions after measurement date 7 4

Unrecognized transitional asset (18) (28)

Unamortized past service costs 11 3

Unamortized net actuarial loss 122 122

Deferred pension asset $ 39 $ 34

2007 2006

Plan assets, beginning of year $ 545 $ 484

Actual return on plan assets 39 40

Contributions by employees 18 15

Contributions by employer 28 28

Benefits paid (24) (22)

Plan assets, end of year $ 606 $ 545

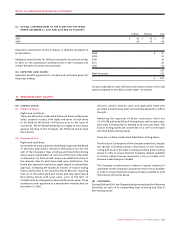

2007 2006

Accrued benefit obligations, beginning of year $ 612 $ 575

Service cost 29 24

Interest cost 34 32

Benefits paid (24) (22)

Contributions by employees 18 15

Actuarial loss (gain) 10 (12)

Plan amendments 10 –

Accrued benefit obligations, end of year $ 689 $ 612